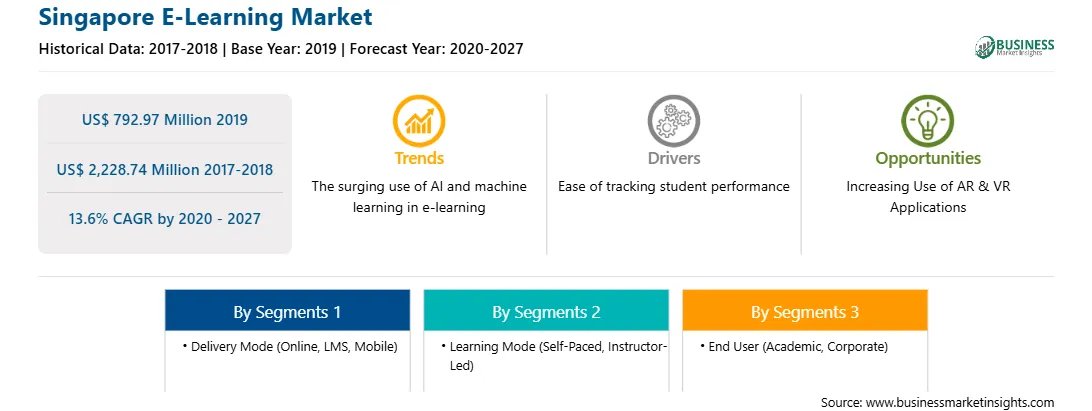

The Singapore E-Learning market was valued US$ 792.97 million in 2019 and is expected to reach US$ 2,228.74 million by 2027; it is estimated to grow at a CAGR of 13.6% during 2020–2027.

Education technology solutions are becoming popular in Singapore's schools and higher education institutions, providing a digital platform for documenting and tracking online education. E-learning leverages gamification by quickly tracking students' progress and improving their interactions with teachers and other students. Also, the popularity of e-learning is increasing in Singapore due to the need of systems such as LMS and analytics, which are used to understand and upgrade the learning process. This further encourages vendors to integrate learning modules, such as gamified learning, into software systems. Additionally, increased government investment in e-learning technologies is also expected to contribute to market growth. Singapore government launched its e-government masterplan named eGov2015 that aims to integrate systems, processes, and service delivery. The vision of the eGov 2015 drives the government toward a collaborative body that can co-create and connect with people. The masterplan aimed to guide government agencies to implement new ICT programs and transform Singapore into a global city that exploits infocomm's potential to add value to the economy and society, encompassing administration and education institutions in the country. The eGov 2015 has enabled access to the latest knowledge and new learning resources, giving rise to learning with multimedia and interactive elements, and creating an environment wherein independent and lifelong learning could take place. The goal was to build a new nationwide infrastructure by connecting schools, and make Singapore the model for the innovative use of ICTs in education and learning. This factor is anticipated to offer ample growth opportunities for the Singapore E-Learning market players in the region.

Every year the government devotes the most significant portion of its resources to healthcare and education, which are the two critical sectors. Both sectors form the fundamental building blocks of economic growth. In Budget 2019, it announced the allocation of US$ 6.1 billion in a new Merdeka Generation Fund. The government spending on education has increased from US$ 7.5 billion in 2007 to ~US$ 12.8 billion in 2018, with more than 70% rise. The education system in Singapore is considered among the best in the world. The mean years of schooling among people aged 25 years and above were 11.1 in 2018. For those aged 15 and above, the literacy rate was 97.3% in 2018, well above the global literacy rate of 86.2%. Singapore consistently leads international rankings, including the OECD Program for International Student Assessment (PISA), a test for students across the world on mathematics, reading, and science. The scores, in particular, shows that Singaporean students are outperforming their peers overseas despite spending far less than most developed countries. Thus, the inclination of toward pursuing education acts as a major growth opportunity for the Singapore e-learning market players.

Impact of COVID-19 Pandemic on Singapore E-Learning Market

The shutdown of educational institutions, and corporate and government offices to contain the spread of COVID-19 has resulted in significant interruptions in the education schedules and cancelation of assessments. However, the COVID-19 pandemic has paved opportunities for Singapore e-learning market players. The lockdown is expected to boost e-learning platform demand in the coming years. However, the demand, especially that from end users in K-12 and higher education, may decline during the post-lockdown period in 2020 or 2021. However, the market would witness steady growth over the forecast period as the synchronous and collaborative virtual classes allow students to participate actively and create an environment similar to that of a physical classroom. The e-learning technology is gaining traction with an increasing number of academic and corporate institutes deploying these solutions for enhanced training sessions.

Market Insights

Ease of Tracking Student Performance and Maintaining Centralized Student Database Drives the Market Growth

E-learning enables teachers to track student progress and ensure their performance accomplishments are met. For example, in case students fail to clear online exams, the instructor offers various customized learning methods, based on personalities, so that the students can more easily grasp the learning materials, ultimately improving their performance. Advanced e-learning systems provide reporting and analytical tools that enable teachers to identify areas that may be missing from their e-learning courses and where they excel. For example, if many students have difficulty mastering certain learning materials, the teacher can assess the content and improve it, if necessary. Moreover, all detailed students information is stored safely in a centralized system. Schools can have a control over the data access authority. Personal student details, completed assignments and exams, payment status, and various learning activities can all be displayed on a single screen. These features are anticipated to drive the learning market growth in Singapore during the forecast period.

Delivery Mode-Based Insights

Based on delivery mode, the Singapore E-learning market is segmented into online, LMS, mobile, and others. The online segment led the market in terms of share in 2019. Online learning is the popular and newest form of distance education. It has had a significant impact on post-secondary education over the past decade, and the trend is growing at a steady pace. Online learning gives the learner the freedom to learn remotely as most online educational tools are portable. Thus, the increasing reliance of online knowledge, coupled with technological advancements, is expected to increase boost the online e-learning market as technological advancements allow students to adopt entirely online study plan while socializing with classmates, watching lectures, and participating in subject-specific discussions.

Strategic insights for the Singapore E-Learning provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 792.97 Million |

| Market Size by 2027 | US$ 2,228.74 Million |

| Global CAGR (2020 - 2027) | 13.6% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Delivery Mode

|

| Regions and Countries Covered | Singapore

|

| Market leaders and key company profiles |

The geographic scope of the Singapore E-Learning refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Learning Mode-Based Insights

Based on learning mode, the Singapore e-learning market is segmented into self-paced and instructor-led. E-learning provides the option of customizing the content according to the desired learning style of the target group. The use of e-learning can simplify various aspects of instructor-led training in organizations. It is comparatively expensive to conduct instructor-led training sessions in physical classrooms or workshops and limits the number of learners that can benefit from the process.

Strategic Insights

The market players focus on new product innovations and developments by integrating advanced technologies and features in their products to compete with the competitors.

Singapore E-Learning Market – by Delivery Mode

Singapore E-Learning Market – by

Learning Mode

Singapore E-Learning Market – by

End User

Company Profiles

The List of Companies - Singapore E-learning Market

The Singapore E-Learning Market is valued at US$ 792.97 Million in 2019, it is projected to reach US$ 2,228.74 Million by 2027.

As per our report Singapore E-Learning Market, the market size is valued at US$ 792.97 Million in 2019, projecting it to reach US$ 2,228.74 Million by 2027. This translates to a CAGR of approximately 13.6% during the forecast period.

The Singapore E-Learning Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Singapore E-Learning Market report:

The Singapore E-Learning Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Singapore E-Learning Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Singapore E-Learning Market value chain can benefit from the information contained in a comprehensive market report.