Saudi Arabia and UAE Frozen French Fries for Foodservice Market

No. of Pages: 97 | Report Code: BMIRE00030960 | Category: Food and Beverages

No. of Pages: 97 | Report Code: BMIRE00030960 | Category: Food and Beverages

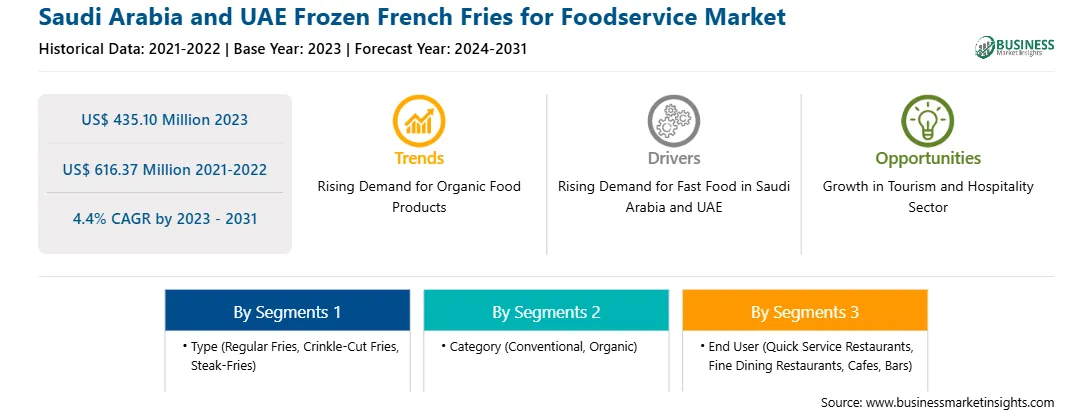

The Saudi Arabia and UAE frozen French fries for foodservice market size is projected to grow from US$ 435.10 million in 2023 to US$ 616.37 million by 2031; the market is expected to register a CAGR of 4.4% during 2023–2031.

Western dietary patterns have significantly influenced the eating patterns in Saudi Arabia and the UAE. French fries are a staple in many fast-food meals, contributing to their rising consumption. The increase in fast-food chains and quick-service restaurants in Saudi Arabia and the UAE is a primary driving factor contributing to the increasing demand for frozen French fries. Saudi Arabia and the UAE have a significant portion of their population living in urban areas. The demand for fast food, especially among young consumers, increases as the cities expand. As per the study published by researchers from Taibah University and King Abdulaziz University, Saudi Arabia, in 2022, one-third of youths in Saudi Arabia consume fast food more than twice a week. Moreover, more male adolescents consumed fast food than female adolescents. The study also revealed that high disposable income was one of the prime factors responsible for the rising demand for fast food.

The UAE fast food industry is one of the region's most competitive, with established international players and emerging local chains. The high demand for convenient and affordable meals contributes to the addition of French fries to the menu by foodservice operators. Fast foods, such as French fries, are popular globally across all demographics. Both Saudi Arabia and the UAE are witnessing significant urbanization with a high number of consumers with busy lifestyles. Consumers have also adopted the culture of dining or eating out. Fast-food restaurants cater to this shift by offering quick and affordable meals. Thus, the rising demand for fast food is contributing to the growth of the Saudi Arabia and UAE frozen French fries for foodservice market.

By type, the market is segmented into regular fries, crinkle-cut fries, steak-fries, and others. The regular fries segment held the largest Saudi Arabia and share in 2023. These French fries can be paired with a variety of seasonings and coatings, enhancing the flavor. This shape and size allow for even and quick cooking on all sides, and it is great for eating with burgers, sandwiches, and meat and seafood appetizers. They are a popular side dish in burger joints, fast-food restaurants, and cafes.

In terms of end user, the market is segmented into quick service restaurants, fine dining restaurants, cafes and bars, and others. The quick service restaurants segment dominated the market in 2023. Due to the rising fast-food trend, foodservice operators face challenges related to rapid turnaround time. Thus, they prefer to sell products that require minimum preparation time. Frozen French fries require minimal time for preparation as they just need to be fried or baked. Moreover, they have a high shelf life when stored at optimum temperature conditions. These factors contributing to the Saudi Arabia and growth for the segment.

Lamb Weston Holdings Inc, McCain Foods Ltd, GOLDEN DUNES GENERAL TRADING LLC, Seara Foods, Sunbulah Food & Fine Pastries Manufacturing Co Ltd, Saudia Dairy & Foodstuff Company (SADAFCO), BRF SA, Ecofrost, AJC International, Inc, Mondial Foods BV, Al Kabeer Group ME, Almunajem Foods Co, Del Monte Foods (UAE.) FZE, Crown Food, and Farm Frites International BV. are among the leading companies profiled in the Saudi Arabia and UAE frozen French fries for foodservice market report.

The overall Saudi Arabia and UAE frozen French fries market size has been derived using primary and secondary sources. To begin the research process, exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the market. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain more analytical insights into the topic. The participants of this process include industry experts such as VPs; business development managers; market intelligence managers; national sales managers; and external consultants, including valuation experts, research analysts, and key opinion leaders, specializing in the Saudi Arabia and UAE frozen French fries market.

Strategic insights for the Saudi Arabia and UAE Frozen French Fries for Foodservice provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 435.10 Million |

| Market Size by 2031 | US$ 616.37 Million |

| Global CAGR (2023 - 2031) | 4.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Saudi Arabia and UAE

|

| Market leaders and key company profiles |

The geographic scope of the Saudi Arabia and UAE Frozen French Fries for Foodservice refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Saudi Arabia and UAE Frozen French Fries for Foodservice Market is valued at US$ 435.10 Million in 2023, it is projected to reach US$ 616.37 Million by 2031.

As per our report Saudi Arabia and UAE Frozen French Fries for Foodservice Market, the market size is valued at US$ 435.10 Million in 2023, projecting it to reach US$ 616.37 Million by 2031. This translates to a CAGR of approximately 4.4% during the forecast period.

The Saudi Arabia and UAE Frozen French Fries for Foodservice Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Saudi Arabia and UAE Frozen French Fries for Foodservice Market report:

The Saudi Arabia and UAE Frozen French Fries for Foodservice Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Saudi Arabia and UAE Frozen French Fries for Foodservice Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Saudi Arabia and UAE Frozen French Fries for Foodservice Market value chain can benefit from the information contained in a comprehensive market report.