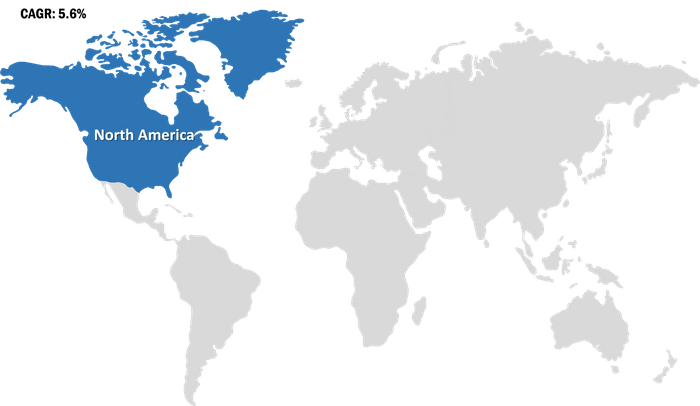

The North America wet pet food market is accounted to US$ 8,880.9 Mn in 2018 and is expected to grow at a CAGR of 5.6% during the forecast period 2019 – 2027, to account to US$ 14,453.4 Mn by 2027.

Pet food, which is composed of a high percentage of water, ranging between 75% and 85%, along with other dry ingredients, is termed as wet pet food. The wet pet food is increasingly being preferred by pet owners as they help to boosts energy, builds muscles and lean mass, and stimulates the overall growth mechanism in animals. Consumption of wet pet food helps to provide the necessary nutrients such as proteins, vitamins, and minerals to pets to keep them healthy and hydrated. Moreover, such kinds of foods are considered as an ideal option for pets who cannot chew properly due to missing teeth, improper adjustment of jaws, or other related pet concerns. Such advantages offered by wet pet food makes them a popular and attractive option and the best source of hydration. However, the demand for wet pet food is always dependent upon the health of the pet and the choice of pet owners. The need for a wet pet is increasing across the globe with the rise in focus towards premiumization of pet food products and increase in consumer focus towards the health of their pets.

Strategic insights for the North America Wet Pet Food provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 8,880.9 Million |

| Market Size by 2027 | US$ 14,453.4 Million |

| Global CAGR (2019 - 2027) | 5.6% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Wet Pet Food refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Growing concerns among pet owners about pet nutrition and health are primarily driving the growth of the wet pet food market. Wet pet food contains animal and plant derivatives such as chicken, beef, lamb, meat broth, vegetable broth, and eggs. Also, the percentage of water ranges from 75% to 85%. Wet pet food is the best source of hydration. It also contains higher amounts of proteins and fats, minerals with added flavours and preservatives, making it more nutritional and tasty for pets. These nutrients offer various health benefits such as boosts energy, builds and tones muscles, and builds lean mass. It also helps fight infection, perform daily activities, repair teeth and bones, and improve stamina for better metabolism. All these advantages have raised the demand for wet pet food among pet owners. Nowadays, pet owners are more concern about their pet's nutrition. The shift in pet “ownership” to “parenting” has been identified as the major reason driving the growth of the market. Moreover, growing awareness about adequate diet for pet's overall health has forced buyers to opt for superior food products, which is likely to drive the growth of the wet pet food market.

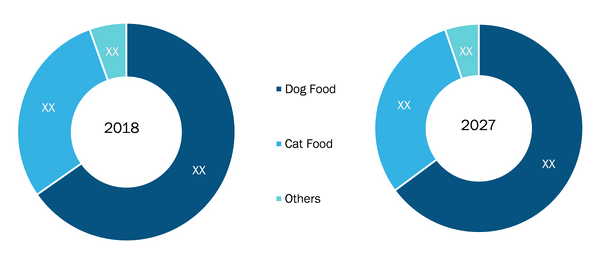

The North America wet pet food market is segmented on the basis of product is segmented into dog food, cat food, and others. The dog food segment in the North America wet pet food market is estimated to hold a leading share in the market, whereas the cat food segment is estimated to grow at the fastest rate. Dogs are among the most preferred pets food across North America. They are omnivore and thus adopt traditional eating habits, such as meat and non-meat scraps. They require proper nutrition at every stage of their life. Therefore a complete diet program with an adequate combination of carbohydrates, minerals, proteins, fats, vitamins, and water is crucial to maintain healthy body weight. Wet pet food contains a higher amount of aforementioned nutrients, and thus, dog owners prefer buying wet pet food. Wet food helps dogs fight infection, perform daily activities, repair teeth and bones, and maintain their build and muscle tone.

The North America wet pet food market is segmented on the basis of packaging type as canned, pouches, and others. The canned segment accounts for the largest share in the North America wet pet food market, while the pouches segment also contributes a significant share in the market. Cans are ideal for pet food packaging. They preserve food for a long time and keep it fresh, clean, and free from contamination due to airtight packaging. Wet food is generally made from fresh meat products, and it contains 70–80% moisture. Thus, pet food manufacturers prefer cans for packaging as these are easy to transport over long distances. Materials such as plastic in the form of PVC, HDPE, PET, and metals such as steel and aluminium are used for canned pet food packaging. Growing concerns related to pet health among pet owners have raised the demand for products that are attractive, informative, and protective.

The North America wet pet food market is segmented on the basis of distribution channel is segmented into supermarkets & hypermarkets, specialized pet shops, online, and others. The supermarkets & hypermarkets segment in the North America wet pet food market is estimated to hold a leading share in the market, whereas the online segment is estimated to grow at the fastest rate. Supermarkets and Hypermarkets are self-service shops offering a wide variety of pet products such as pet food, pet toys, pet homes, and other pet healthcare products. These also includes mass merchandisers, discounters, or mass/dollar/clubs. Wide array of these products are placed in eye-catching assortments into organized sections and shelves to attract customers. Supermarkets and hypermarkets offer an extensive choice of pet products of different bands to buyers at one place with affordable prices compared to other distribution channels.

Strategic insights for the North America Wet Pet Food provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 8,880.9 Million |

| Market Size by 2027 | US$ 14,453.4 Million |

| Global CAGR (2019 - 2027) | 5.6% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Wet Pet Food refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Wet Pet Food Market, by Packaging Type

North America

Wet Pet Food Market, by Packaging Type

The List of Companies - North America Wet Pet Food Market

The North America Wet Pet Food Market is valued at US$ 8,880.9 Million in 2018, it is projected to reach US$ 14,453.4 Million by 2027.

As per our report North America Wet Pet Food Market, the market size is valued at US$ 8,880.9 Million in 2018, projecting it to reach US$ 14,453.4 Million by 2027. This translates to a CAGR of approximately 5.6% during the forecast period.

The North America Wet Pet Food Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Wet Pet Food Market report:

The North America Wet Pet Food Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Wet Pet Food Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Wet Pet Food Market value chain can benefit from the information contained in a comprehensive market report.