Geographically, the automotive disc brake market in SAM is segmented into Brazil and Argentina. South America's automotive industry is booming, owing to increased credit supply, economic prosperity, and low interest rates. Estimates say that the Latin American automotive industry exported 5.72 million units in 2019, up 4.3% year over year. The revival of the Brazilian economy and the strong success of the SUV segment are largely responsible for the industry's growth; the SUV segment is expected to account for 25.4% of the market following the launch of new models and restyling. As a result of the region's rising vehicle production, demand for automotive disc brakes will also increase. Brazil's automobile market is one of the most dynamic markets in South America, as the nation has established itself as a major country in the global automotive and auto parts markets. The nation has attracted the attention of some of the world's leading automobile companies in recent decades, with many of these companies establishing manufacturing facilities in the country. As a result, the demand for automotive disc brakes grows in tandem with the number of vehicles produced, resulting in the growth of the market.

In case of COVID-19, SAM is highly affected especially Brazil, followed by Ecuador, Chile, Peru, and Argentina, among others. The government of South America (SAM) has taken an array of actions to protect their citizens and contain COVID-19’s spread. It is anticipated that South America will face lower export revenues, both from the drop in commodity prices and reduction in export volumes, especially to China, Europe, and the United States, which are important trade partners. Containment measures in several countries of South America has impacted the manufacturing industry including automotive manufacturing. Major automotive manufacturers have also temporarily closed their production process in the region owing to cost control measure due to the pandemic. Further, due to non-availability of raw materials and supply chain disruption, the automotive disc brake market has been negatively affected in 2020. In 2021, with the uplifting of lockdowns and vaccination process, the shipment of raw materials needed for disc brake manufacturing and the manufacturing of passenger vehicles & commercial vehicles has started again. Therefore, this will create a positive impact in the growth of automotive disc brake market in the region.

Strategic insights for the South America Automotive Disc Brake provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

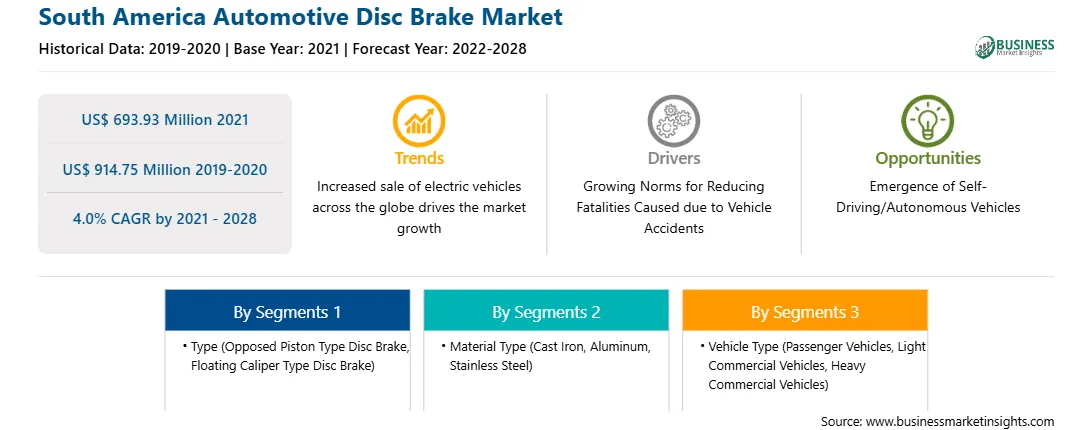

| Market size in 2021 | US$ 693.93 Million |

| Market Size by 2028 | US$ 914.75 Million |

| Global CAGR (2021 - 2028) | 4.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Automotive Disc Brake refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

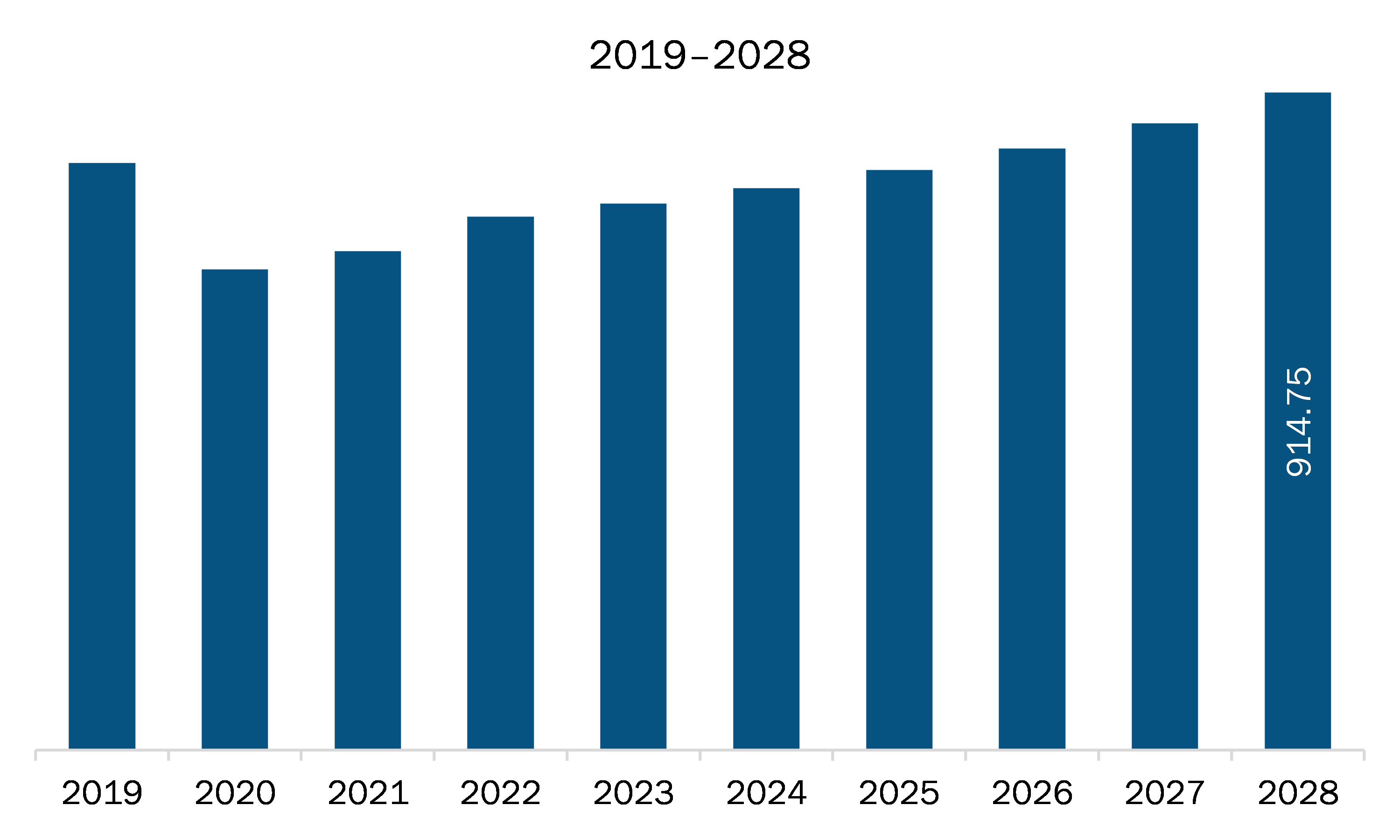

The SAM automotive disc brake market is expected to grow from US$ 693.93 million in 2021 to US$ 914.75 million by 2028; it is estimated to grow at a CAGR of 4.0% from 2021 to 2028. The rising sales of both passenger cars and commercial vehicles is fostering the brakes market growth across the region. The increasing demand for vehicles is positively impacting the production cycle of the same across the region. As the demand for vehicles is increasing, the formation of regulatory mandates for making the vehicles safer is rising. This is leading to a surge in demand for brakes. The penetration of anti-lock braking system and electronic stability control is expanding. Therefore, government bodies of countries across the region have taken a step in regulating safety critical components within commercial vehicles and passenger vehicles, which has resulted into a rise in demand for anti-lock braking systems. Moreover, fatalities caused due to vehicle accidents is one of the factors encouraging the government bodies to introduce new norms for both vehicle & road safety, which would help in reducing fatalities. As poor braking system is one of the causes that leads to road accidents, establishment of proper norms for using friction materials and braking system is a must. Several aforesaid laws with respect to the use of friction materials and disc brakes are supporting the SAM market growth.

In terms of type, the floating caliper type disc brake segment accounted for the largest share of the SAM automotive disc brake market in 2020. In terms of material type, the stainless steel segment held a larger market share of the SAM automotive disc brake market in 2020. Further, the passenger vehicles segment held a larger share of the SAM automotive disc brake market based on vehicle type in 2020.

A few major primary and secondary sources referred to for preparing this report on the SAM automotive disc brake market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Brembo S.p.A.; EBC Brakes; Haldex Group; Hitachi Astemo Americas, Inc.; Hyundai Mobis; Knorr-Bremse AG; Mando Corporation; and Nissin Kogyo Co., Ltd.

The South America Automotive Disc Brake Market is valued at US$ 693.93 Million in 2021, it is projected to reach US$ 914.75 Million by 2028.

As per our report South America Automotive Disc Brake Market, the market size is valued at US$ 693.93 Million in 2021, projecting it to reach US$ 914.75 Million by 2028. This translates to a CAGR of approximately 4.0% during the forecast period.

The South America Automotive Disc Brake Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Automotive Disc Brake Market report:

The South America Automotive Disc Brake Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Automotive Disc Brake Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Automotive Disc Brake Market value chain can benefit from the information contained in a comprehensive market report.