South America Commercial Vehicle Transmission Oil Pump and Transmission System Market

No. of Pages: 177 | Report Code: TIPRE00025231 | Category: Automotive and Transportation

No. of Pages: 177 | Report Code: TIPRE00025231 | Category: Automotive and Transportation

The automotive manufacturing sector in SAM is witnessing growth owing to the presence of many OEMs and automakers in the region. Brazil benefits from being a potentially large domestic market with low vehicle ownership and a growing economy. Moreover, the growing automotive production is supporting the growth of the commercial vehicle transmission oil pump and transmission system market in the region. As per OICA, Brazil witnessed a growth of 2.2% Y-o-Y in the total vehicle production in 2019 and produced 496,498 commercial vehicles before the COVID-19 outbreak. The region has strong presence of leading commercial vehicle manufacturers such as Agrale S.A, Volkswagen, Mecedez-Benz, MAN, Volvo, Scania, Ford, and Iveco among others. Moreover, SAM has the presence of major automakers such as General Motors, Volkswagen, Hyundai, Ford, Toyota, Peugeot, and Renault. The national regulatory bodies of various countries in the region have realized the importance of the automotive sector and are taking initiatives for the development of the automotive industry. For instance, the Brazilian government has formulated favorable trade investment policies to encourage private investments. The government has also made provisions to give investors exemption from customs duties and other taxes on the purchase of certain infrastructure and capital goods. In 2017, Argentine President Mauricio Macri announced a 1 Million Plan for the automotive industry. Under this, the country aimed to produce 750,000 cars annually by 2019 and one million units annually by 2023. Therefore, the government initiatives to support the growth of the automotive sector would strengthen the automotive manufacturing industry in the region in the coming years, which is likely to support the growth of the commercial vehicle transmission oil pump and transmission system market in SAM during the forecast period.

In SAM, Brazil witnessed the highest number of COVID-19 confirmed cases, followed by Ecuador, Peru, Chile, and Argentina. Governments have been imposing travel restrictions, lockdowns, and trade bans to contain the spread of novel coronavirus that causes COVID-19. Thus, the COVID-19 pandemic is severely affecting the commercial vehicle transmission oil pump and transmission system market growth in the region. Response measures need to consider the sudden demand once the pandemic ends. However, recent relaxations in lockdown and the arrangement of large-scale vaccination drives would help the economies to bounce back, which would allow industries to regain their operations in the next few quarters.

Strategic insights for the South America Commercial Vehicle Transmission Oil Pump and Transmission System provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

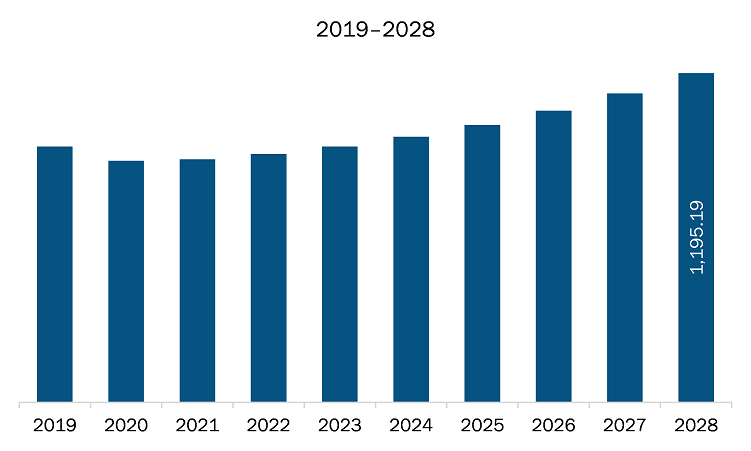

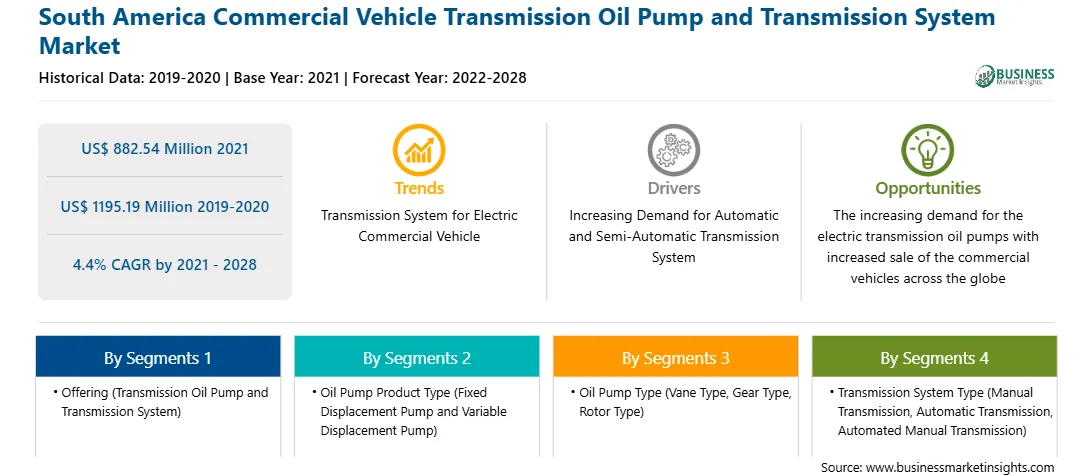

| Market size in 2021 | US$ 882.54 Million |

| Market Size by 2028 | US$ 1195.19 Million |

| Global CAGR (2021 - 2028) | 4.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Commercial Vehicle Transmission Oil Pump and Transmission System refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The commercial vehicle transmission oil pump and transmission system market in South America is expected to grow from US$ 882.54 million in 2021 to US$ 1195.19 million by 2028; it is estimated to grow at a CAGR of 4.4% from 2021 to 2028. Hybrid vehicles, electric vehicles, and idling stop systems as well as other recent advancements in fuel economy can experience incompatibility with traditional mechanical oil pumps. Therefore, the advancements demand electric oil pumps. The automobile industry is striving toward lowering fuel usage by reducing the amount of time an engine is running: idling stop systems evolve into coasting stop systems (engine shutting down during deceleration), and subsequently sailing stop systems (turning off the engine when the car is benefitting from inertia after acceleration). Another rising trend is the extension of electric oil pump applications to include clutch disengagement, cooling, and lubrication. These pumps are also being used frequently in large hybrid vehicles, which is propelling the demand for larger pump models. In addition, higher fuel economy rules are driving the growth of the commercial vehicle transmission oil pump and transmission system market. Market players are expecting to expand their electric oil pump lineup in the future to include compact and large models for continuously variable transmissions, dual-clutch gearboxes, EV traction motor cooling, and a variety of other applications. For instance, Bosch developed electric oil pumps to address essential market demands in the electric vehicles market. In eAxle and automated transmissions, Bosch pumps optimize lubrication, cooling, and actuation functions. Three modular power classes and an application-specific hydraulic part meet market expectations. The design approach ensures that hydraulic elements, motors, and control electronics are all integrated. Smart functions can be combined based on the needs of the customer. Therefore, Surge in demand for electric transmission oil pump will drive the market growth.

In terms of offering, transmission system segment held a larger market share of the commercial vehicle transmission oil pump and transmission system market in 2020. Based on oil pump product type, fixed displacement pump segment held a larger market share in 2020. Based on oil pump type, gear type segment held a larger market share in 2020. Based on transmission system type, manual transmission segment held a larger market share in 2020. Based on vehicle type, HCV (Class VII to Class VIII) segment held a larger market share in 2020. Similarly Based on powertrain type, internal combustion engine segment held the largest share in the market.

A few major primary and secondary sources referred to for preparing this report on the commercial vehicle transmission oil pump and transmission system market in South America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Allison Transmission Holding INC; Daimler AG; Eaton Group; Mack Trucks; Scania; Sinotruk (Hong Kong) Limited; Shaanxi Fast Auto Drive Co. Ltd.; Volvo AG; Voith GmbH & Co. KGaA; ZF Friedrichshafen AG; Hyundai Transys; Mahle GmbH; Concentric AB; SHW AG; and BorgWarner Inc. among others.

The South America Commercial Vehicle Transmission Oil Pump and Transmission System Market is valued at US$ 882.54 Million in 2021, it is projected to reach US$ 1195.19 Million by 2028.

As per our report South America Commercial Vehicle Transmission Oil Pump and Transmission System Market, the market size is valued at US$ 882.54 Million in 2021, projecting it to reach US$ 1195.19 Million by 2028. This translates to a CAGR of approximately 4.4% during the forecast period.

The South America Commercial Vehicle Transmission Oil Pump and Transmission System Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Commercial Vehicle Transmission Oil Pump and Transmission System Market report:

The South America Commercial Vehicle Transmission Oil Pump and Transmission System Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Commercial Vehicle Transmission Oil Pump and Transmission System Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Commercial Vehicle Transmission Oil Pump and Transmission System Market value chain can benefit from the information contained in a comprehensive market report.