Improving social conditions and changing economic structure are accelerating the pace of the region’s development. Countries in SAM are upgrading their aircraft systems with modern technologies to improve flight operations. Commercial aircraft service providers are also expanding their services in the region. For instance, in December 2020, JetBlue airline started a new flight service between Cheddi Jagan International Airport (GEO) in Guyana and John F. Kennedy International Airport (JFK) in New York. According to the Boing commercial market outlook report, Latin America is likely to witness a rising demand for fleet deliveries, i.e., around 3,040 fleet deliveries in the next 20 years. Therefore, increasing number of airlines and aircraft, with growing research & development activities, and emerging services in the airline industry are creating a tremendous surge in aircraft actuator requirement, thereby augmenting the market growth. Countries, such as Brazil and Argentina, are propelling the market growth by generating the demand for advanced aircraft equipped with modern actuators. According to Embraer, an aircraft manufacturing company, 66 new airports would be built in Brazil under the 2026 Privatization Plan. Increasing number of airports would create the need for new aircraft fleet, thereby boosting the demand for aircraft actuators. According to the Embraer company reports, Latin America had 430 aircraft fleet in service in 2019 and the number is projected to reach 810 by 2029.

Brazil has the highest number of COVID-19 cases, followed by Peru, Chile, Colombia, and Ecuador, among others. South America's government has taken an array of actions to protect their citizens and contain COVID-19's spread. Brazil is the largest spender in the aerospace industry and is the only modern aircraft manufacturing country in the region. Owing to this, the demand for components and aircraft related systems and technologies is at an all-time high in the country. In addition, the majority of the components are imported from the US, China, and SAMan countries. The slowdown in commercial and military aircraft production in the country has impaired the supply chain in Brazil. This has weakened the demand for several components, including actuation system. Thus, the outbreak of COVID-19 has had a harsh impact on the South American aircraft actuators market, especially in Brazil.

Strategic insights for the South America Aircraft Actuators provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2020 | US$ 638.39 Million |

| Market Size by 2027 | US$ 834.38 Million |

| Global CAGR (2020 - 2027) | 3.9% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2027 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Aircraft Actuators refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

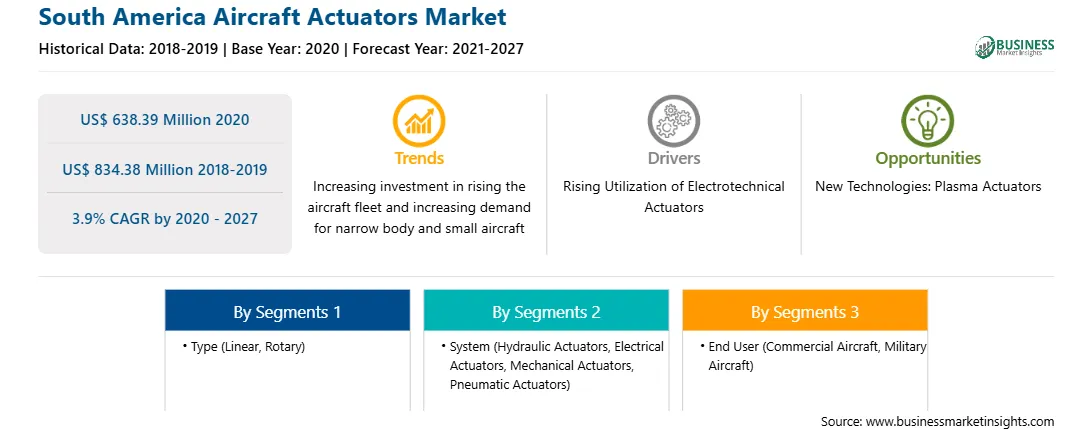

The aircraft actuators market in SAM is expected to grow from US$ 638.39 million in 2020 to US$ 834.38 million by 2027; it is estimated to grow at a CAGR of 3.9% from 2020 to 2027. Rising Use of Electrotechnical Actuators. Aircraft flight control systems are shifting from bulky, heavy, and leaky hydraulic systems to an electric autonomous system. The advancements in electro-mechanical (EM) actuator, such as reliability, compact nature, light weight, and cost-efficiency, are mounting its adoption in aircraft. Commercial and military aircraft fleets are looking for advanced system, which are lighter in weight to enhance fuel efficiency. Actuators in aircraft are used in the functionality of landing gear, slats and spoilers, seats, flaps, positioning engine inlet guide vanes, rudder, ailerons, and opening and closing cargo or weapon bay doors, among others. Since, the aircraft OEMs are increasingly emphasizing on lightweight aircraft models, the electromechanical actuators are attracting the OEMs in the current scenario, which is catalyzing the aircraft actuators market. Another reason for the increasing adoption of electromechanical actuators is the paradigm shift of aerospace industry toward electric aircraft, which is obsoleting the hydraulic, pneumatic, and mechanical systems and are increasing the adoption of electric actuation systems. This trend is generating substantial demand for the electrical actuators, which is ultimately boosting the aircraft actuators market. This is bolstering the growth of the aircraft actuators market.

In terms of end user, the Commercial Aircraft segment accounted for the largest share of the SAM aircraft actuators market in 2019. Further, the Commercial Aircraft segment held a larger share of the market based on end user in 2019.

A few major primary and secondary sources referred to for preparing this report on the aircraft actuators market in SAM are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Collins Aerospace; Raytheon Technologies Company; Eaton Corporation plc, Honeywell International Inc; Meggitt PLC, Moog Inc.; Parker-Hannifin Corporation; Woodward, Inc.

The South America Aircraft Actuators Market is valued at US$ 638.39 Million in 2020, it is projected to reach US$ 834.38 Million by 2027.

As per our report South America Aircraft Actuators Market, the market size is valued at US$ 638.39 Million in 2020, projecting it to reach US$ 834.38 Million by 2027. This translates to a CAGR of approximately 3.9% during the forecast period.

The South America Aircraft Actuators Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Aircraft Actuators Market report:

The South America Aircraft Actuators Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Aircraft Actuators Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Aircraft Actuators Market value chain can benefit from the information contained in a comprehensive market report.