The Saudi Arabia liquid filtration market was valued at US$ 77.6 million in 2018 and is expected to grow at a CAGR of 5.1

% from 2019 to 2027 to reach US$

119.8 million by 2027.

The liquid filtration is the process of removal or separation of undesirable chemicals, suspended solids, and biological contaminants from fluids. Liquid filtration system consists of various components such as demister pads, random packing rings, structured packing, vane mist eliminator among others. The liquid filtration system consists of polymer and metal liquid filter housings that available for used in controlling water, collecting dust particles, refining solvents, petrochemicals and chemicals. Liquid filtration system is also used for the sterilization method in laboratories, processing of oils and fats from animal and vegetable source. Latest advanced filtration technology such as ultrafiltration, reverse osmosis and nanofiltration where it removes particles of 0.001–0.1 µm from fluids are gaining popularity in dairy industry, metal industry and other industries. Saudi Arabia is considered as a lucrative region which is contributing the liquid filtration market share and demand. Increase in liquid filtration requirements in different industries such as pharmaceuticals, mining, food, and beverages drive the growth of the Saudi Arabia liquid filtration market. Furthermore, rise in concerns related to water pollution coupled with technical cognizance and constant research and development activity has further stimulated the demand for liquid filtration systems.

Strategic insights for the Saudi Arabia Liquid Filtration provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 77.6 Million |

| Market Size by 2027 | US$ 119.8 million |

| Global CAGR (2019 - 2027) | 5.1 % |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Fabric Material

|

| Regions and Countries Covered | Saudi Arabia

|

| Market leaders and key company profiles |

The geographic scope of the Saudi Arabia Liquid Filtration refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Market Insights

Increasing demand of filtration systems in oil and gas industry is driving the Saudi Arabia liquid filtration

Saudi Arabia is the largest country in Middle East, covering around two million square kilometres and 14th largest country in the world. The country is the second-largest crude oil producer and the largest exporter of petroleum in the world. The oil and gas industry of the country accounts for about 50 per cent of gross domestic product, and about 70 per cent of export earnings. Sustained growth in the consumption of natural gas, petroleum, and petrochemical products across the world has increased the exports and imports of oil and gas in Saudi Arabia. Thus, the oil and gas companies in Saudi Arabia need to expand their production to meet emerging demand in the future. The companies are investing heavily in technologies and modern developments to reduce the cost of operations and optimize the output of petroleum industry. It also has significant applications in many industries such as aeronautics, automobiles, mining, power plant, refineries, water treatment, aerospace, defense petrochemicals and many more. It also has significant applications in many industries such as aeronautics, automobiles, mining, power plant, refineries, water treatment, aerospace, defense petrochemicals and many more.

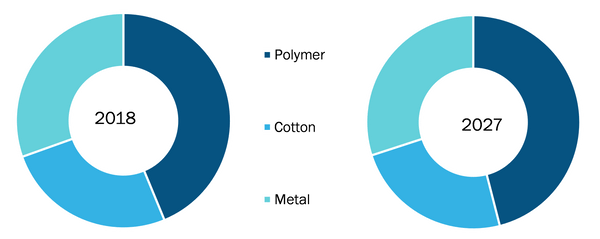

Fabric Material Insights

The polymer segment captured the largest share in the Saudi Arabia liquid filtration market. Polymers possess a broad range of properties which makes it an essential and ubiquitous element. Polymers are used to minimize the use of energy and helps to conduct the process of filtration in high-stress and high-temperature conditions. The polymer are of two types natural and synthetic polymers. Mostly, two kinds of polymers are used to make the filtration systems which are poly (oxythelene) and poly (vinylidene fluoride). Several high-performing polymer fibers are incorporated in filter media to meet various specific requirements in varied filtration uses. For instance, filters made from fluoropolymer (Polytetrafluoroethylene (PTFE), 36 Polyvinylidene fluoride (PVDF), 37 and Perfluoroalkoxy alkane (PFA)) fibers, possess inherent, chemical-resistant, and flame-retardant characteristic features, and are widely used to filter aggressive chemicals and acids.

Strategic insights for the Saudi Arabia Liquid Filtration provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 77.6 Million |

| Market Size by 2027 | US$ 119.8 million |

| Global CAGR (2019 - 2027) | 5.1 % |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Fabric Material

|

| Regions and Countries Covered | Saudi Arabia

|

| Market leaders and key company profiles |

The geographic scope of the Saudi Arabia Liquid Filtration refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Filter Media Insights

The nonwoven filter media segment captured the largest share in the Saudi Arabia liquid filtration market. Non-woven media are defined as the sheets and web structures which are bonded together by entangling the fiber and filaments together through mechanical or chemical process. They are considered as flat or porous sheets which are made directly by separate fibers. The critical pore size resembles to the diameter of nominally spherical solid particle which is going to pass through the pore. If the number of fiber strata is higher, the thickness of nonwoven count would be greater and higher would be the probability of encountering the pores of minimum size. The application of nonwovens’ kind of fiber material is rising in several filtration applications which is driving the overall Saudi Arabia liquid filtration market in several end use industry.

End User Insights

The industrial treatment segment captured the largest share in the Saudi Arabia liquid filtration market. The industrial treatment covers the processes and mechanisms that are used to treat the waters contaminated in a way by anthropogenic commercial or industrial activities. Most of the industries produce wet waste that is known to contaminate the water. Some of the major sources of industrial wastewater include agricultural waste from breweries, the dairy industry, pulp and paper industry, iron and steel industry, mines and quarries, and food industry amongst others. A range of industries are known to use and manufacture organic complex organic chemicals that pollute and contaminate the water. These include the pharmaceuticals, paint and dyes, pesticides, detergents, petro-chemicals, and plastics amongst others. The industrial treatment comprises of the treatment of water contaminated by the feed-stock materials product material in particulate or soluble form, by-products, washing and cleaning agents, and the solvents and added value products like plasticizers.

Strategic Insights

Strategy and business planning strategy is commonly adopted by companies to expand their footprint worldwide, which is further impacting the size of the market. The players present in the liquid filtration market adopt the strategy of expansion and investment in research and development to enlarge customer base across the world, which also permits the players to maintain their brand name globally.

Saudi Arabia Liquid Filtration Market – By Fabric Material

Saudi Arabia Liquid Filtration Market – By Filter Media

Saudi Arabia Liquid Filtration Market – By End Use Industry

Company Profiles

The List of Companies - Saudi Arabia Liquid Filtration Market

The Saudi Arabia Liquid Filtration Market is valued at US$ 77.6 Million in 2018, it is projected to reach US$ 119.8 million by 2027.

As per our report Saudi Arabia Liquid Filtration Market, the market size is valued at US$ 77.6 Million in 2018, projecting it to reach US$ 119.8 million by 2027. This translates to a CAGR of approximately 5.1 % during the forecast period.

The Saudi Arabia Liquid Filtration Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Saudi Arabia Liquid Filtration Market report:

The Saudi Arabia Liquid Filtration Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Saudi Arabia Liquid Filtration Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Saudi Arabia Liquid Filtration Market value chain can benefit from the information contained in a comprehensive market report.