In the oil & gas industry, various components such as metallic pieces, engine shafts, sucker rods, stanchions, bolts, and nuts are used in oil drilling and exploration. Here, the lathe machine is used for the production of the above components for quick replacements if there is any equipment damage at the oil field while exploration. In addition, in oil fields, there is often a breakdown of piping systems causing machine tool manufacturers to work strategically to deal with this problem. Here, conventional lathes are used to handle very large diameter pipes as those in the drilling and conveyance sections. The constant need to repair and maintain piping and conveyance systems is increasing the demand for conventional lathe machines across oil fields. Furthermore, the growing oil exploration industry is fueling the market's growth. Thus, the growing oil & gas industry is expected to fuel the growth of the South America conventional lathe machine market.

The South America conventional lathe machine market in SAM is segmented into Brazil, Argentina, and the Rest of SAM. In vehicle manufacturing, conventional lathe machines are used to produce disc brakes, engine parts, and different parts of the vehicle. As the automotive industry is witnessing tremendous growth in the region, the need for conventional lathe machines is also rising. Governments of various countries in SAM plays a substantial role in developing the automotive industry. The increase in commercial and passenger vehicle sales in Brazil over the past decade is primarily driven by national economic growth, favorable consumer credit policies, and fiscal incentives offered by the government. According to the OICA, in 2022, motor vehicle production was ~2.96 million units, which increased by 9% compared to 2021. Furthermore, the growing EV production capabilities from leading players in the region is likely to increase the demand for conventional lathe machines in the coming years. In November 2022, BYD signed a letter of intent with the local government of Camacari, Brazil, to establish a manufacturing facility for EVs and the processing of raw battery materials. The company announced its plan to start the construction of the facility by June 2023. The manufacturing plant will have two production lines, one of which will be for raw battery materials preparation and the other for the manufacturing of electric buses and trucks. These two lines are expected to be operational by October 2024. In addition, the company also plans to construct the third production line for the manufacturing of electric cars and plug-in hybrid vehicles, which is expected to be operational by January 2025. Also, according to the Automotive Association of Peru (AAP), in Peru, the sales of hybrid and EVs increased by 151.7% in 2021 from the sales in 2020. Thus, the growing automobile production in the country is expected to fuel the growth of the South America conventional lathe machine market in SAM during the forecast period.

Strategic insights for the South America Conventional Lathe Machine provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South America Conventional Lathe Machine refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

South America Conventional Lathe Machine Strategic Insights

South America Conventional Lathe Machine Report Scope

Report Attribute

Details

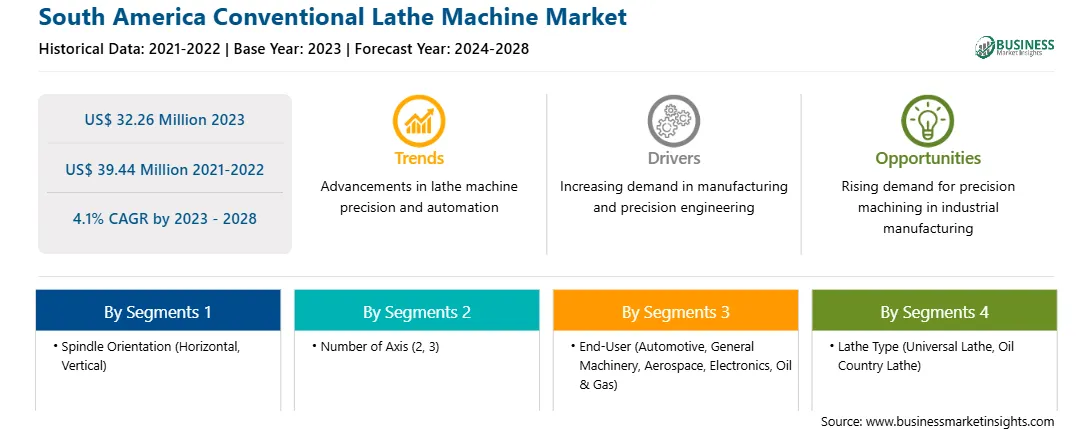

Market size in 2023

US$ 32.26 Million

Market Size by 2028

US$ 39.44 Million

Global CAGR (2023 - 2028)

4.1%

Historical Data

2021-2022

Forecast period

2024-2028

Segments Covered

By Spindle Orientation

By Number of Axis

By End-User

By Lathe Type

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South America Conventional Lathe Machine Regional Insights

South America Conventional Lathe Machine Market Segmentation

The South America conventional lathe machine market is segmented into spindle orientation, number of axis, end-user, lathe type, and country.

Based on spindle orientation, the South America conventional lathe machine market is segmented into horizontal and vertical. In 2023, the horizontal segment held the larger share of the South America conventional lathe machine market.

Based on number of axis, the South America conventional lathe machine market is segmented into 2 and 3. In 2023, the 2 segment held the larger share of the South America conventional lathe machine market.

Based on end-user, the South America conventional lathe machine market is segmented into automotive, general machinery, aerospace, electronics, oil & gas, others. In 2023, the automotive segment held the largest share of the South America conventional lathe machine market.

Based on lathe type, the South America conventional lathe machine market is segmented into universal lathe and oil country lathe. In 2023, the universal lathe segment held the larger share of the South America conventional lathe machine market.

Based on country, the South America conventional lathe machine market is segmented into Brazil, Argentina, and the Rest of South America. In 2023, Brazil accounted for the largest share of the South America conventional lathe machine market.

CNC-TAKANG Co Ltd, Colchester Machine Tool Solutions Ltd, Knuth Werkzeugmaschinen GmbH, L&L Machinery Industry Co Ltd, Optimum Maschinen GmbH, and Romi Machine Tools Ltd are the leading companies operating in the South America conventional lathe machine market.

The South America Conventional Lathe Machine Market is valued at US$ 32.26 Million in 2023, it is projected to reach US$ 39.44 Million by 2028.

As per our report South America Conventional Lathe Machine Market, the market size is valued at US$ 32.26 Million in 2023, projecting it to reach US$ 39.44 Million by 2028. This translates to a CAGR of approximately 4.1% during the forecast period.

The South America Conventional Lathe Machine Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Conventional Lathe Machine Market report:

The South America Conventional Lathe Machine Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Conventional Lathe Machine Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Conventional Lathe Machine Market value chain can benefit from the information contained in a comprehensive market report.