The rising number of cyber-attacks, coupled with a significant increase in the number of connected devices and access points, has notably increased the demand for superior monitoring and controlling of enterprise applications. As a result, the demand for extensive protection and coverage of end-point access has risen significantly and subsequently gained traction among numerous industry verticals. Thus, several market players operating in the application control market currently provide extensive business offerings that facilitate the advanced protection of enterprise applications through enabling varying degree of control such as execution, monitoring and authentication among other controls. The application control-based solutions have extensive scope of utilization for network security, enforcing control over servers, end-point protection and authentication, among several other benefits to the end-user organization. In addition, the advancement in application control tools have facilitated the integration of forensic control that automate the validation process, enabling checks for inputs and data correctness among other niche advantages to the end users. Thus, the application control market is poised to provide numerous profitable business opportunities for the market players during the forecast period. Thus, the Countering IT threats by launching government mandates is expected to create a significant demand for application control in the coming years, which is further anticipated to drive the SAM application control market. Also the ongoing COVID-19 pandemic is badly impacting the SAM region. The SAM region is predominantly dominated by selected number of countries such as Brazil, Argentina and Ecuador among selected few others Brazil has the highest number of COVID-19 confirmed cases, followed by other countries such as Ecuador, Peru, Chile, and Argentina. The governments of various countries in SAM are taking several initiatives to protect people and to contain COVID-19’s spread in the region through lockdowns, trade bans, and travel restrictions, thus having direct impact on the region’s economic growth as the region will face lower export revenues, both from the drop in commodity prices and reduction in export volumes, especially to major trading partners. Moreover, the region also significantly constitutes various island nations and small countries accounted consolidated demand for application control solutions and services. In order to mitigate the impact of COVID-19 various restrictions in the several prominent countries in the SAM region is likely to cause a negative impact in demand for application control market.

Strategic insights for the South America Application Control provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 118.96 Million |

| Market Size by 2027 | US$ 143.13 Million |

| Global CAGR (2020 - 2027) | 2.4% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Application Control refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

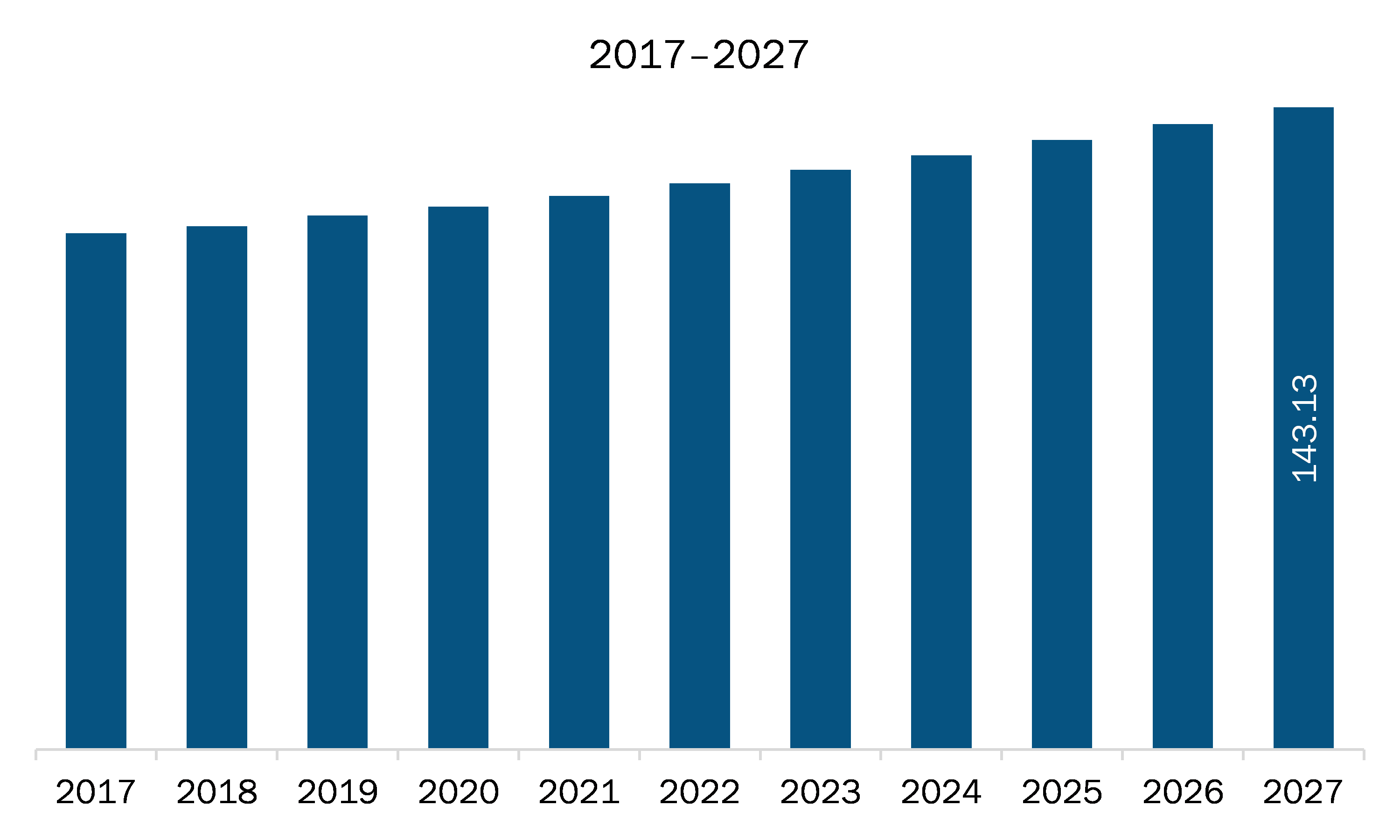

The application control market in SAM is expected to grow from US$ 118.96 million in 2019 to US$ 143.13 million by 2027; it is estimated to grow at a CAGR of 2.4% from 2020 to 2027. The traction toward integrated security solutions is growing as these solutions allow the companies to eradicate chances of theft and data loss while enabling quick response as well as staff and customer traffic monitoring. The integrated security solutions are developed to assist critical firms in protecting their confidential information. Credit unions, banks, and other financial institutions are adopting integrated security solutions to reap their benefits. The banking industry deals with enormous personal data of individuals and banks. DGA Security, Tyco Integrated Security, and PACOM System Pty Ltd., are among the providers of integrated security solutions for the banking industry. The financial service providers demand more stringent security solutions to protect the data regarding institution’s interests, along with property, asset, and customer information. The integrated security solutions generate detailed access reports and conduct security audits. The integrated security software and services assist in protecting banks against internal and external threats by facilitating better protection to bank employees, assets, customers, branches and bank office operations. This is further going to bolster the growth of SAM application control market.

In terms of component, solution held the largest share of the SAM application control market in 2019. In terms of access points, mobiles/tablets is expected to the fastest growing segment over the forecast period. On the basis of organization size large enterprises segment contributed a substantial share in 2019. Based on vertical, IT and Telecom segment held the largest share in 2019 and it is projected to continue its dominance over the forecast period also.

A few major primary and secondary sources referred to for preparing this report on the application control market in SAM are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Broadcom Inc.; Cambium Networks; Check Point Software Technologies Ltd.; Ivanti; McAfee, LLC; Trend Micro Incorporated; VMware, Inc.; WatchGuard Technologies, Inc.

The List of Companies - South America Application Control Market

The South America Application Control Market is valued at US$ 118.96 Million in 2019, it is projected to reach US$ 143.13 Million by 2027.

As per our report South America Application Control Market, the market size is valued at US$ 118.96 Million in 2019, projecting it to reach US$ 143.13 Million by 2027. This translates to a CAGR of approximately 2.4% during the forecast period.

The South America Application Control Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Application Control Market report:

The South America Application Control Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Application Control Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Application Control Market value chain can benefit from the information contained in a comprehensive market report.