The SAM express delivery market is further segmented into Brazil, Argentina, and the Rest of SAM. Countries in SAM observe growth in industrialization—especially involving further developments in the food & beverages, manufacturing, automotive, and industrial sectors. There is a high dependence on imported goods in SAM countries; however, rise in foreign direct investment (FDIs) has uplifted several industries' performance, allowing them to contribute substantial shares in the respective country's GDP. The SAM countries are attracting huge FDIs due to the availability of cheap labor and low entry barriers as well as interest rates. Certain countries in the region have relaxed FDI regulations, thus attracting investments from several companies. For instance, Argentina is concentrating on attracting FDIs through initiatives, such as easing import restrictions, lifting restrictions on foreign investment, and signing international bilateral agreements. Such initiatives are expected to facilitate the development of different sectors across the region. The e-commerce sector is continuously booming in South America and is altering the way companies are serving their customers.

Brazil has the largest number of cases with COVID-19, followed by Argentina, Colombia, Peru and Ecuador amongst others across the region. The covid-19 pandemic has led to the closure of all economic activities across the region, in order to combat the spread of the virus. The closure of all mode of transportation due to the temporary lockdown imposed across the region has also suspended all delivery services thereby negatively impacting the express delivery market. The closure of the economy in countries like Brazil and Argentina has led to the increase in unemployment across the country thereby impacting the overall spending capacity of the country. The unemployment rate rose from 11.0 percent in the fourth quarter of 2019 to 12.2 percent in the first quarter of 2020, according to the official statistics agency IBGE, reaching 12.9 million people. This will also have a longer impact on the express delivery market across the country as it costs higher than normal or standard delivery. Thus, the above-mentioned factors are expected to negatively influence the express delivery market over the years owing to the outbreak of the pandemic.

Strategic insights for the South America Express Delivery provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2020 | US$US$ 5,839.45 Million |

| Market Size by 2027 | US$ 6259.8 Million |

| Global CAGR (2020 - 2027) | 1.0% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2027 |

| Segments Covered |

By Destination

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Express Delivery refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

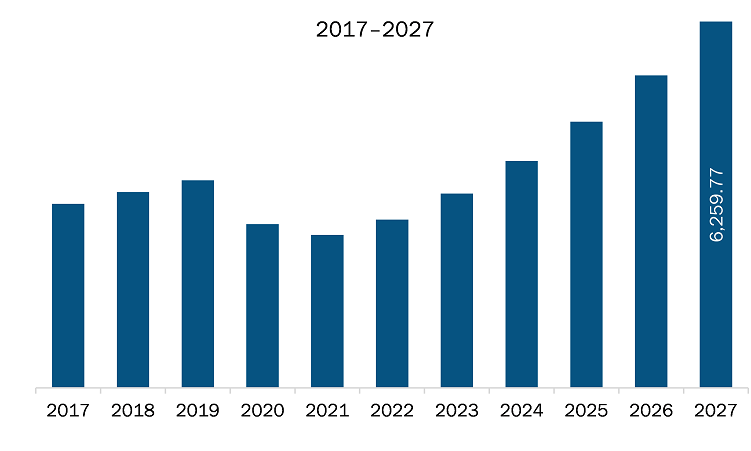

The express delivery market in South America is expected to grow from US$ 6259.8 million by 2027 from US$ 5,839.45 million in 2020. The market is estimated to grow at a CAGR of 1.0% from 2020 to 2027. Same-day delivery ensures that the product ordered by the consumer is delivered within few hours, thereby ensuring customer satisfaction and loyalty toward the brand over the years. For instance, Amazon—the world's largest online retailer—is aggressively supporting same-day delivery and has launched the service in many cities already. However, over the last couple of years, several same-day delivery proponents have successfully launched new pilots and businesses. In addition, other big multichannel and online retailers, such as Walmart and Alibaba, have made strategic initiatives to integrate same-day delivery in their business model. E-commerce-savvy towns in both developed and developing countries are the key growth hubs. Customers have been compelled to turn to online platforms for their basic to advanced level requirements owing to the availability of all goods on the Internet with real-time ratings, feedback, and best prices, thereby significantly boosting the e-commerce industry worldwide. Competition has become more critical with the rise in demand, and customers expect their goods to be delivered as soon as possible. This is influencing the investment of the companies to take advantage of express delivery over its competitors. Thus, the above-mentioned factors are contributing to the increased investments by companies on developing same-day delivery or instance delivery options in their services. This, in turn, is expected to contribute to the express delivery market over the years.

South America express deliver market is segmented based on destination, business type, and end- user Based on destination, the South America express delivery market based on destination is segmented into domestic and international. The domestic sector accounted for the highest share in the market in 2019 and International sector is expected to be fastest growing during forecast period. Based on business type is segmented into B2B and B2C. The B2B segment accounted for the highest share in 2019 and B2C sector is expected to be the fastest growing during forecast period. Based on end-user the market is segmented into Automotive, Retail and E-commerce, Pharmaceuticals, BFSI, IT and Telecom, Electronics, and Others. The automotive segment accounted for the highest share in 2019 and retail and automotive sector is expected to be the fastest growing during forecast period

A few major primary and secondary sources referred to for preparing this report on express delivery market in South America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Amazon.com, Inc.; Aramex; DHL International GmbH; FedEx Corporation; TNT Holdings B.V.; and United Parcel Service of America, Inc. among others.

The South America Express Delivery Market is valued at US$US$ 5,839.45 Million in 2020, it is projected to reach US$ 6259.8 Million by 2027.

As per our report South America Express Delivery Market, the market size is valued at US$US$ 5,839.45 Million in 2020, projecting it to reach US$ 6259.8 Million by 2027. This translates to a CAGR of approximately 1.0% during the forecast period.

The South America Express Delivery Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Express Delivery Market report:

The South America Express Delivery Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Express Delivery Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Express Delivery Market value chain can benefit from the information contained in a comprehensive market report.