Rising Demand for High-Performance Wind Turbine Parts is Driving North America Wind Turbine Forging

Market

Wind turbines need high-performance turbine components to operate in remote locations, extreme operating conditions, and harsh environments. The technical requirements of the wind power generation industry are encouraging turbine component manufacturers to provide forged parts for performance optimization. A few of the most commonly demanded forged parts for wind power turbines include main turbine shafts pitch, yaw drives, hub bearings, tower flanges, gear boxes, gear blanks, ring gears, bull gears, and output gears. The rising demand for such products has forced companies to partner and collaborate with metallurgists and forging experts to discover new methods for designing metal forged parts that reduce long-term costs and improve lead times. Metal forged part manufacturers maintain an extensive inventory of ferrous and non-ferrous materials that comply with wind power-specific grades and meet OEM specifications. This ready inventory helps the forged part suppliers to eliminate the delays associated with order processing, allowing for shorter lead times. Wind turbine parts such as the rotor hub, gearbox, frame, and tower are made of steel; however, many smaller turbines have started using aluminum alloys for these components to make turbines lighter and more efficient. High toughness values are a key requirement for offshore applications, as they are easier to fabricate. Forging helps in high precision metal manufacturing, and the obtained final material consists of correct dimensions and a good surface finish. This leads to increased cost-effectiveness. Further, forging also ensures the superior strength of forged metal parts. Components that are strong, highly ductile, and reliable are being widely used in wind turbines to maintain their performance in a wider temperature range. Thus, the growing need for high-performance forged wind turbine parts and components is driving the growth of the North America wind turbine forging market.

North America Wind Turbine Forging Market Overview

The growing demand for wind energy has led to increased installations of wind turbines across North America, especially in the US. In February 2022, Apex Clean Energy Holdings planned a 75.6 MW onshore wind power project in Virginia (US), which is currently in permitting stage. The country is witnessing a surge in wind energy projects, which is anticipated to supply enough clean energy to power households and offset the annual carbon dioxide (CO2) emissions. The project cost is estimated at US$ 130.7 million, and the wind power project consists of 14 turbines. Such factors are anticipated to provide significant growth opportunities to the players operating in the North America wind turbine forging market. US-based Forged Products, Inc. offers hydraulic presses and manipulators to handle heavy-weight forgings and delivers open die forgings from 500 lbs. to 60,000 lbs. with the highest quality. The company forges materials such as carbon and alloy steel and most stainless steel grades. The rising demand for metal forged bearings, pitch, yaw, and main hub forged rings that ensure optimal core performance for a wide range of gear applications, coupling high-torque and high-speed transmission, is further propelling the growth of the North American wind turbine forging market.

Strategic insights for the North America Wind Turbine Forging provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Wind Turbine Forging refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.North America Wind Turbine Forging Strategic Insights

North America Wind Turbine Forging Report Scope

Report Attribute

Details

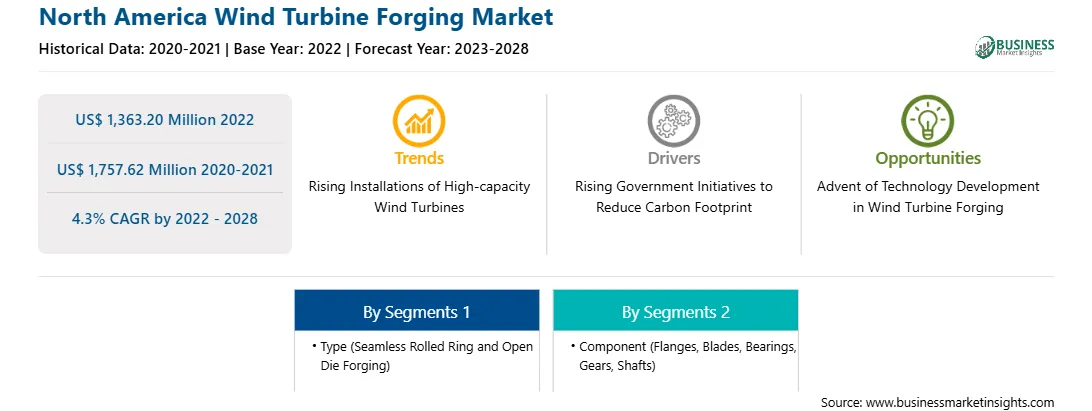

Market size in 2022

US$ 1,363.20 Million

Market Size by 2028

US$ 1,757.62 Million

Global CAGR (2022 - 2028)

4.3%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Type

By Component

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Wind Turbine Forging Regional Insights

North America Wind Turbine Forging Market Segmentation

The North America wind turbine forging market is segmented into type, component, and country.

Based on type, the North America wind turbine forging market is bifurcated into seamless rolled ring and open die forging. The open die forging segment registered the largest market share in 2022.

Based on component, the North America wind turbine forging market is segmented into flanges, blades, bearings, gears, shafts, and others. The flanges segment held the largest market share in 2022.

Based on country, the North America wind turbine forging market is segmented into the US, Canada, and Mexico. The US dominated the market share in 2022.

Bharat Forge Ltd, Bruck GmbH, Frisa Industrias SA de CV, Gerdau Summit Aços Fundidos e Forjados SA, Scot Forge Co, Specialty Ring Products Inc, and ULMA Forja S Coop are the leading companies operating in the North America wind turbine forging market.

The North America Wind Turbine Forging Market is valued at US$ 1,363.20 Million in 2022, it is projected to reach US$ 1,757.62 Million by 2028.

As per our report North America Wind Turbine Forging Market, the market size is valued at US$ 1,363.20 Million in 2022, projecting it to reach US$ 1,757.62 Million by 2028. This translates to a CAGR of approximately 4.3% during the forecast period.

The North America Wind Turbine Forging Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Wind Turbine Forging Market report:

The North America Wind Turbine Forging Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Wind Turbine Forging Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Wind Turbine Forging Market value chain can benefit from the information contained in a comprehensive market report.