Brazil, Argentina, Peru, and Chile are among the major countries that make up the South American economy. Compared to the Caribbean and other Eastern SAM countries, Western SAM countries are more advanced. Despite many economic challenges, favorable government initiatives would propel the growth of the region’s economy during the forecast period. The region has a high urbanization rate, owing to the government initiatives that support industrial growth. With the growth in the industrial sector, the scope of adoption of arbitrary waveform generators is projected to increase over the years. Further, the telecommunications sector in SAM is evolving with the integration of advanced technologies. According to Ericsson’s mobility report, the Latin America 5G network would hold a 26% share by 2026, and the remaining 56% would be contributed by 4G. At present, the 5G networks have been launched in Brazil and Colombia, while Argentina, Chile, and Mexico are investing in its deployment to deploy it by the end of 2026. Meanwhile, the increasing disposable income per capita is encouraging the demand for high-tech consumer electronics, thereby fueling the growth of the arbitrary waveform generator market in SAM.

The containment measures have led to lesser production of commodities, goods, and services. The manufacturing sector have witnessed a decline in their operations due to temporary shutdown of activities. The electronics industry took a significant hit as the demand for electronic components was lowered from industrial sector and end users. The revenue model for electronics has declined as no mass production was carried in the lockdown period. Post lockdown, the semiconductor and electronics industry started to regain the market share as production facilities restarted the operation by taking social distancing measures. Brazil is currently the most affected country by COVID-19 in South America, followed by Argentina, Colombia, Chile, and among others. Most of the commercial operations in the region were shut down in 2020 to prevent the spread of the disease. Containment measures imposed in cities have compelled most production plant operators to suspend their operation indefinitely, which led reduction in demand for electronics equipment. Therefore, the COVID-19 pandemic has been restraining the arbitrary waveform generator market growth in South America.

Strategic insights for the South America Arbitrary Waveform Generator provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

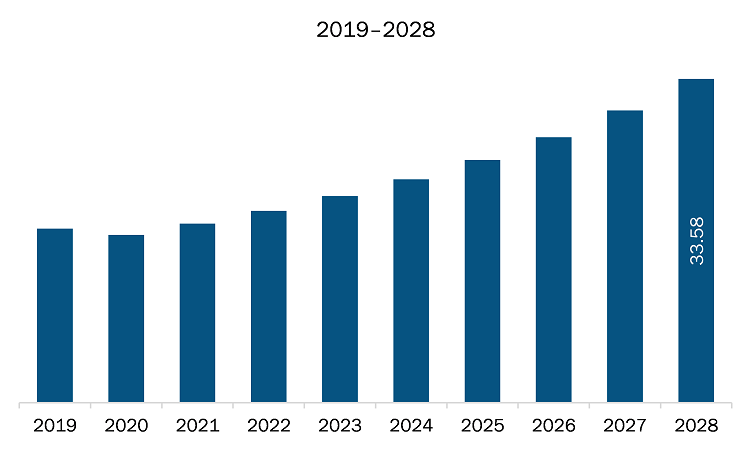

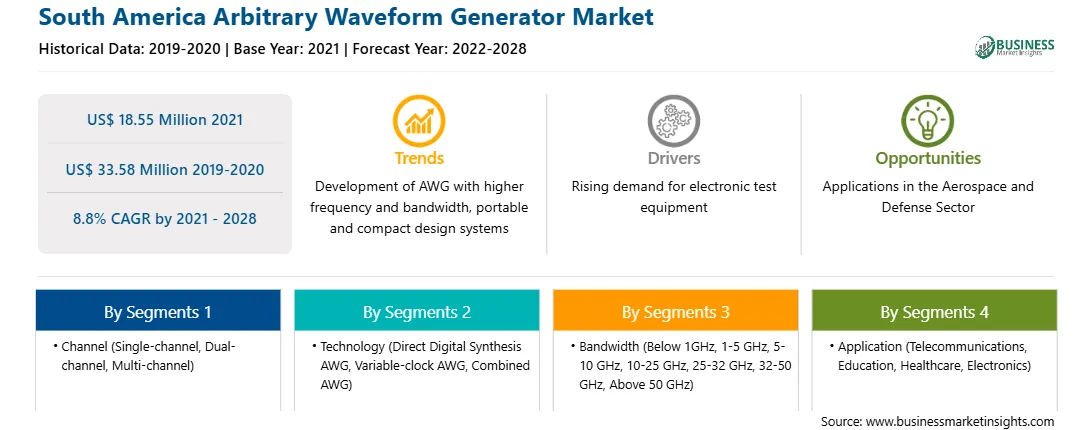

| Market size in 2021 | US$ 18.55 Million |

| Market Size by 2028 | US$ 33.58 Million |

| Global CAGR (2021 - 2028) | 8.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Channel

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Arbitrary Waveform Generator refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The arbitrary waveform generator market in SAM is expected to grow from US$ 18.55 million in 2021 to US$ 33.58 million by 2028; it is estimated to grow at a CAGR of 8.8% from 2021 to 2028. Accelerating growth in telecommunication industry; telecommunication sector is one of the most innovative sectors. The tremendous progress in telecommunication technology is expected to impact the telecom manufacturing and service industries positively. With the advent of wireless technologies such as 5G networks, IoT and smart cities, AI, and diversified ecosystems, there is an increased need for precise and efficient arbitrary waveform generators to carry out specific critical equipment testing. The RF-related applications of an AWG such as measuring the frequency response of bandpass filter, measuring intermodulation distortion of RF components, and measuring pulsed noise-testing, are widely used in the telecommunication industry. Thus, the ongoing advancement in the telecommunication industry worldwide is creating ample opportunities for the key players to grow in the arbitrary waveform generator market. This is bolstering the growth of the arbitrary waveform generator market.

Based on channel, the market is segmented into single-channel, dual-channel, and multi-channel. In 2020, the dual-channel segment held the largest share SAM arbitrary waveform generator market. Based on technology, the market is segmented into direct digital synthesis AWG, variable-clock AWG, and combined AWG. In 2020, the direct digital synthesis AWG segment held the largest share SAM arbitrary waveform generator market. Based on bandwidth, the market is segmented into below 1GHz, 1–5 GHz, 5–10 GHz, 10–25 GHz, 25–32 GHz, 32–50 GHz, and above 50 GHz. In 2020, the below 1GHz segment held the largest share SAM arbitrary waveform generator market. Based on application, the arbitrary waveform generator market is divided into telecommunication, education, healthcare, electronics, and others. In 2020, the telecommunication held the largest share SAM arbitrary waveform generator market.

A few major primary and secondary sources referred to for preparing this report on the arbitrary waveform generator market in SAM are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are B&K Precision Corporation, KEYSIGHT TECHNOLOGIES, Rohde & Schwarz, Tabor Electronics Ltd., TEKTRONIX, INC, Teledyne LeCroy, and Texas Instruments Incorporated are among others.

The South America Arbitrary Waveform Generator Market is valued at US$ 18.55 Million in 2021, it is projected to reach US$ 33.58 Million by 2028.

As per our report South America Arbitrary Waveform Generator Market, the market size is valued at US$ 18.55 Million in 2021, projecting it to reach US$ 33.58 Million by 2028. This translates to a CAGR of approximately 8.8% during the forecast period.

The South America Arbitrary Waveform Generator Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Arbitrary Waveform Generator Market report:

The South America Arbitrary Waveform Generator Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Arbitrary Waveform Generator Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Arbitrary Waveform Generator Market value chain can benefit from the information contained in a comprehensive market report.