SAM includes Brazil and Argentina. The region is significantly looking to adopt automatic tolling systems for smoother toll collection. For instance, Ausol Autopistas del Sol SA, the largest toll concessionaire in Argentina supporting a 120 km roadway network and more than 900,000 vehicles per day, has chosen TransCore’s radio frequency identification (RFID) technology multiprotocol windshield sticker tags and multiprotocol encompass 6 reader technology to upgrade its current system. Similarly, Indra Sistemas has been awarded with a EUR 10.5 million (US$ 11.8 million) contract by Ruta del Cacao Concessionaire to supply all the traffic management technology, intelligent transport systems (ITS), communications, and toll systems for a major new BBY Highway in Colombia, SAM. Therefore, the adoption of advanced technologies in toll collection systems is leading the demand for automatic tolling systems in the region. Further, SAM countries are focusing on several highway projects. With the growing number of highways and roads, there is an increasing need for advanced toll collection systems. For instance, the Inter-American Development Bank and the World Bank were heavily engaged in the highway construction projects such as the construction of the bridge links joining Paraguay & Argentina, Argentina & Uruguay, and Paraguay & Brazil. A road linking Venezuela & Brazil allows north-south movement through the Amazon basin. Brazil continues to have the largest network of roads belonging to the Pan-American Highway system, which extends throughout the Americas. Thus, there is an increasing need for toll collection systems, owing to rise in the highway construction projects, which is boosting the demand for automatic tolling systems.

SAM countries have been witnessing growth in several industries over the past few years. Industries such as automotive, aerospace, and equipment manufacturing have experienced a fair growth rate. The COVID-19 pandemic has affected several sectors including the toll collections activity. Due to non-availability of raw materials the market has been negatively affected, as the automatic tolling system includes various semiconductor components such as cameras, and most of these components are needed to import from other countries, and due to supply chain disruption, the work is at halt, impacted negatively in 2020. In 2021, with the uplifting of lockdowns and vaccination process, the shipment of raw materials has started again, and the development of older toll collection system has started again. Therefore, this will lead the growth of automatic tolling system market in the region.

Strategic insights for the South America Automatic Tolling System provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 277.32 Million |

| Market Size by 2028 | US$ 344.34 Million |

| Global CAGR (2021 - 2028) | 3.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Automatic Tolling System refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

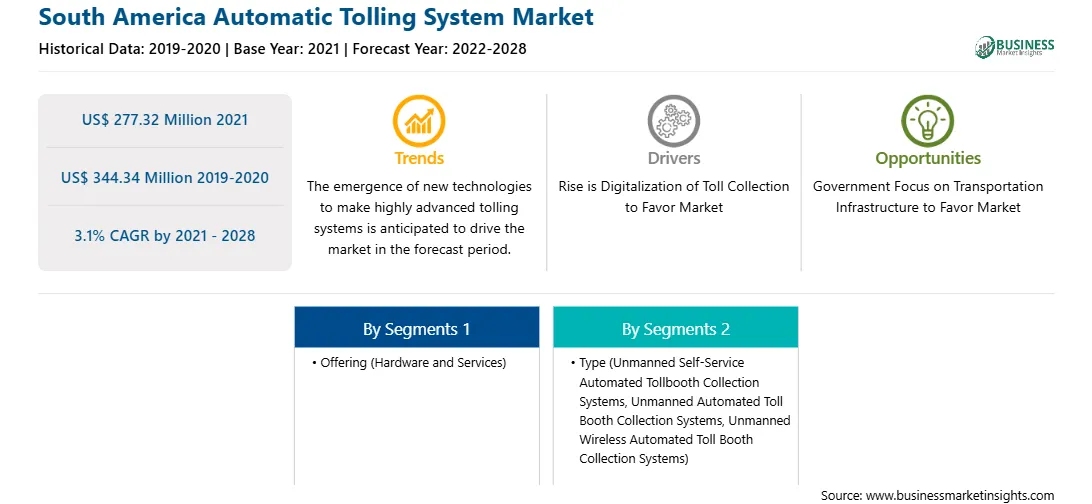

The automatic tolling system market in SAM is expected to grow from US$ 277.32 million in 2021 to US$ 344.34 million by 2028; it is estimated to grow at a CAGR of 3.1% from 2021 to 2028. Due to the nonavailability of raw materials, the market has been negatively affected. The automatic tolling system includes various semiconductor components such as cameras, and most of these components are needed to be imported from other countries. Due to supply chain disruption, the transportation of such components was negatively impacted in 2020. However, in 2021, with the relaxation of lockdown restrictions and beginning of vaccination process, the shipment of raw materials has started again, and the development of toll collection system has started again. Therefore, this will fuel the growth of the automatic tolling system market in the region.

The SAM automatic tolling system market is segmented into offering and type. Based on offering, the SAM automatic tolling system market is segmented into hardware and services. The services segment held the largest market share in 2020. Based on type, the automatic tolling system market is segmented into unmanned self-service automated toll booth collection system, unmanned automated toll booth collection system, and unmanned wireless automated toll booth collection system. The unmanned automated toll booth collection system segment led the automated tolling system market in 2020.

A few major primary and secondary sources referred to for preparing this report on the automatic tolling system market in SAM are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Conduent Business Services, LLC; Feig Electronic; Indra Sistemas, S.A.; Raytheon Technologies Corporation; Siemens Mobility; STMicroelectronics N.V.; Tecsidel, S.A.; and Thales Group.

The South America Automatic Tolling System Market is valued at US$ 277.32 Million in 2021, it is projected to reach US$ 344.34 Million by 2028.

As per our report South America Automatic Tolling System Market, the market size is valued at US$ 277.32 Million in 2021, projecting it to reach US$ 344.34 Million by 2028. This translates to a CAGR of approximately 3.1% during the forecast period.

The South America Automatic Tolling System Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Automatic Tolling System Market report:

The South America Automatic Tolling System Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Automatic Tolling System Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Automatic Tolling System Market value chain can benefit from the information contained in a comprehensive market report.