The ongoing expansion of the automotive manufacturing sector in the South America region is attributed to the presence of a large number of OEMs and automakers in the region. Brazil is a potentially large domestic market with low vehicle ownership and a growing economy. However, with time the country is witnessing rising automotive production is supporting the growth of the automotive radar market in the region. For instance, as per OICA, total vehicle/cars production in Brazil increased by 2.2% y-o-y in 2019. Further, the region has presence of a few major automakers—such as Volkswagen, General Motors, Hyundai, Toyota, Peugeot, Ford, and Renault. The national regulatory bodies of various countries in the region are encouraging the development of safer and more advanced vehicles. For instance, the Brazilian government has formulated favorable trade investment policies to encourage private investments in varied industry vertical including Automotive. The Brazilian government has also made provisions to give exemption to investors from custom duties and other taxes on the purchase of certain infrastructure and capital goods. Such government initiatives to support the growth of the automotive sector would strengthen the automotive manufacturing industry in the region, which is expected to support the growth of the automotive radar market in the region in the coming years.

The ongoing COVID-19 outbreak is negatively impacting SAM. Due to the presence of most of the automotive manufacturing capabilities of Brazil, SAM witnessed a limited impact despite slower demand for passenger vehicle sales. As per the Brazil automaker’s association, it is anticipated that the sales of automotive will recover to pre-COVID-19 levels by 2025. Also, several automakers in the country have witnessed a sharp decline in their production capabilities. According to Anfavea, the automakers association, the automotive production is expected to witness a fall of 45% in 2020 as compared to 2019. Also, the auto exports are expected to see a decline of 53% for the same duration. Moreover, recently, Ford Motors announced the closure of its three production facilities, It also announced that it will stop manufacturing operations in SAM. The COVID–19 pandemics would have a short-term impact on the SAM automotive radar market; however, it is anticipated that the market will recover in the coming years.

Strategic insights for the South America Automotive Radar provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

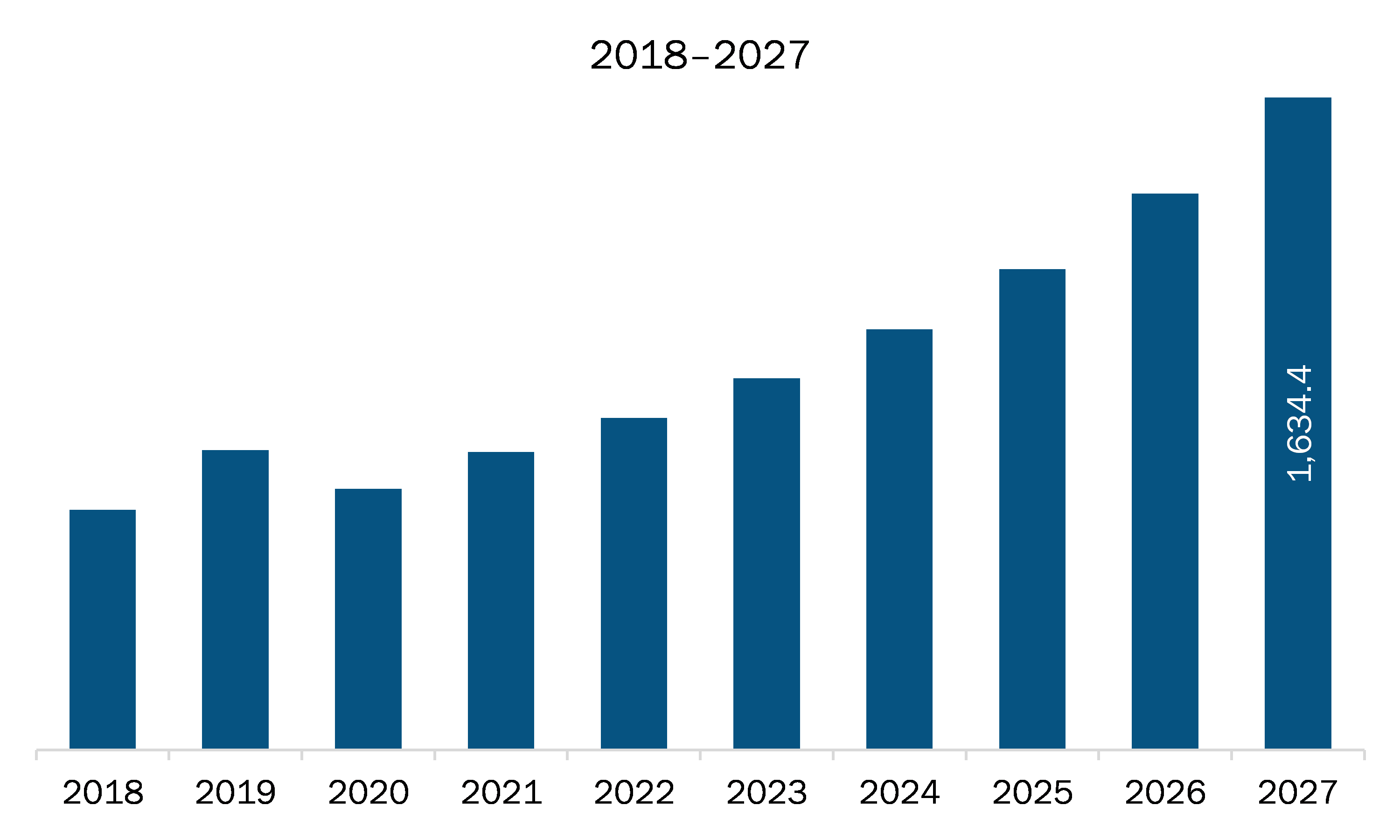

| Market size in 2019 | US$ 751.5 Million |

| Market Size by 2027 | US$ 1,634.4 Million |

| Global CAGR (2020 - 2027) | 14.0% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Range

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Automotive Radar refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The automotive radar market in SAM is expected to grow from US$ 751.5 million in 2019 to US$ 1,634.4 million by 2027; it is estimated to grow at a CAGR of 14.0% from 2020 to 2027. The radar technology is used in automobiles to operate and enable various ADAS functions. There is a significant shift toward smaller node complementary metal-oxide semiconductor (CMOS) or silicon-on-insulator (SOI) chips, which enable higher monolithic functions. The operational frequency of the radar technology is increasing with enhanced velocity and angular resolution. Moreover, the range resolution of the technology is increasing with the improvement in its overall bandwidth. There are number of startups that are in the forefront of some of these trends. The radar systems, made available from 2019, are developed for level 3 to level 5 autonomous driving vehicles. The systems scan the environment to gain understanding about the distance, speed, height, and depth of the object around the vicinity of the car. GhostWave Inc. is another startup that offers radar solutions that eliminate/avoid unintentional jamming. Oculli, a Canadian company, has 4D radar systems that can follow 200 targets simultaneously for mapping and localization. Thus, the growing focus on high-resolutions radar systems is emerging as a key trend in the SAM automotive radar market.

Based on range, the short range radar segment is expected to lead the market throughout the forecast period. By frequency, 24 GHz is expected to dominate the market in 2019; however, the 77 GHz is anticipated to attain the highest market share by frequency by 2027. By Application, the adaptive cruise control segment is anticipated to dominate the market by 2027. The passenger cars segment is expected to hold over 70% of the market share based on vehicle type from 2019 to 2027.

A few major primary and secondary sources referred to for preparing this report on the automotive radar market in SAM are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are SAM automotive radar market. Aptiv Plc, Continental AG, Denso Corporation, HELLA KGaA Hueck & Co., Nidec Corporation, Robert Bosch GmbH, Valeo, Veoneer Inc, and ZF Friedrichshafen AG.

The South America Automotive Radar Market is valued at US$ 751.5 Million in 2019, it is projected to reach US$ 1,634.4 Million by 2027.

As per our report South America Automotive Radar Market, the market size is valued at US$ 751.5 Million in 2019, projecting it to reach US$ 1,634.4 Million by 2027. This translates to a CAGR of approximately 14.0% during the forecast period.

The South America Automotive Radar Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Automotive Radar Market report:

The South America Automotive Radar Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Automotive Radar Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Automotive Radar Market value chain can benefit from the information contained in a comprehensive market report.