The food inclusions market in South America is sub segmented into Brazil, Argentina, and the Rest of South America. The rise in the expenditure on convenience food products and the increase in disposable income are driving the food inclusions market growth in South America. The demand for bakery products such as pastry, bread, and biscuits made with food inclusions (such as fruits and nuts) is driven by the nutritional profile, and convenience and accessibility of these inclusions. In addition, an increase in urbanization and working population in South America is propelling the demand for convenience and on the go food, which sometimes contains food inclusions. Growing industrialization, triggering the food production business, and changing food habits of consumers, bolstering the demand for food with specific flavors and textures, are propelling the sales of food inclusions in South America.

Brazil has the highest number of COVID-19 cases, followed by Argentina, Colombia, Peru and Chile. South America's government has taken an array of actions to protect its citizens and contain COVID-19's spread. It is anticipated that South America will face lower export revenues, both from the dropping commodity prices and reduction in export volumes, especially to China, Europe, and the US, which are important trade partners. Containment measures in several South American countries have reduced economic activity in the food & beverages industry for at least the next quarter, with a rebound once the epidemic is contained.

Strategic insights for the South America Food Inclusions provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

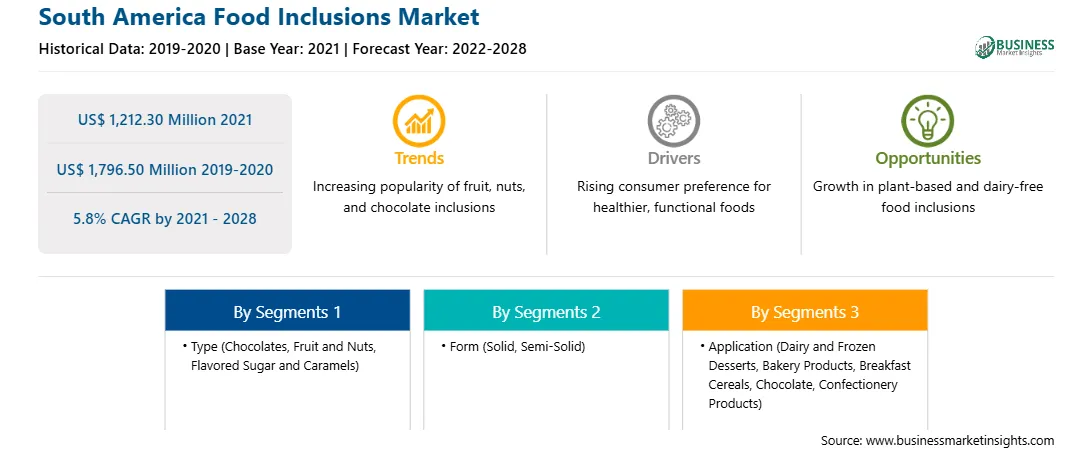

| Market size in 2021 | US$ 1,212.30 Million |

| Market Size by 2028 | US$ 1,796.50 Million |

| Global CAGR (2021 - 2028) | 5.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Food Inclusions refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The food inclusions market in South America is expected to grow from US$ 1,212.30 million in 2021 to US$ 1,796.50 million by 2028; it is estimated to grow at a CAGR of 5.8% from 2021 to 2028. Changing consumer preference has always been major factor influencing the food & beverages industry. Continuous shifts in consumer preferences are propelling food manufacturers to introduce gluten-free, organic, dairy-free, and vegan diets products that meet dietary needs of various consumers. Further, the growing trend of veganism, especially in the western countries, is a major consumer trend influencing the growth of food inclusions market. According to data cited by the Sainsbury’s Future of Food report, the vegan and vegetarian population is expected to account for a quarter of the global population by 2025. Vegans and several flexitarians are opting for non-dairy products, such as plant-based ice creams and yogurts, which, in turn, is boosting the demand for non-dairy/plant-based food inclusions such as nuts, seeds, and fruits. Further, the rise in the prevalence of celiac diseases is driving a shift in consumer preference toward gluten-free products. According to data cited by The Institute for Functional Medicine, based on their 2020 meta-analysis, there has been an increase in the incidence of celiac disease by an average of 7.5% per year in the past decades. Thus, to cater to the rising demand for gluten-free products, food manufacturers are focusing on incorporating gluten-free food inclusions in their products. Thus, changing consumer preferences are giving rise to several key trends that are bound to affect the food inclusions market growth in the coming years.

In terms of type, the chocolate segment accounted for the largest share of the South America food inclusions market in 2020. In term of form, the solid segment held a larger market share of the food inclusions market in 2020. Further, the bakery products segment held a larger share of the market based on application in 2020.

A few major primary and secondary sources referred to for preparing this report on the food inclusions market in South America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are ADM; AGRANA Beteiligungs-AG; Puratos; Barry Callebaut; Cargill, Incorporated; Kerry Group; Georgia Nut Company; Taura Natural Ingredients Ltd.; and Sensient Technologies among others.

The South America Food Inclusions Market is valued at US$ 1,212.30 Million in 2021, it is projected to reach US$ 1,796.50 Million by 2028.

As per our report South America Food Inclusions Market, the market size is valued at US$ 1,212.30 Million in 2021, projecting it to reach US$ 1,796.50 Million by 2028. This translates to a CAGR of approximately 5.8% during the forecast period.

The South America Food Inclusions Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Food Inclusions Market report:

The South America Food Inclusions Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Food Inclusions Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Food Inclusions Market value chain can benefit from the information contained in a comprehensive market report.