South America includes Argentina, Brazil and Rest of South America. The market is expected to have growth opportunities in Brazil in terms of urbanizations and rising used of automobiles. The ongoing expansion of the automotive manufacturing sector in the South America region is attributed to the presence of a large number of OEMs and automakers in the region. Brazil is a potentially large domestic market with low vehicle ownership and a growing economy. However, with time the country is witnessing rising automotive production is supporting the growth of the automotive steel wheels market in the region. For instance, as per OICA, total vehicle/cars production in Brazil increased by 2.2% in 2019. Further, the region has presence of a few major automakers—such as Volkswagen, General Motors, Hyundai, Toyota, Peugeot, Ford, and Renault. The national regulatory bodies of various countries in the region are encouraging the development of safer and more advanced vehicles. For instance, the Brazilian government has formulated favorable trade investment policies to encourage private investments in varied industry vertical including automotive. The Brazilian government has also made provisions to give exemption to investors from custom duties and other taxes on the purchase of certain infrastructure and capital goods. Such government initiatives to support the growth of the automotive sector would strengthen the automotive manufacturing industry in the region, which is expected to support the growth of the automotive steel wheels market in the region in the coming years.

These regions are of low cost; therefore, they face the most significant challenge due to the coronavirus pandemic. Due to COVID-19, many South and Central American countries have restricted traveling, which has significantly affected several industries. As per the Brazil automaker’s association, it is anticipated that the sales of automotive will recover to pre-COVID levels by 2025. Also, several automakers in the country have witnessed a sharp decline in their production capabilities. According to Anfavea, the automakers association, the automotive production is expected to witness a fall of 45% in 2020 as compared to 2019. Also, the auto exports are expected to saw a decline of 53% for the same duration. Moreover, recently, Ford Motors announced to close its three production facilities and will stop manufacturing operations in SAM region

Strategic insights for the South America Automotive Steel Wheels provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

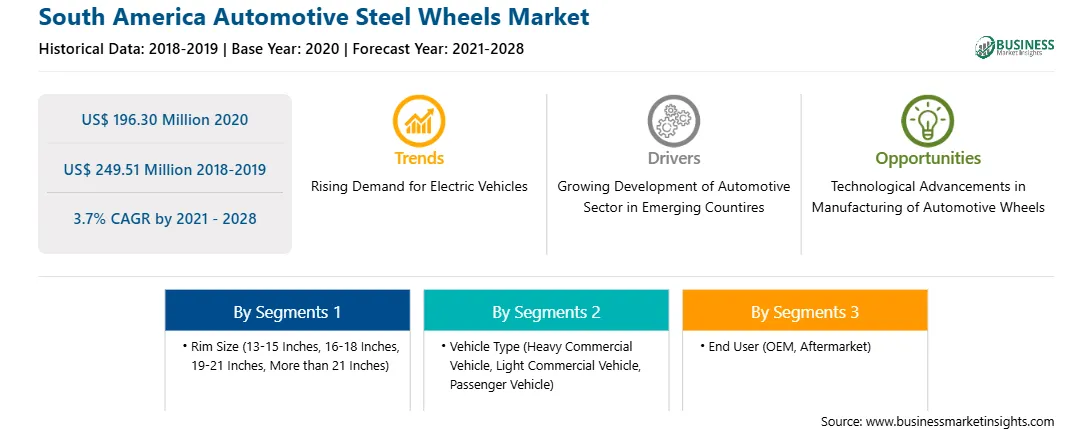

| Market size in 2020 | US$ 196.30 Million |

| Market Size by 2028 | US$ 249.51 Million |

| Global CAGR (2021 - 2028) | 3.7% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2028 |

| Segments Covered |

By Rim Size

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Automotive Steel Wheels refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

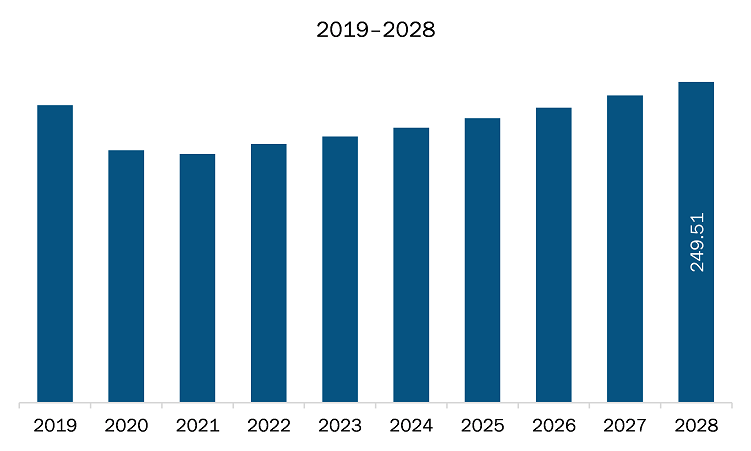

The Automotive Steel Wheels Market in SAM is expected to grow from US$ 196.30 Million in 2020 to US$ 249.51 Million by 2028; it is estimated to grow at a CAGR of 3.7% from 2021-2028. The manufacturing of vehicles is expected to increase in the coming years with the rising need of personal transportation means, such as cars and SUVs, especially during the ongoing COVID-19 pandemic, as people are more inclined toward buying personal cars to avoid public transport. The automotive manufactures provide a steel wheel as a spare wheel with every unit of vehicle. Factors such as increasing road accidents and surge in road transport are boosting the demand for low-cost wheels. As per the Insurance Institute for Highway Safety – Highway Loss Data Institute, ~33,244 motor vehicle crashes were reported in the US in 2019. Such accidents generate demand for spare components, such as wheels. Thus, the surge in demand for lightweight steel wheels due to their high performance, and low manufacturing and repair costs is driving the market growth.

The MEA automotive steel wheels market is segmented based on rims size, vehicle type, end user and country. Based market is segmented as Rim Size 13-15 Inches, 16-18 Inches, 19-21 Inches, and more than 21 Inches. In 2020, the 16-18 Inch segment held the largest share MEA automotive steel wheels market. Based on vehicle type the automotive steel wheels market is divided into Heavy Commercial Vehicle, Light Commercial Vehicle, and Passenger Vehicle. Passenger Vehicle is expected to the fastest growing segment over the forecast period. On the basis of user the market is segmented into OEM, and Aftermarket. The OEM segment accounts for largest market share in the 2020.

A few major primary and secondary sources referred to for preparing this report on the Automotive Steel Wheels Market in MEA are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Topy Industries limited, Steel Strips Wheels limited, Klassic Wheels Ltd., IOCHPE-MAXION SA., MANGLES

The South America Automotive Steel Wheels Market is valued at US$ 196.30 Million in 2020, it is projected to reach US$ 249.51 Million by 2028.

As per our report South America Automotive Steel Wheels Market, the market size is valued at US$ 196.30 Million in 2020, projecting it to reach US$ 249.51 Million by 2028. This translates to a CAGR of approximately 3.7% during the forecast period.

The South America Automotive Steel Wheels Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Automotive Steel Wheels Market report:

The South America Automotive Steel Wheels Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Automotive Steel Wheels Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Automotive Steel Wheels Market value chain can benefit from the information contained in a comprehensive market report.