Market Introduction

The SAM Electromagnetic Compatibility (EMC) Testing Market is sub segmented into Brazil, Argentina, and the Rest of SAM. The region is characterized by a mixed growth scenario, with many countries having complex political and macroeconomic environments. Governments are striving to bring developments in various industries at a sustainable pace, thereby allowing economies to thrive. At present, several countries in SAM lack the infrastructure and resources required for establishing manufacturing units. Furthermore, the passenger car industry in the region is growing steadily as most countries have been witnessing adverse effects of economic crises and currency fluctuations in the past. With the slow but continuous recovery of the Brazilian market, the overall passenger car industry is also flourishing gradually, and it accounts for a significant share of the market in terms of production, sales, and exports. Low interest rates on vehicle loans are encouraging the sales of passenger cars. A resultant rise in the production of the automotive sector across the region is expected to influence the region. Brazil has a vast electronics manufacturing industry with the presence of manufacturing plants of a few of the largest electronics companies. The country imposes high taxes on imported products such as computers, telecommunications equipment, and appliances. However, foreign electronics that are manufactured in Brazil are levied with lower tax burdens. The country is witnessing a high demand for electronic products due to the rising middle-class population. Further, other manufacturing industries in Brazil include electronics, aerospace, and food & beverages.

Brazil has the largest number of COVID-19 cases, followed by Ecuador, Chile, Peru, and Argentina. In order to combat the spread of the virus, all economic activities across the region were halted. The closure of manufacturing activities across major countries in SAM, such as Brazil and Argentina, affected the adoption of any new technology. The recession in the manufacturing sector has influenced government bodies to take necessary steps in order to boost the sector across the country. Though the electromagnetic compatibility (EMC) testing market is adversely affected due to the COVID-19 outbreak, the government initiatives to attract investors in the manufacturing sector are expected to influence the adoption of the technology across various industries in the region.

Strategic insights for the South America EMC Testing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South America EMC Testing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

South America EMC Testing Strategic Insights

South America EMC Testing Report Scope

Report Attribute

Details

Market size in 2021

US$ 67.75 Million

Market Size by 2028

US$ 100.82 Million

Global CAGR (2021 - 2028)

5.8%

Historical Data

2019-2020

Forecast period

2022-2028

Segments Covered

By Offering

By Service Type

By End-Use

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South America EMC Testing Regional Insights

Market Overview and Dynamics

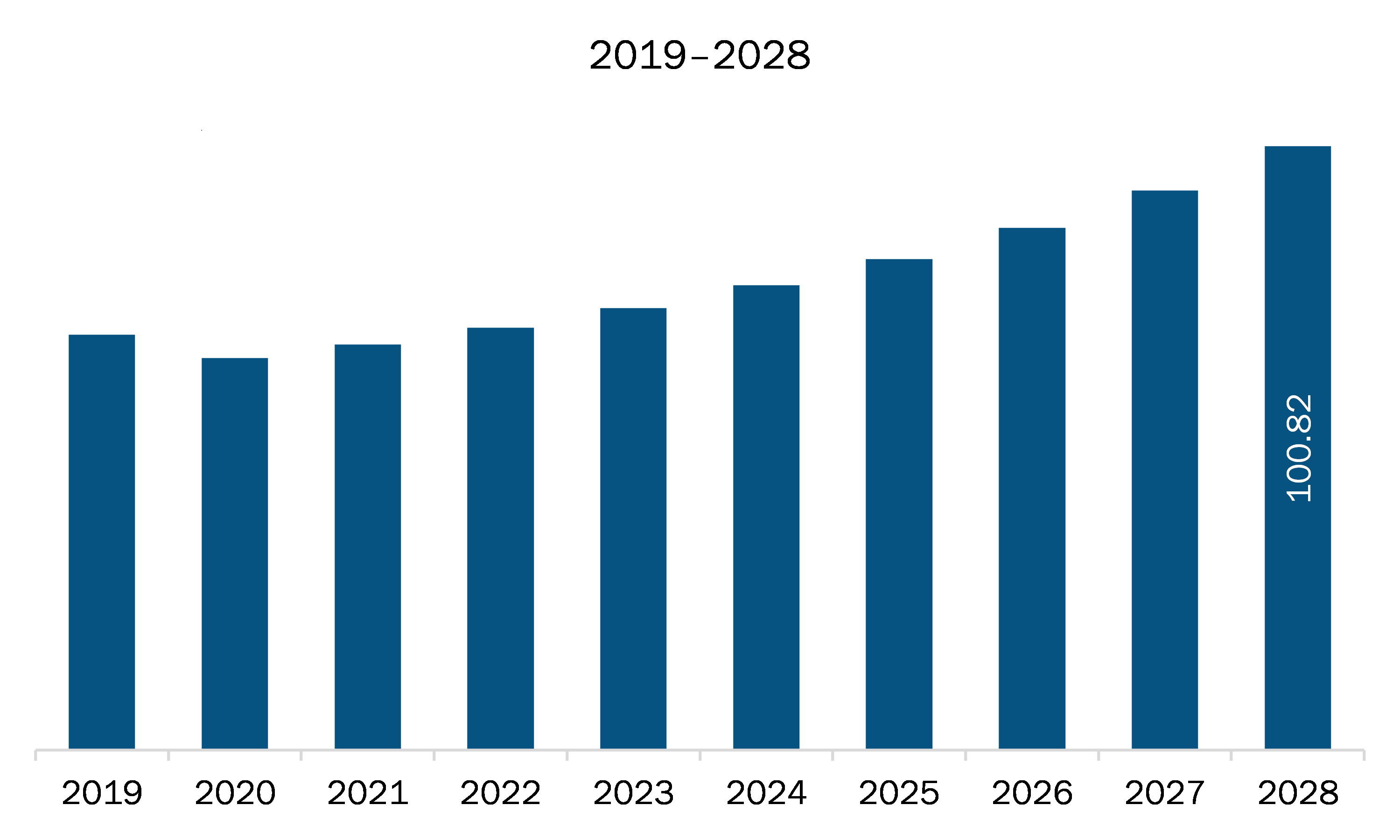

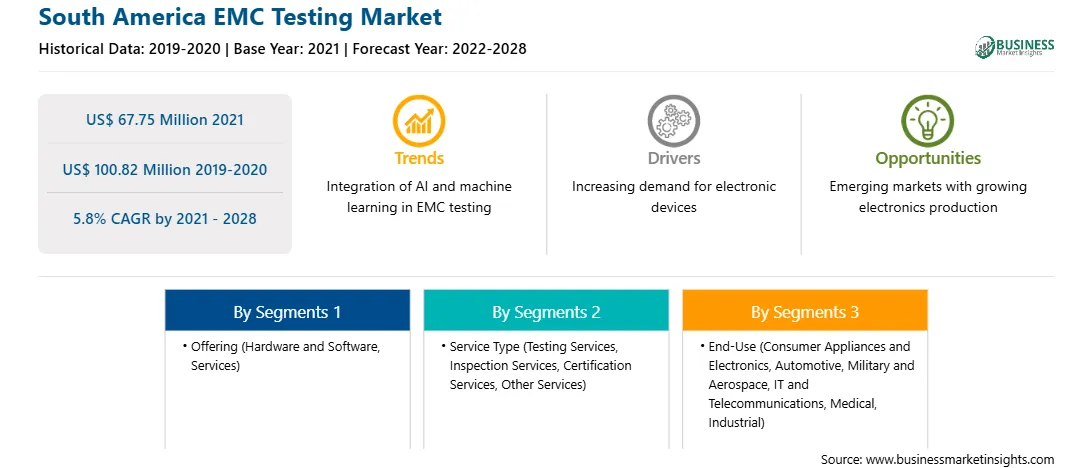

The EMC testing market in SAM is expected to grow from US$ 67.75 million in 2021 to US$ 100.82 million by 2028; it is estimated to grow at a CAGR of 5.8% from 2021 to 2028. SAM countries are attracting huge FDIs in the manufacturing sector with the availability of cheap labor, low entry barriers, and low-interest rates. A few of these countries have relaxed FDI regulations. For example, Argentina is attracting high FDIs by easing import restrictions and signing international bilateral agreements; it is also bringing relaxations in restrictions on foreign investments for the same purpose. Thus, a continuously growing manufacturing sector across the countries in SAM is magnifying the demand for EMC testing across the region.

Key Market Segments

SAM EMC testing market is segmented into offering, service type, end-use, and country. Based on offering, SAM EMC testing market is segmented into hardware and software and services. The hardware and software segment held the largest market share of the SAM EMC testing market in 2020. Based on service type, the SAM EMC testing market is segmented into testing services, inspection services, certification services, and other services. Testing services segment held the largest market share in 2020. Further, on the basis of end-use, the SAM EMC testing market is segmented into consumer appliances and electronics, automotive, military and aerospace, IT and telecommunications, military & aerospace, industrial, and others. Consumer appliances and electronics segment held the largest market share in 2020. Based on country, the SAM EMC testing market is segmented into Brazil Argentina, and Rest of SAM. Brazil held the largest market share in 2020.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the EMC testing market in SAM are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are AMETEK, Inc.; Bureau Veritas; Intertek Group plc; SGS SA; TÜV SÜ; and UL, LLC.

Reasons to buy report

SAM

EMC Testing Market Segmentation

SAM EMC Testing Market -

By Offering

SAM EMC Testing Market - By

Service Type

SAM EMC Testing Market - By End-Use

SAM EMC Testing Market - By Country

SAM EMC Testing Market - Company Profiles

The South America EMC Testing Market is valued at US$ 67.75 Million in 2021, it is projected to reach US$ 100.82 Million by 2028.

As per our report South America EMC Testing Market, the market size is valued at US$ 67.75 Million in 2021, projecting it to reach US$ 100.82 Million by 2028. This translates to a CAGR of approximately 5.8% during the forecast period.

The South America EMC Testing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America EMC Testing Market report:

The South America EMC Testing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America EMC Testing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America EMC Testing Market value chain can benefit from the information contained in a comprehensive market report.