South America Data Center Colocation Market

No. of Pages: 103 | Report Code: TIPRE00026092 | Category: Technology, Media and Telecommunications

No. of Pages: 103 | Report Code: TIPRE00026092 | Category: Technology, Media and Telecommunications

Infrastructure development is a key to South America’s economic growth, which is significantly increasing the per capita incomes of South American countries. Infrastructure development projects have enabled increased productivity, and competitiveness among countries at the global level and domestic levels. Growth of manufacturing facilities, commercial complexes, educational institutions, and government offices, among others with the integration of smart devices and technologies has increased the amount of data generation, and thereby boosted the demands of data center colocation facilities in South America. Governments of countries such as Brazil, Argentina, and Chile are concentrating on attracting FDIs by taking several initiatives such as easing import restrictions, signing international bilateral agreements, and reducing restrictions on foreign investments. Increasing enterprise demands for cost-effective solutions to reduce overall IT cost is the major factor driving the growth of the SAM data center colocation market.

Brazil reported the highest number of COVID-19 cases, followed by Ecuador, Chile, Peru, and Argentina in SAM. To curb the spread of the virus, all economic activities in the region were partially halted. Despite the COVID-19 pandemic, the region recorded growth in the data center business, owing to high pressure on end-user industries to support remote working and fast track their work into digitalization and deploy it on the cloud platform.

Strategic insights for the South America Data Center Colocation provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

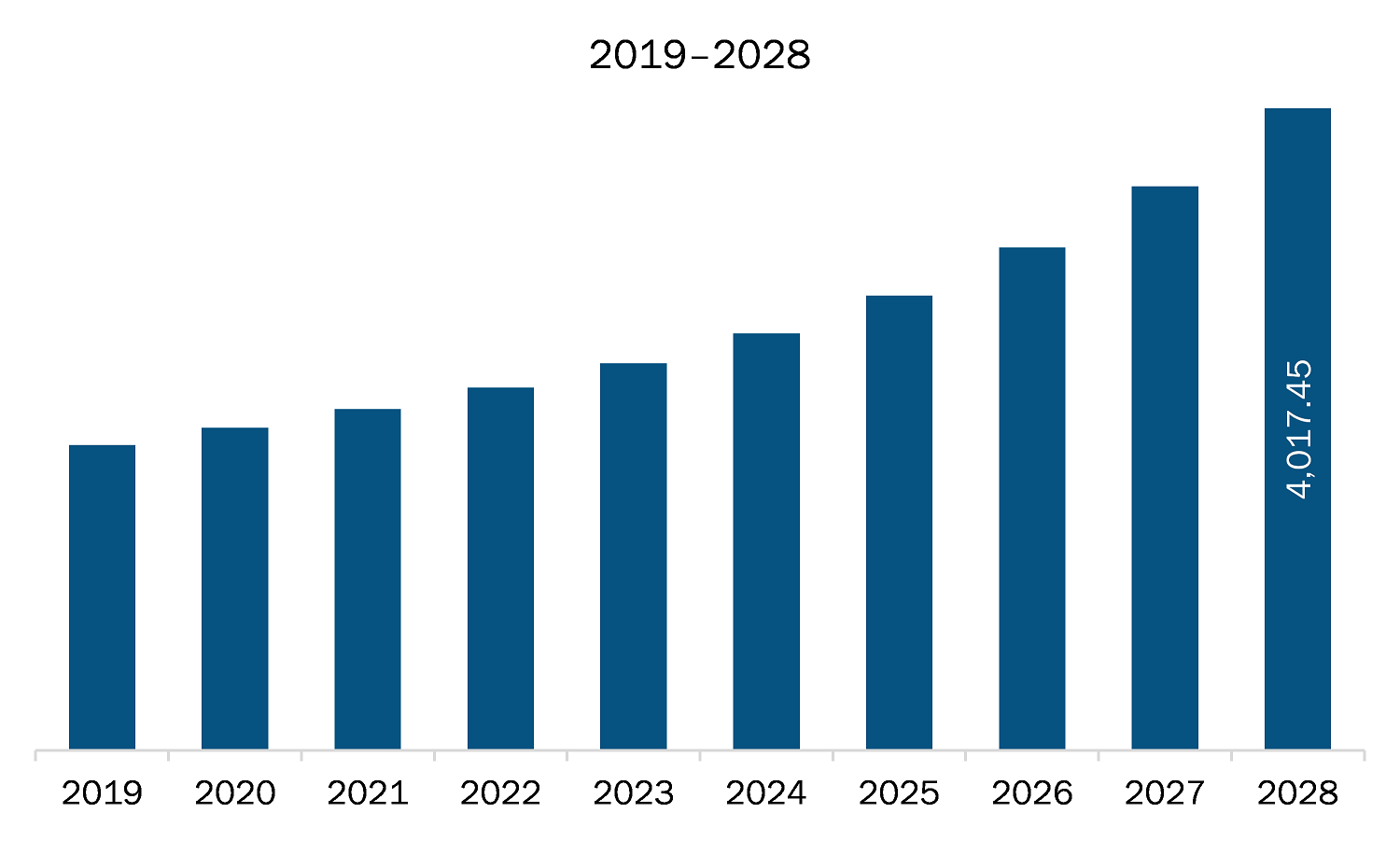

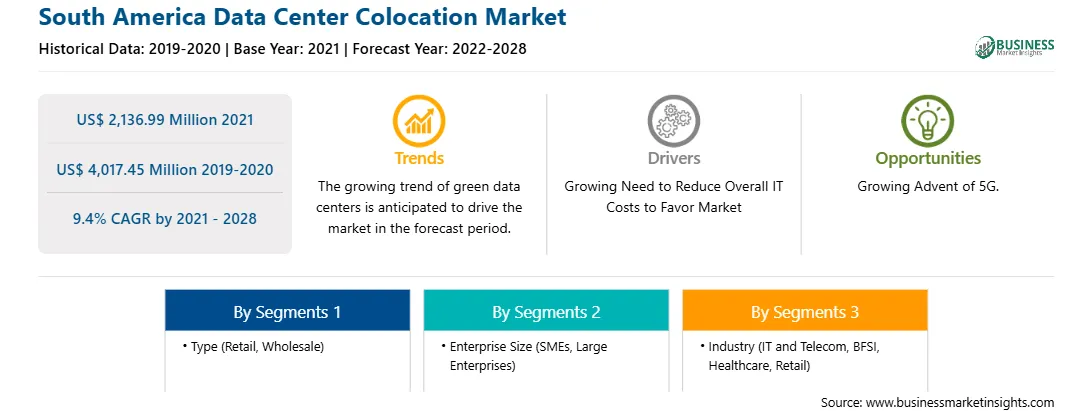

| Market size in 2021 | US$ 2,136.99 Million |

| Market Size by 2028 | US$ 4,017.45 Million |

| Global CAGR (2021 - 2028) | 9.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Data Center Colocation refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The data center colocation market in SAM is expected to grow from US$ 2,136.99 million in 2021 to US$ 4,017.45 million by 2028; it is estimated to grow at a CAGR of 9.4% from 2021 to 2028. Edge computing has emerged as an ideal solution for companies involved in streamlining their data gathering processes and a large number of customers demanding low-latency streaming content. Companies can deliver faster services and free up valuable bandwidth for several other activities that are performed closer to the network’s core by relocating their considerable processing workloads to devices and edge data centers on the outer edges of the network. Moreover, the growth of edge computing significantly depends on the rapid adoption of devices enabled with the internet of things (IoT). The IoT edge devices have developed incredible applications across diverse industries with their capabilities to collect data beyond the reach of conventional networks and extend services with the use of cellular and Wi-Fi connections. However, these functionalities still require a backbone of infrastructure for operating effectively and efficiently. As a result, companies have begun to re-architect their corporate IT infrastructures with respect to colocation and interconnection points of presence. Through the combination of colocation services with regional edge computing data centers, companies can extend their edge network reach quickly and cost-effectively. E-commerce and retail sectors are embracing the edge data center. There is a growing demand for edge data centers in the pharmaceutical industry due to the regulatory requirements and generation of the humungous amount of data. The flexibility of not being dependent upon a centralized infrastructure enables enterprises to adapt quickly to developing markets and scale their data and computing requirements more efficiently. Thus, the increasing development in edge computing creates lucrative growth opportunities for the data center colocation market players.

The SAM data center colocation market is segmented into type, enterprise size, industry, and country. Based on type, the market is segmented into retail and wholesale. The retail segment dominated the market in 2020 and wholesale segment is expected to be the fastest growing during the forecast period. Based on enterprise size, the data center colocation market is divided into SMEs and large enterprises. The large enterprises segment dominated the market in 2020 and SMEs segment is expected to be the fastest growing during the forecast period. Further, based on industry, the market is segmented into IT & Telecom, BFSI, healthcare, retail, and others. The IT & Telecom segment dominated the market in 2020 and BFSI segment is expected to be the fastest growing during the forecast period.

A few major primary and secondary sources referred to for preparing this report on data center colocation market in SAM are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are AT&T Intellectual Property; CyrusOne, Inc.; Digital Realty Trust LP; Equinix Inc.; NTT Communications Corporation; and Verizon Partner Solutions. are among others.

The South America Data Center Colocation Market is valued at US$ 2,136.99 Million in 2021, it is projected to reach US$ 4,017.45 Million by 2028.

As per our report South America Data Center Colocation Market, the market size is valued at US$ 2,136.99 Million in 2021, projecting it to reach US$ 4,017.45 Million by 2028. This translates to a CAGR of approximately 9.4% during the forecast period.

The South America Data Center Colocation Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Data Center Colocation Market report:

The South America Data Center Colocation Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Data Center Colocation Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Data Center Colocation Market value chain can benefit from the information contained in a comprehensive market report.