Market Introduction

SAM comprises of several economies which are experiencing substantial growth in the tourism and transportation sector. Brazil, Argentina, Uruguay, Panama, Costa Rica, Peru, Colombia, and Ecuador are some of the major countries in the SAM region. As per World Tourism Organization (UNWTO), in 2018, Peru had 637,219 travelers and Colombia had 516,581 travelers from Europe. While beefing up the presence in South America and some smaller airfields, Airport operator Corporacion America Airports SA received a 20 year extension for a key international airport in Uruguay in 2021. The company’s Uruguay subsidiary, Puerta del Sur SA, has extended the concession of the airport which is serving the capital city, Montevideo and also added six domestic airports to the agreement. The company is planning to upgrade the infrastructure of the existing local airports, which till now were losing money. Along with growth in aviation, tourism and transportation sector, the region is also prone to high level of smuggling. In June 2019, customs officials at the Arturo Merino Benitez Airport had seized around 9,860 pills of MDMA. In 2018, Chilean authorities had arrested a Spanish woman who was having over 9,000 Ecstasy tablets in her possession at Santiago's international airport. In 2019, three foreigners at the Santiago airport were arrested for trying to smuggle around 27,000 doses of ecstasy into the country. Thus, growing instances of smuggling and increasing count of travelers drives the demand for full body scanners across all the international and domestic airports in the SAM region. Adoption of millimeter-wave and terahertz technology-based scanners and introduction of 3D Images from full-body scanners are the major factor driving the growth of the SAM full body scanner market.

SAM has experienced a significant decline in the tourism and travel sector during the COVID-19 pandemic. Brazil is the world’s second worst-hit country by the disease. The tourism sector’s net contribution to Brazil’s GDP dropped by 53% in 2020 compared to the previous year. The enactment of containment measures by governments in the region led to a decline in seaborne trading activities, which further affected the adoption full-body scanner from end-users. Moreover, the inefficient distribution of full body scanners in the region affected the performance of the supply side. Owing to the high risk of drugs smuggling, the SAM region is expected to need high-end full body scanners at borders and airports post-pandemic.

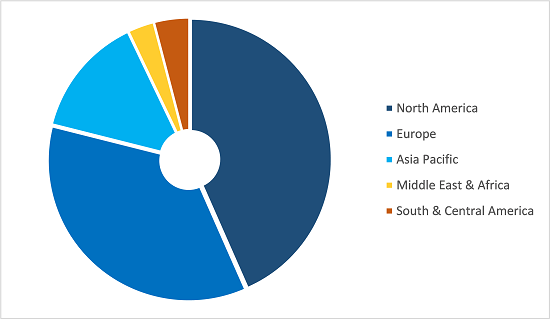

Strategic insights for the South America Full Body Scanner provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South America Full Body Scanner refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

South America Full Body Scanner Strategic Insights

South America Full Body Scanner Report Scope

Report Attribute

Details

Market size in 2021

US$ 20.25 Million

Market Size by 2028

US$ 32.65 Million

Global CAGR (2021 - 2028)

7.1%

Historical Data

2019-2020

Forecast period

2022-2028

Segments Covered

By Component

By Technology

By Application

By Detection

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South America Full Body Scanner Regional Insights

Market Overview and Dynamics

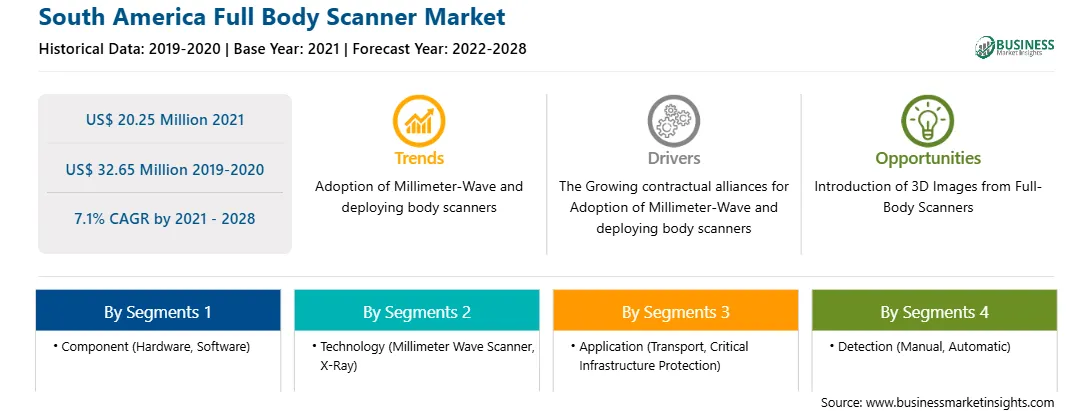

The SAM full body scanner market is expected to grow from US$ 20.25 million in 2021 to US$ 32.65 million by 2028; it is estimated to grow at a CAGR of 7.1% from 2021 to 2028. The use of body scanners across public sites is high among transport and critical infrastructures. The transport sector consists of airports, subways, railway and coach stations, and custom control booths. Critical infrastructures include borders and high-security locations such as nuclear power plants, corporate & government buildings. The airport authorities across the region are experiencing contracts for the deployment of body scanners to detect & locate forbidden objects concealed inside a person's clothing. So, growing contractual alliances for deploying body scanners is expected to fuel the SAM market growth.

Key Market Segments

In terms of component, the hardware segment accounted for the largest share of the SAM full body scanner market in 2020. In terms of technology, the x-ray segment held a larger market share of the SAM full body scanner market in 2020. In terms of application, the transport segment held a larger market share of the SAM full body scanner market in 2020. Further, the automatic segment held a larger share of the SAM full body scanner market based on detection in 2020.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the SAM full body scanner market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Aventura Technologies, Inc.; Leidos; Nuctech Company Limited; Rohde & Schwarz; Smiths Detection Group Ltd. (Smiths Group plc); and Westminster Group Plc among others.

Reasons to buy report

SAM Full Body Scanner Market Segmentation

SAM Full Body Scanner Market - By Component

SAM Full Body Scanner Market -

By Technology

SAM Full Body Scanner Market -

By Application

SAM Full Body Scanner Market -

By Detection

SAM Full Body Scanner Market - By Country

SAM Full Body Scanner Market - Company Profiles

The South America Full Body Scanner Market is valued at US$ 20.25 Million in 2021, it is projected to reach US$ 32.65 Million by 2028.

As per our report South America Full Body Scanner Market, the market size is valued at US$ 20.25 Million in 2021, projecting it to reach US$ 32.65 Million by 2028. This translates to a CAGR of approximately 7.1% during the forecast period.

The South America Full Body Scanner Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Full Body Scanner Market report:

The South America Full Body Scanner Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Full Body Scanner Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Full Body Scanner Market value chain can benefit from the information contained in a comprehensive market report.