South America Educational Furniture Market

No. of Pages: 145 | Report Code: BMIRE00028660 | Category: Consumer Goods

No. of Pages: 145 | Report Code: BMIRE00028660 | Category: Consumer Goods

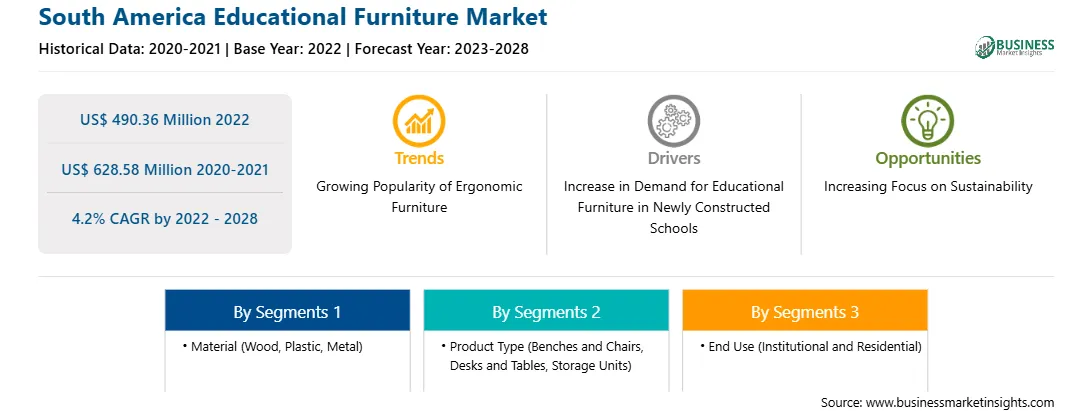

The region is increasingly recognizing the importance of sustainability, and the education sector is no exception. As schools and universities strive to operate with greater sensitivity toward the environment, the demand for sustainable educational furniture is on the rise. Green classrooms and school-wide “go green” initiatives are rising as educators encourage students to adopt values supporting environmental-friendly behavior. Sustainable storage products, chairs, and desks are widely preferred in classrooms across the region. Such furniture products are manufactured using eco-friendly materials such as polypropylene, renewable timber, or steel, which meet emission standards mandatory for approval; moreover, they are designed to maintain indoor air quality. Further, using sustainable materials in furniture manufacturing allows manufacturers to recycle product waste, thus preventing the deposition of waste into landfills. Governments of various countries are encouraging enterprises to introduce products that promote the sustainable construction of schools. A rise in the number of initiatives to promote sustainable infrastructure would create lucrative opportunities for the growth of the South America educational furniture market in the coming years.

South America marks the presence of educational furniture manufacturers, namely, Maqmóveis, Milan Moveis, RoyalDoor SRL, and Albano Muebles. According to a report published by the Organization for Economic Co-Operation and Development (OECD) in 2022, public spending on primary, secondary, and tertiary education was 11.1% of total government expenditure in Argentina. According to the World Bank, the Argentine government prioritizes investment in education to promote national productivity and economic growth in the long run. The government invested US$ 31 billion in education in 2020, of which US$ 5 billion was spent on private schools and US$ 26 billion on government-run institutions. According to a report released by the Inter-American Development Bank (IDB) in 2023, the government of Costa Rica signed three agreements, allowing IDB Invest to collaborate with key partners to finance education in Latin America. According to the report published by International Trade Administration in 2023, government of Brazil prioritizes education and increased education budget to US$ 26.5 billion in 2022. Further, Brazil registered enrollment of 8.3 million students in pre-school and 26.5 million in elementary school, whereas enrollment of 7.7 million in high school and 4.1 million in young and adult education programs. The increased education budget and enrollment of students can prompt expansion of educational infrastructure and create lucrative opportunities for building materials in Brazil. Thus, government initiatives and policies for the development of educational infrastructure are expected to contribute to the growth of the educational furniture market in South America during the forecast period.

Strategic insights for the South America Educational Furniture provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 490.36 Million |

| Market Size by 2028 | US$ 628.58 Million |

| Global CAGR (2022 - 2028) | 4.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Material

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Educational Furniture refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The South America educational furniture market is segmented based on material, product type, end use, and country.

Based on material, the South America educational furniture market is segmented into wood, plastic, metal, and others. The wood segment held the largest share of the South America educational furniture market in 2022.

Based on product type, the South America educational furniture market is segmented into benches and chairs, desks and tables, storage units, and others. The benches and chairs segment held a larger share of the South America educational furniture market in 2022.

Based on end use, the South America educational furniture market is segmented into institutional and residential. The institutional segment held a larger share of the South America educational furniture market in 2022.

Based on country, the South America educational furniture market has been categorized into Brazil, Argentina, and the Rest of South America. Our regional analysis states that the Rest of South America dominated the South America educational furniture market in 2022.

Haworth Inc, Knoll Inc, Virco Manufacturing Corp, and Vitra International AG are the leading companies operating in the South America educational furniture market.

1. Haworth Inc

2. Knoll Inc

3. Virco Manufacturing Corp

4. Vitra International AG

The South America Educational Furniture Market is valued at US$ 490.36 Million in 2022, it is projected to reach US$ 628.58 Million by 2028.

As per our report South America Educational Furniture Market, the market size is valued at US$ 490.36 Million in 2022, projecting it to reach US$ 628.58 Million by 2028. This translates to a CAGR of approximately 4.2% during the forecast period.

The South America Educational Furniture Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Educational Furniture Market report:

The South America Educational Furniture Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Educational Furniture Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Educational Furniture Market value chain can benefit from the information contained in a comprehensive market report.