The class D audio amplifier market in SAM is further segmented into Brazil, Argentina, and the Rest of SAM. There is a mixed growth scenario in the region, with a few countries having complex macroeconomic and political environments. Moreover, several countries in this region presently lack the infrastructure and resources needed to further develop the same across the region. Despite many challenges, the positive initiatives taken by governments are facilitating economic growth at a reasonable pace. Developing economies such as Brazil, Argentina, Chile, and Peru are making significant investments in infrastructure and industrial development. South America is experiencing huge investments in infrastructural developments in countries such as Brazil, Argentina, Columbia, Ecuador, Peru, and Uruguay. A few of the major infrastructural development project are Bogotá Metro, Metro de Quito - Phase 2, 50MW Molino deRosas, Cartagena Port Expansion, Deep water port on Rocha Coast, Southern Peruvian Pipelines, and New Airport for Mexico City, Puerto de Gran Escala, Porto Sul Bahia, and El Tablón, and Los Llanitos y Jicatuyo. This is boosting the adoption of class D audio amplifiers across the region.Further, several SAM countries have been stable adopters of mobile devices and data services for years. Many businesses in this region have been undergoing digital transformations to become more competitive in the market they serve. Colombia and Brazil are rapidly evolving into digital countries, and Chile is one of the top countries exhibiting the rapid pace of digitization and innovation. Moreover, rising urbanization has resulted in growth of various shopping complexes and recreation centers. Thus, the digital transformation and growing urbanization are providing new opportunities to the class D audio amplifier providers in SAM.

In case of COVID-19, Brazil got the highest no. of cases in SAM region. followed by countries such as Ecuador, Peru, Chile, and Argentina. Thus, the government is adopting several initiatives to protect people and to slow down the disease spread in the region through travel restrictions, lockdown, and trade bans. Hence, these factors are anticipated to directly affect the growth rate of class D audio amplifier market in this region for the next few quarters. Manufacturers of class D audio amplifiers are focusing on lowering operating costs to stay competitive. They are expected to resume production activities during the post-lockdown phase. Factory shutdowns, travel and trade bans, and border lockdowns to combat and contain the infection have impacted manufacturing, supply, and sales of various audio products. Government initiatives to boost economies and relaxations amid lockdown impositions are expected to fuel demand for class D audio amplifiers in the coming years. Moreover, high adoption of new technologies in the automotive and consumer electronics industries would further bolster the demand for class D audio amplifiers.

Strategic insights for the South America Class D Audio Amplifier provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

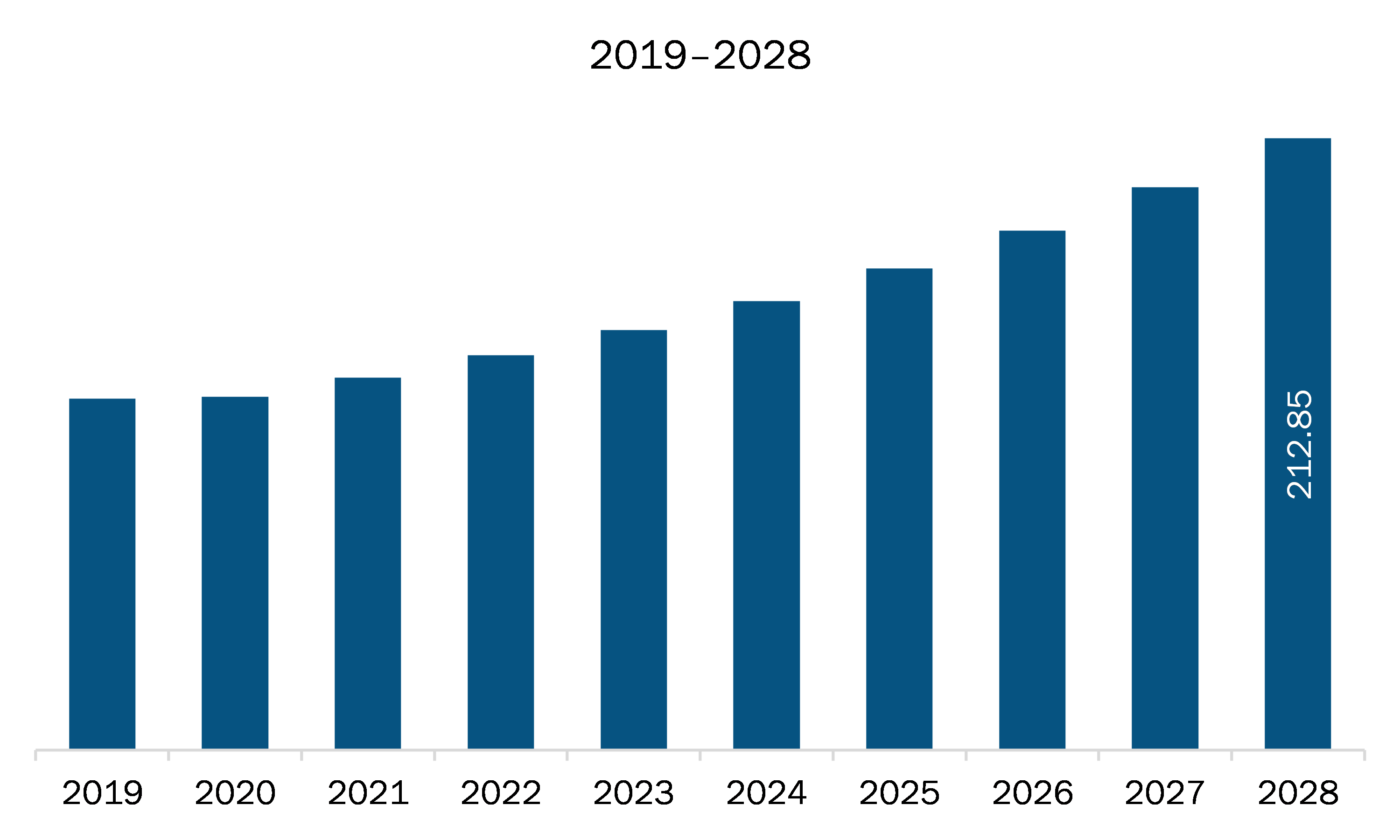

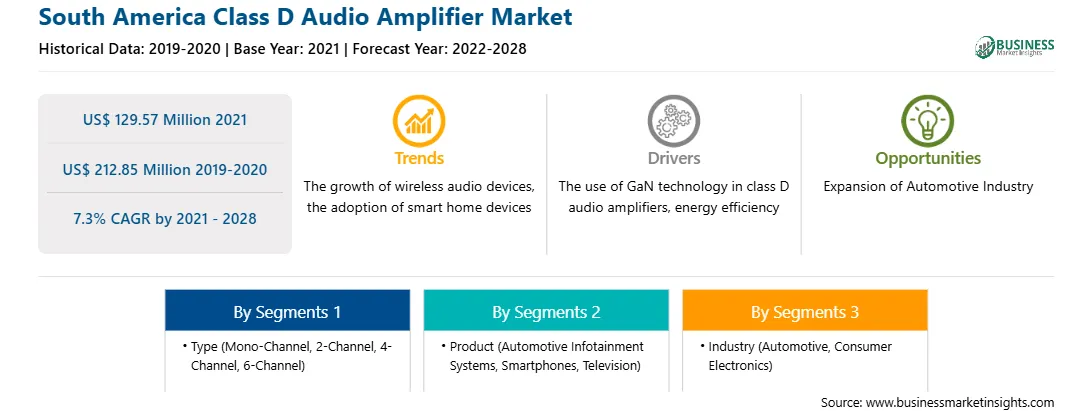

| Market size in 2021 | US$ 129.57 Million |

| Market Size by 2028 | US$ 212.85 Million |

| Global CAGR (2021 - 2028) | 7.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Class D Audio Amplifier refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The SAM class D audio amplifier market is expected to grow from US$ 129.57 million in 2021 to US$ 212.85 million by 2028; it is estimated to grow at a CAGR of 7.3% from 2021 to 2028. The SAM automotive sector has experienced the emergence of several new carmakers over the years. The automotive giants are continuously eyeballing the electric vehicle manufacturing, as an attractive segment for expanding their clientele. Major players catalyzing the SAM electric vehicle market growth include Tesla, BMW, Nissan, Ford, and Volkswagen, among others. As per International Energy Agency, the sales of electric cars reached 2.1 million in 2019, with a 40% year-on-year increase. With the rising electric vehicle production, the demand for in-vehicle infotainment systems is also on rise. In addition to the country such as Brazil, which is known for large adoption of electric vehicles across the region, several other countries are also generating high demands for these vehicles. As the infotainment systems includes audio amplifier components, the ongoing demand for electric vehicles is expected to propel the growth of SAM class D audio amplifier market during the forecast period.

In terms of type, the mono-channel segment accounted for the largest share of the SAM class D audio amplifier market in 2020. In terms of product, the others segment held a larger market share of the SAM class D audio amplifier market in 2020. Further, the consumer electronics segment held a larger share of the SAM class D audio amplifier market based on industry in 2020.

A few major primary and secondary sources referred to for preparing this report on the SAM class D audio amplifier market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Analog Devices, Inc; INFINEON TECHNOLOGIES AG; Maxim Integrated; NXP Semiconductors N.V.; ON Semiconductor Corporation; Qualcomm Technologies, Inc.; Silicon Laboratories, Inc.; STMicroelectronics N.V.; and Texas Instruments Incorporated.

The South America Class D Audio Amplifier Market is valued at US$ 129.57 Million in 2021, it is projected to reach US$ 212.85 Million by 2028.

As per our report South America Class D Audio Amplifier Market, the market size is valued at US$ 129.57 Million in 2021, projecting it to reach US$ 212.85 Million by 2028. This translates to a CAGR of approximately 7.3% during the forecast period.

The South America Class D Audio Amplifier Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Class D Audio Amplifier Market report:

The South America Class D Audio Amplifier Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Class D Audio Amplifier Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Class D Audio Amplifier Market value chain can benefit from the information contained in a comprehensive market report.