The need to heat thermic fluids, process fluids, and feedstock is compelling oil & gas companies to use fired air heaters. Since a decade ago, oil output in Central and South America has peaked at more than 7 million barrels per day. 7.5 million Barrels per day is the most recent statistic. Venezuela and Brazil currently control the majority of Central and South American oil output. According to studies, South America and Central America are rich in energy resources, particularly oil, and are one of the world's major oil and gas producing regions. The region possessed one-fifth of the world's proven oil reserves as of the end of 2016. Moreover, in the region, oil demand is increasing. Brazil's rising prosperity is palpable. In Central and South America, it accounts for the majority of demand. This is further creating potential growth opportunities for the market. Moreover, thermal fluid, electric, or gas-fired process heaters, and waste heat recovery systems can all be used for suction heating in the mining and minerals industry. South America's mining sector has been on the rise for several years, with international investors from all corners of the globe joining the market to take advantage of the region's rich natural resources and low-cost labor market. Furthermore, the sector is likely to continue its upward trend, with markets such as Brazil selling off mining areas to raise cash, generate employment, and attract foreign direct investment (FDI). According to data given by World Mining Data 2019, Latin America accounted for 6.6% of total world mining production in that year (compared with, for example, 5.6 % from Africa; although, placing that in context, 57.9% of global production originated from Asia). The outbreak of COVID-19 has had a significant impact on the mining and natural gas industries in SAM, resulting in reduced demands and significant losses in the region. According to studies, South America had been one of the worst-affected regions by the COVID-19 outbreak, with drilling activity down about 50% from 2019 levels last year. Adequate funding and strategies by the government authorities and key market players are anticipated to boost the regional market growth.

In case of COVID-19, SAM is highly affected especially Brazil, followed by Peru, Chile, Colombia, and Ecuador, among others. SAM's government has taken an array of actions to protect their citizens and contain COVID-19's spread. Brazil is amongst the largest counties for chemical production in the industry. Owing to this, the demand for natural gas, and other petrochemicals is at an all-time high in the country. In addition, the majority of the components are exported from the US, China, and European countries. The geographical restrictions have decreased the local fired air heaters market as well. Moreover, the slowdown in mining activities coupled with the supply chain disruptions in Brazil has hindered the market for fired air heaters. Thus, the outbreak of COVID-19 has had a harsh impact on the SAM fired air heaters market, especially in Brazil. However, the slow recover of the end users is expected to aid the fired air heaters market regain its profits.

Strategic insights for the South America Fired Air Heaters provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

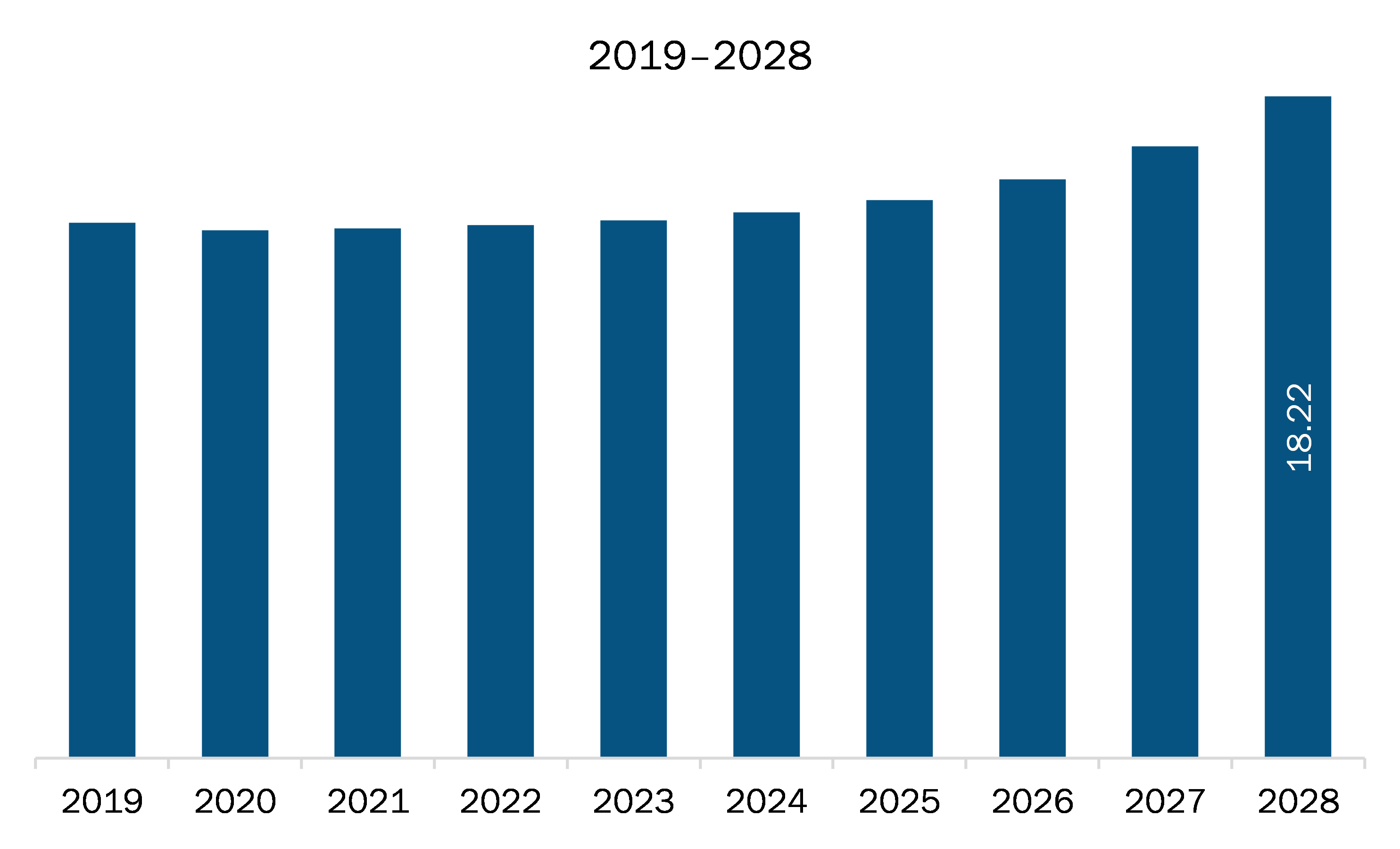

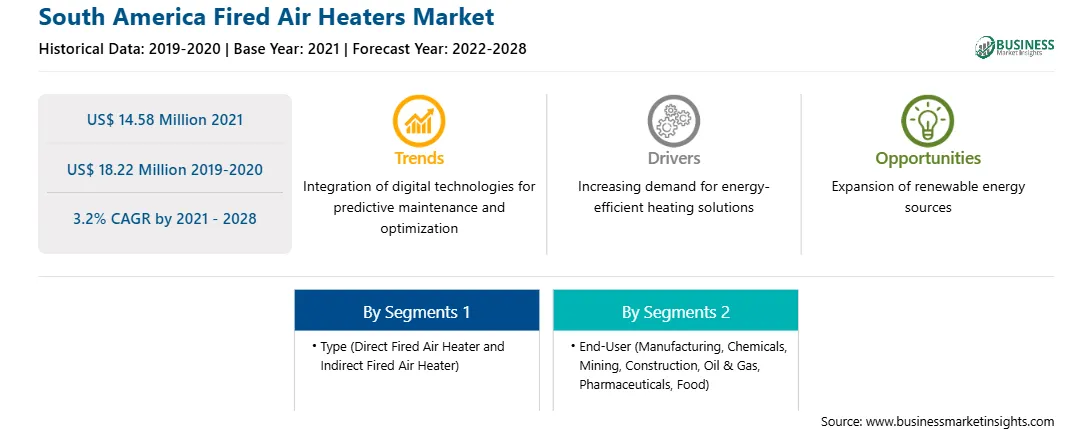

| Market size in 2021 | US$ 14.58 Million |

| Market Size by 2028 | US$ 18.22 Million |

| Global CAGR (2021 - 2028) | 3.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Fired Air Heaters refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The SAM fired air heaters market is expected to grow from US$ 14.58 million in 2021 to US$ 18.22 million by 2028; it is estimated to grow at a CAGR of 3.2% from 2021 to 2028. Boilers, heat pumps, and furnaces are industrial heating equipment used in chemical, food, construction, mining, and other industries to carry out production processes. A boiler is a closed vessel in which water or another liquid is heated and steam is formed, subsequently used to drive machines when dispensed under high pressure. Furthermore, a heat pump is a device that transfers heat to warm or cool areas. Moreover, furnaces are essential components of a central heating system. In amine and glycol reboilers, the corrosive hydrogen sulfide and carbon dioxide gases must be removed from hydrocarbon steam before the respective fuels may be stored or introduced into the pipeline in natural gas and crude oil refining. Similar to natural gas steam, glycol is used to remove water from natural gas before distribution. Because of its cheap maintenance and simplicity, this type of heater is used in natural gas, crude oil, and processing sectors. In the chemical process sector, fired heaters are commonly used to heat process fluids and generate steam. In most cases, fired heaters consume the most energy in the process industry. A box-type heater with vertical tubes is utilized to heat a hydrocarbon fluid for this investigation. Elution heaters, a specialized application of fired air heaters that requires a distinct and unique design, are used in the mining industry. Elution is the process of extracting one material from another by washing with a solvent, nearly always with the addition of heat, in analytical and organic chemistry. Minerals such as gold are extracted using exchangers. A mineral and solvent solution circulates on one side of the exchanger and a heat-transmitting fluid—commonly thermal fluid—distributes on the other. In the food industry, particularly in frying trains – potatoes, snacks, and precooked – is via heat transfer fluid heaters, in which thermal fluid circulates that is heated in the equipment, and its heat is transferred to the oil that fries the products above through an exchange. Some installations have been carried out here, similar to the mining elution process, where the frying oil circulates straight through the boiler, which is subsequently used as a fired air heater. In the petrochemical industry, direct fired heaters are occasionally used as heat transfer fluid heaters or indirect heaters. The good operation of the maintenance service of direct fired heaters in chemical plants and refineries, as well as the uniformity of spare parts, are the main reasons for this uptake, because as will see later, heat transfer fluid heaters are renowned for their advantages in their specific functions. Thus, the rise in demand for heating equipment for various industrial applications is driving the SAM fired air heaters market.

In terms of type, the direct fired air heater segment accounted for the largest share of the SAM fired air heaters market in 2020. In terms of end-user, the chemicals segment held a larger market share of the SAM fired air heaters market in 2020.

A few major primary and secondary sources referred to for preparing this report on the SAM fired air heaters market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are ALLMAND BROS., INC; Pirobloc, S.A.; SIGMA THERMAL, INC; Wacker Neuson SE; and Zeeco, Inc.

The South America Fired Air Heaters Market is valued at US$ 14.58 Million in 2021, it is projected to reach US$ 18.22 Million by 2028.

As per our report South America Fired Air Heaters Market, the market size is valued at US$ 14.58 Million in 2021, projecting it to reach US$ 18.22 Million by 2028. This translates to a CAGR of approximately 3.2% during the forecast period.

The South America Fired Air Heaters Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Fired Air Heaters Market report:

The South America Fired Air Heaters Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Fired Air Heaters Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Fired Air Heaters Market value chain can benefit from the information contained in a comprehensive market report.