South Africa Anti-Infective Market to 2027 - Regional Analysis and Forecasts by Type (Antibacterial, Antiviral and Antifungal); Range (Broad Spectrum and Narrow Spectrum), and Distribution Channel (Hospital Pharmacies, Retail Pharmacies and Mail Order Pharmacies)

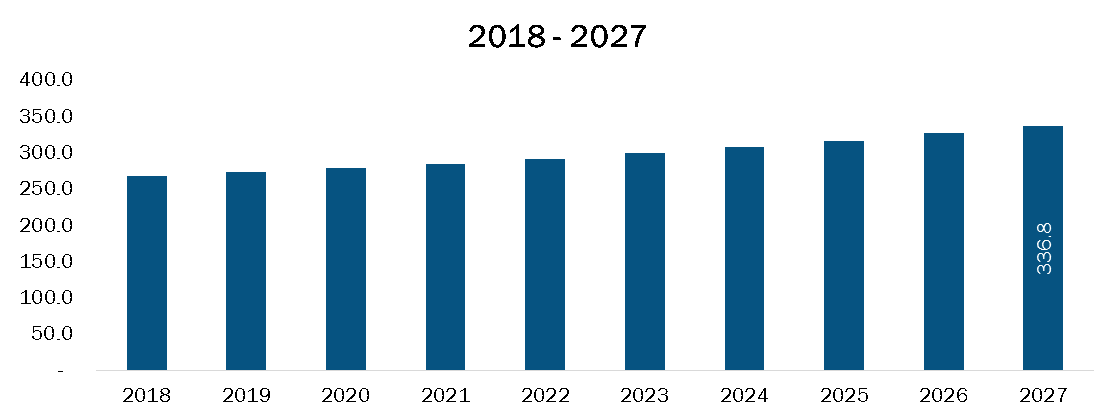

The South Africa anti-infective market is expected to reach US$ 2,572.5 Mn in 2027 from US$ 1,893.5 Mn in 2018. The market is estimated to grow with a CAGR of 3.6% from 2019-2027.

The growth of the market is driven by the factors such as,rise in the cases of viral diseases in South Africa. However, the market is likely to get impacted due to lack of awareness regarding fungal infections in South Africa.

In South Africa, almost 7.52 million people were living with HIV in 2018, as per data released by GHE. Also, during the year 2017, approximately 21% of South Africa patients living with HIV were from South Africa. The projected overall HIV prevalence rate during 2018 was almost 13.1% among the South African population, whereas for adults between 15-49 years, an estimated 19.0% of the population is found to be HIV positive. Also, South Africa has one of the highest rates of liver cancer in the world, which is related to the increased rate of HBV among adults.

Also, the incidences of tinea capitis are dominating in South Africa. Also, the country has a more significant number of tuberculosis and HIV, which further leads to a considerable amount of cases for chronic pulmonary aspergillosis (CPA). Moreover, as the data published at Gulf Conference on Clinical Microbiology and Infectious Diseases stated that approximately 99,350 cases of CPA were present in South Africa. The prevalence rate was nearly 175/100,000, which is the highest prevalence in the world. Furthermore, as per the data published by the CDC in April 2019 stated that in 2012-2016, Candida auris affected nearly 451 patients across the country. Therefore, owing to increasing prevalence across the country are likely to drive the growth of the anti-infective market during the forecast period.

South Africa anti-infective market, based on distribution channel was segmented into hospital pharmacies, retail pharmacies, and online pharmacies. In 2018, the hospital pharmacies segment held the largest share of the market, by distribution channel. This segment is also anticipated to grow at the highest rate during the forecast period.

Get more information on this report : South Africa Online Pharmacies Market Revenue and Forecasts to 2027 (US$ Mn)

ASIA PACIFIC DIABETES CARE DEVICES – MARKET SEGMENTATION

By Type

- Antibacterial

- Antiviral

- Antifungal

By Application

- Broad Spectrum

- Narrow Spectrum

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online pharmacies

Company Profiles

- Sanofi

- Abbott

- GlaxoSmithKline plc.

- Pfizer Inc.

- Merck & Co. Inc.

- Bayer AG

- Johnson & Johnson Services, Inc.

- Sandoz International GmbH

- Aspen Holdings

- Astellas Pharma Inc.

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 South Africa Anti-Infective Market – By Type

1.3.2 South Africa Anti-Infective Market – By Range

1.3.3 South Africa Anti-Infective Market – By Distribution Channel

2. South Africa Anti-Infective Market – Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. South Africa Anti-Infective– Market Landscape

4.1 Overview

4.2 Pest Analysis

4.2.1 South Africa – PEST Analysis

4.3 Expert Opinions

5. South Africa Anti-Infective Market – Key Industry Dynamics

5.1 Key Market Drivers

5.1.1 Rise in the Cases of Viral Diseases in South Africa

5.2 Key Market Restraint

5.2.1 Lack of Awareness Regarding Fungal Infections

5.3 Key Market Opportunities

5.3.1 Growth in the Pharmaceutical Industry in the Country

5.4 Future Trends

5.4.1 Growing Research Activates

5.5 Impact Analysis

6. Anti-Infective Market – South Africa Analysis

6.1 South Africa Anti-infective Market Revenue Forecasts And Analysis

7. South Africa Anti-Infective Market Analysis– by Type

7.1 Overview

7.2 South Africa Anti-Infective Market Share by Type 2018 & 2027 (%)

7.3 Antibacterial

7.3.1 Overview

7.3.2 Antibacterial Market Revenue and Forecast to 2027 (US$ Mn)

7.4 Antiviral

7.4.1 Overview

7.4.2 Antiviral Market Revenue and Forecast to 2027 (US$ Mn)

7.5 Antifungal

7.5.1 Overview

7.5.2 Antifungal Market Revenue and Forecast to 2027 (US$ Mn)

8. South Africa Anti-Infective Market Analysis– by Range

8.1 Overview

8.2 South Africa Anti-Infective Market Share by Range 2018 & 2027 (%)

8.3 Broad Spectrum

8.3.1 Overview

8.3.2 Broad Spectrum Market Revenue and Forecast to 2027 (US$ Mn)

8.4 Narrow Spectrum

8.4.1 Overview

8.4.2 Narrow Spectrum Market Revenue and Forecast to 2027 (US$ Mn)

9. South Africa Anti-Infective Market Analysis– by Distribution Channel

9.1 Overview

9.2 South Africa Anti-Infective Market Share by Distribution Channel 2018 & 2027 (%)

9.3 Hospital Pharmacies

9.3.1 Overview

9.3.2 Hospital Pharmacies Market Revenue and Forecast to 2027 (US$ Mn)

9.4 Retail Pharmacies

9.4.1 Overview

9.4.2 Retail Pharmacies Market Revenue and Forecast to 2027 (US$ Mn)

9.5 Online Pharmacies

9.5.1 Overview

9.5.2 Online Pharmacies Market Revenue and Forecast to 2027 (US$ Mn)

10. Anti-Infective Market –Industry Landscape

10.1 Overview

10.2 Growth Strategies in the Anti-Infective Market, 2016-2019

10.3 Organic Developments

10.3.1 Overview

10.3.2 Organic Growth Strategies in the Anti-infective Market, 2016-2019

10.4 Inorganic Developments

10.4.1 Overview

10.4.2 Inorganic Growth Strategies in the Anti-Infective Market, 2016-2019

11. Anti-Infective Market–Key Company Profiles

11.1 Sanofi

11.1.1 Key Facts

11.1.2 Business Description

11.1.3 Financial Overview

11.1.4 Product Portfolio

11.1.5 SWOT Analysis

11.1.6 Key Developments

11.2 Abbott

11.2.1 Key Facts

11.2.2 Business Description

11.2.3 Financial Overview

11.2.4 Product Portfolio

11.2.5 SWOT Analysis

11.2.6 Key Developments

11.3 GlaxoSmithKline plc.

11.3.1 Key Facts

11.3.2 Business Description

11.3.3 Financial Overview

11.3.4 Product Portfolio

11.3.5 SWOT Analysis

11.3.6 Key Developments

11.4 Pfizer Inc.

11.4.1 Key Facts

11.4.2 Business Description

11.4.3 Financial Overview

11.4.4 Product Portfolio

11.4.5 SWOT Analysis

11.4.6 Key Developments

11.5 Merck & Co., Inc.

11.5.1 Key Facts

11.5.2 Business Description

11.5.3 Financial Overview

11.5.4 Product Portfolio

11.5.5 SWOT Analysis

11.5.6 Key Developments

11.6 BAYER AG

11.6.1 Key Facts

11.6.2 Business Description

11.6.3 Financial Overview

11.6.4 Product Portfolio

11.6.5 SWOT Analysis

11.6.6 Key Developments

11.7 Johnson & Johnson Services, Inc.

11.7.1 Key Facts

11.7.2 Business Description

11.7.3 Financial Overview

11.7.4 Product Portfolio

11.7.5 SWOT Analysis

11.7.6 Key Developments

11.8 Sandoz International GmbH

11.8.1 Key Facts

11.8.2 Business Description

11.8.3 Financial Overview

11.8.4 Product Portfolio

11.8.5 SWOT Analysis

11.8.6 Key Developments

11.9 Aspen Holdings

11.9.1 Key Facts

11.9.2 Business Description

11.9.3 Financial Overview

11.9.4 Product Portfolio

11.9.5 SWOT Analysis

11.9.6 Key Developments

11.10 Astellas Pharma Inc.

11.10.1 Key Facts

11.10.2 Business Description

11.10.3 Financial Overview

11.10.4 Product Portfolio

11.10.5 SWOT Analysis

11.10.6 Key Developments

12. Appendix

12.1 About The Insight Partners

12.2 Glossary of Terms

LIST OF TABLES

Table 1. Recent Organic Growth Strategies in the Anti-infective Market

Table 2. Recent Inorganic Growth Strategies in the Anti-Infective Market

Table 3. Glossary of Terms, Anti-Infective Market

LIST OF FIGURES

Figure 1. Anti-Infective Market Segmentation

Figure 2. South Africa Anti-Infective Market Overview

Figure 3. Antiviral Segment Held Largest Share Of The Type Segment In Anti-Infective Market

Figure 4. South African Anti-Infective Market, Industry Landscape

Figure 5. South Africa PEST Analysis

Figure 6. Anti-infective Market Impact Analysis Of Driver And Restraints

Figure 7. South Africa Anti-Infective Market – Revenue Forecasts And Analysis – 2018- 2027

Figure 8. South Africa Anti-Infective Market Share by Type 2018 & 2027 (%)

Figure 9. Antibacterial Market Revenue And Forecasts To 2027 (US$ Mn)

Figure 10. Antiviral Market Revenue And Forecasts To 2027 (US$ Mn)

Figure 11. Antifungal Market Revenue And Forecasts To 2027 (US$ Mn)

Figure 12. South Africa Anti-Infective Market Share by Range 2018 & 2027 (%)

Figure 13. Broad Spectrum Market Revenue And Forecasts To 2027 (US$ Mn)

Figure 14. Narrow Spectrum Market Revenue And Forecasts To 2027 (US$ Mn)

Figure 15. South Africa Anti-Infective Market Share by Distribution Channel 2018 & 2027 (%)

Figure 16. Hospital Pharmacies Market Revenue And Forecasts To 2027 (US$ Mn)

Figure 17. Retail Pharmacies Market Revenue And Forecasts To 2027 (US$ Mn)

Figure 18. Online Pharmacies Market Revenue And Forecasts To 2027 (US$ Mn)

Figure 19. Growth Strategies in the Anti-Infective Market, 2016-2019

The List of Companies

- Sanofi

- Abbott

- GlaxoSmithKline plc.

- Pfizer Inc.

- Merck & Co. Inc.

- Bayer AG

- Johnson & Johnson Services, Inc.

- Sandoz International GmbH

- Aspen Holdings

- Astellas Pharma Inc.