R&D is a significant and essential part of the business of pharmaceuticals and biopharmaceutical companies. R&D enables companies to come up with new medicines for various therapeutic applications with significant medical and commercial potential. There has been an increase in R&D spending by biopharmaceutical companies over the years. Drug development and discovery are time-consuming and expensive processes. These processes involve various stages, including early detection of a target, designing of a molecule, and development and regulatory approval. The entire process can take more than 10–15 years. Throughout the drug development phase, various testing services are required to check the quality and efficacy of the drug. In the development and modification of a new vaccine strain for infectious disease, various cell culture studies and experiments are performed that majorly requires biosafety cabinets. Furthermore, increasing demand for smart laboratories has led to the development of smart biosafety cabinets with cloud-based, Internet of Things (IoT), and Artificial Intelligence (AI) technologies. Thus, the rising number of molecules entering clinical trial studies and ramp-up in R&D, along with the growing trend of smart laboratories, will create ample opportunities for the South America biosafety cabinet market during the forecast period.

The South America biosafety cabinet market is segmented into Brazil, Argentina, and the Rest of South America. Brazil held the substantial share of the market in 2023. Brazil has manufacturing plants of many pharmaceutical companies. Added to that, many foreign companies often collaborate with Brazilian laboratories and local companies for the development of biotechnology based medicines. The collaborative efforts are expected to yield in development of novel products in Brazil over the forecast years. Most of the research is conducted in universities and other federal state institutions in Brazil. As per the DWIH São Paulo, biotechnology research is one of the first-tier priorities in Brazil. Thus, the government has established various policies and rules to stimulate the biotech research in the country. For instance, the government established National Policy of Science since 2004 that aims to transform the biotechnology sector into strategic component for revenue generation and development of country. However, in 2019, the government freeze around 42.0% of science funding due to political imbalances in the country, which is expected to have negative impact on the market growth by certain extent. Thus, a high burden of cancer is expected to favor the biosafety cabinet market growth in Brazil in the coming years.

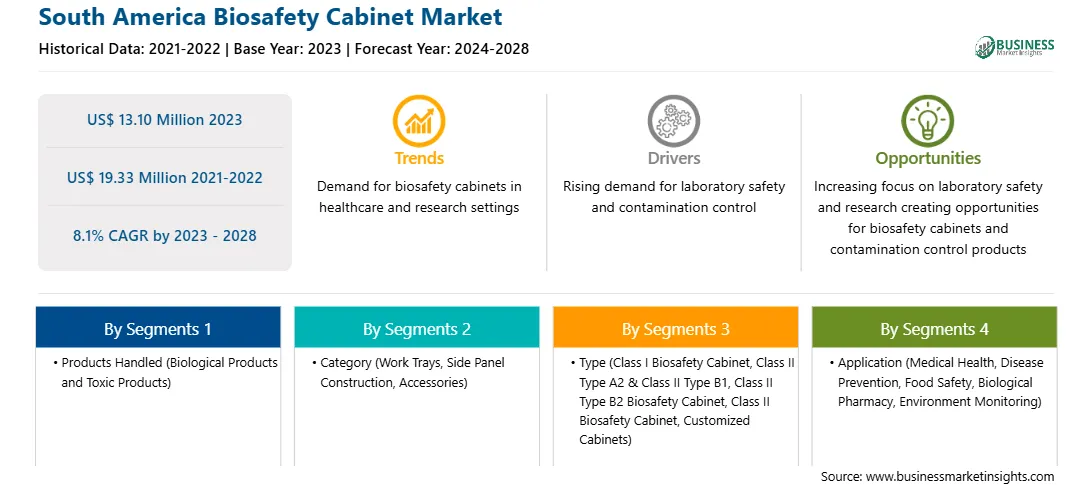

Strategic insights for the South America Biosafety Cabinet provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South America Biosafety Cabinet refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.South America Biosafety Cabinet Strategic Insights

South America Biosafety Cabinet Report Scope

Report Attribute

Details

Market size in 2023

US$ 13.10 Million

Market Size by 2028

US$ 19.33 Million

Global CAGR (2023 - 2028)

8.1%

Historical Data

2021-2022

Forecast period

2024-2028

Segments Covered

By Products Handled

By Category

By Type

By Application

By End User

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South America Biosafety Cabinet Regional Insights

The South America biosafety cabinet market is segmented into products handled, category, type, application, end user, and country.

Based on products handled, the South America biosafety cabinet market is bifurcated into biological products and toxic products. The biological products segment held a larger share of the South America biosafety cabinet market in 2023.

Based on category, the South America biosafety cabinet market is segmented into work trays, side panel construction, and accessories. The work trays segment held the largest share of the South America biosafety cabinet market in 2023.

Based on type, the South America biosafety cabinet market is segmented into class I biosafety cabinet, class II type A2 & class II type B1, class II type B2 biosafety cabinet, class II biosafety cabinet, customized cabinets, and others. The class II type A2 & class II type B1 segment held the largest share of the South America biosafety cabinet market in 2023.

Based on application, the South America biosafety cabinet market is segmented into medical health, disease prevention, food safety, biological pharmacy, environment monitoring, and others. The disease prevention segment held the largest share of the South America biosafety cabinet market in 2023.

Based on end user, the South America biosafety cabinet market is segmented into academic centers, biotech & pharmaceutical companies, microbiology centers, research & development centers, hospitals & clinics, diagnostic laboratories, and others. The biotech & pharmaceutical companies segment held the largest share of the South America biosafety cabinet market in 2023.

Based on country, the South America biosafety cabinet market has been categorized into Brazil, Argentina, and the Rest of South America. Our regional analysis states that the Rest of South America dominated the South America biosafety cabinet market in 2023.

ACMAS Technologies, Esco Group of Companies, Haier Biomedical, Kewaunee Scientific Corp, Labconco Corp, NuAire Inc, and Thermo Fisher Scientific Inc are the leading companies operating in the South America biosafety cabinet market.

1. ACMAS Technologies

2. Esco Group of Companies

3. Haier Biomedical

4. Kewaunee Scientific Corp

5. Labconco Corp

6. NuAire Inc

7. Thermo Fisher Scientific Inc

The South America Biosafety Cabinet Market is valued at US$ 13.10 Million in 2023, it is projected to reach US$ 19.33 Million by 2028.

As per our report South America Biosafety Cabinet Market, the market size is valued at US$ 13.10 Million in 2023, projecting it to reach US$ 19.33 Million by 2028. This translates to a CAGR of approximately 8.1% during the forecast period.

The South America Biosafety Cabinet Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Biosafety Cabinet Market report:

The South America Biosafety Cabinet Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Biosafety Cabinet Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Biosafety Cabinet Market value chain can benefit from the information contained in a comprehensive market report.