According to a 2018 retrospective examination of Medicare users, 8.2 million persons suffered wounds that were infected or not. The cost of acute and chronic wound treatments was estimated to cost between US$ 28.1 billion and US$ 96.8 billion by Medicare. Surgical wounds were the most expensive, followed by diabetic foot ulcers, with outpatient wound care costs higher than inpatient wound care. Traumatic wounds are a significant clinical, social, and economic burden because of the rising healthcare expenditures, an aging population, identification of difficult-to-treat infection risks such as biofilms, and the global hazard of diabetes and obesity. Traumatic wounds are those that have not proceeded through the normal healing process and have been open for longer than a month. Traumatic wounds have a variety of causes, all of which place a strain on the healthcare system. Diabetic and obese patients are at a higher risk of getting chronic wounds. Most persons who have a long-term open wound also have additional serious health problems. Comorbidity refers to the existence of multiple chronic diseases at the same time. Comorbidities complicate chronic wounds, making it difficult to follow chronic wounds as a disease in and of itself. In comparison to the overall burden of chronic wounds as a health care concern, research funding dedicated to studying chronic wounds is disproportionately low. Wound healing using amniotic membrane grafts has some therapeutic potential. Early use of an amniotic membrane for ulcers, burns, and cutaneous injuries proved therapeutic. Therefore, an increasing number of traumatic wounds is boosting the amniotic product market.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the SAM amniotic products market. The SAM amniotic products market is expected to grow at a good CAGR during the forecast period.

Strategic insights for the South America Amniotic Products provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

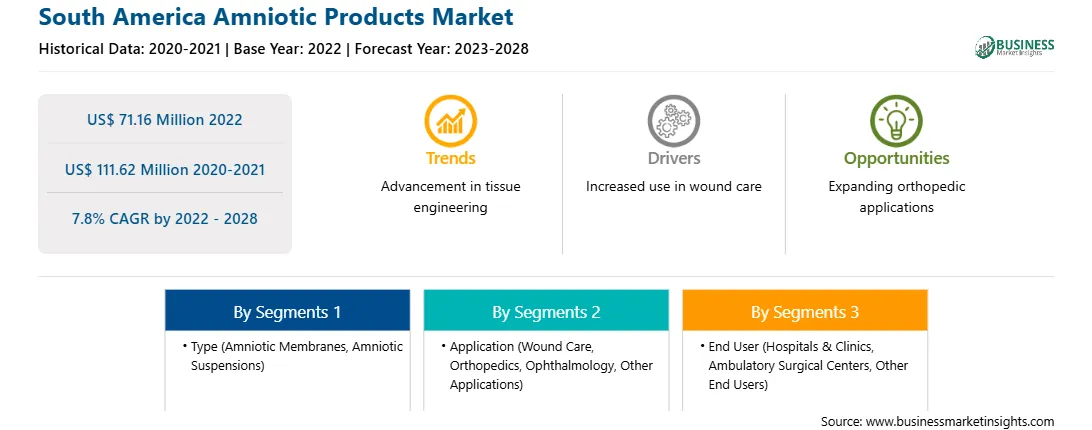

| Market size in 2022 | US$ 71.16 Million |

| Market Size by 2028 | US$ 111.62 Million |

| Global CAGR (2022 - 2028) | 7.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Amniotic Products refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The SAM amniotic products market is bifurcated based on type, application, end user and country. Based on type, the market is segmented into amniotic membranes, and amniotic suspensions. The amniotic membranes segment dominated the market in 2022 and is expected to be fastest growing during forecast period. Based on application, the market is segmented into wound care, orthopedics, ophthalmology, and other applications. The wound care segment dominated the market in 2022 and orthopedics segment is expected to be fastest growing during forecast period. Based on end user, the market is segmented into hospitals and clinics, ambulatory surgical centers, and other end users. The hospitals and clinics segment dominated the market in 2022 and ambulatory surgical centers segment is expected to be fastest growing during forecast period. Based on country, the SAM amniotic products market is segmented into the Brazil, Argentina, and Rest of SAM.

Integra LifeSciences; Katena Products. Inc.; MiMedx; NuVision Biotherapies Ltd; Organogenesis, Inc.; Sanuwave and Sanuwave Health, Inc.; Smith & Nephew; and Stryker are among the leading companies in the SAM amniotic products market.

The South America Amniotic Products Market is valued at US$ 71.16 Million in 2022, it is projected to reach US$ 111.62 Million by 2028.

As per our report South America Amniotic Products Market, the market size is valued at US$ 71.16 Million in 2022, projecting it to reach US$ 111.62 Million by 2028. This translates to a CAGR of approximately 7.8% during the forecast period.

The South America Amniotic Products Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Amniotic Products Market report:

The South America Amniotic Products Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Amniotic Products Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Amniotic Products Market value chain can benefit from the information contained in a comprehensive market report.