The North America webbing market is a highly fragmented market with the presence of considerable regional and local players providing numerous solutions for companies investing in the market arena. The demand for environment-friendly fabric material has been increasing with the rising concerns related to environment degradation and waste management coupled with growing focus on the deployment of sustainable materials. The demand for such materials is strongly driven by stringent government regulations on the use of nonbiodegradable webbing materials due to the adverse impacts of such material. With growing focus toward eco-friendly webbing materials, manufacturers have come up with new materials such as recycled polyester, bamboo webbing, wool webbing, rayon webbing, soy webbing, organic cotton webbing, linen webbing, jute webbing, and hemp webbing. Such webbing materials have comparatively less pH value, which makes them ideal to be used in textile materials. This type of webbing material does not cause skin itching and does not damage the weak acidic environment of the skin surface. Also, the materials do not use disperse dyes, which may cause allergies. The increasing investments by manufacturers in R&D activities for the development of environment-friendly and performance-efficient webbing materials would drive the growth of the webbing market in coming years.

In case of COVID-19, in North America, especially the US, witnessed an unprecedented rise in number of coronavirus cases, which led to the discontinuation of webbing manufacturing activities. Downfall of other chemical and materials manufacturing sectors has negatively impacted the demand for webbing during the early months of 2020. Moreover, decline in the overall fiber and composites manufacturing activities has led to discontinuation of webbing manufacturing projects, thereby reducing the demand for webbing. Similar trend was witnessed in other North America countries, i.e., Mexico, Canada, Panama and Costa Rica. However, the countries are likely to overcome thus drop in demand with the economic activities regaining their pace, especially in the beginning of the 2021.

Strategic insights for the North America Webbing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 230.17 Million |

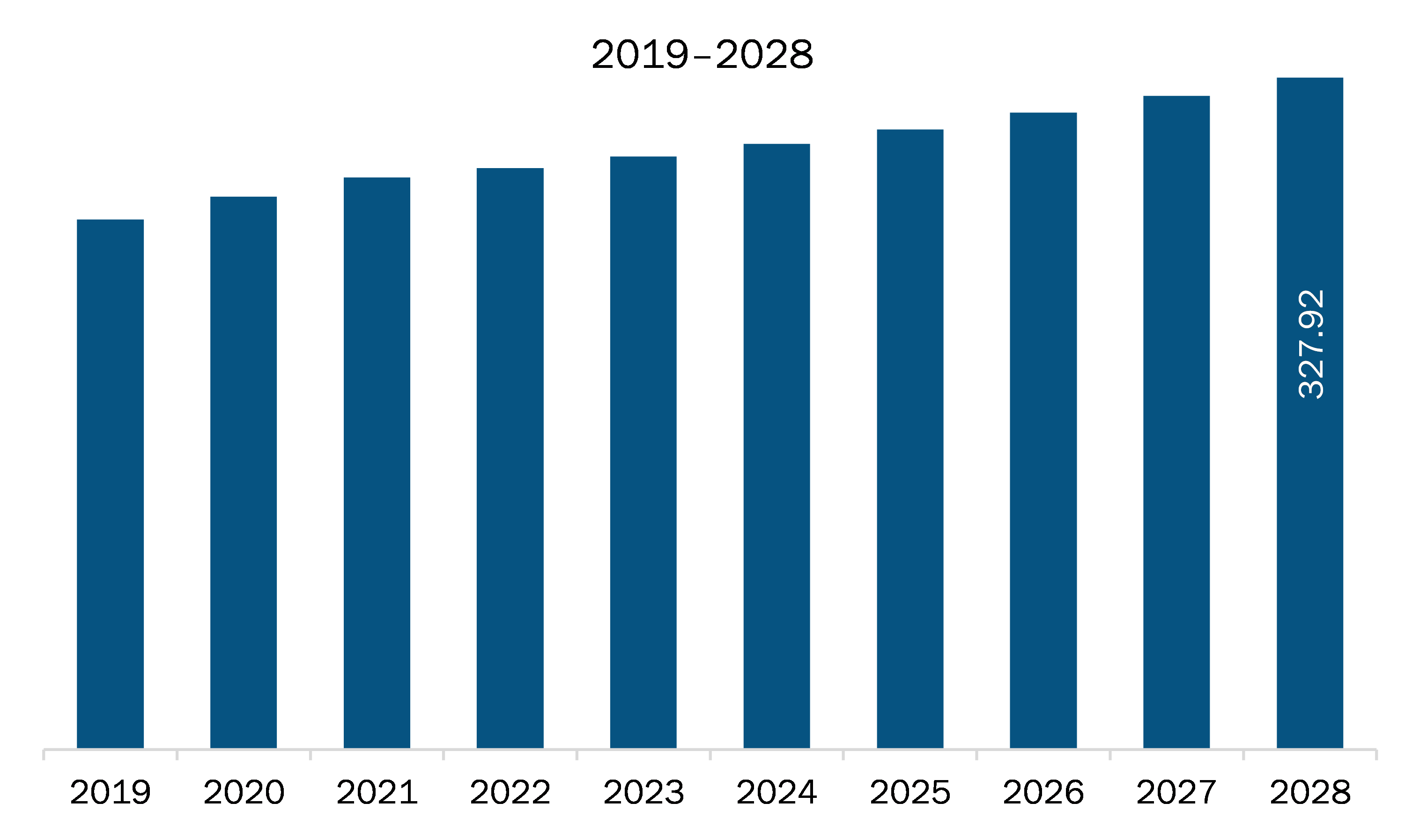

| Market Size by 2028 | US$ 327.92 Million |

| Global CAGR (2021 - 2028) | 5.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Material

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Webbing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The webbing market in North America is expected to grow from US$ 230.17 million in 2021 to US$ 327.92 million by 2028; it is estimated to grow at a CAGR of 5.2% from 2021 to 2028. The webbing material is either naturally procured from animal skin or is prepared artificially. In earlier times, the material was denuded from moose, deer, or caribou. However, in the twentieth century, manufacturers shifted their extraction to cow hide, being the economical and high-quality rawhide. With the expanding demand for webbing, manufacturers have alternatively switched toward man-made webbing material. In the US, ACW is considered as one of the leading manufacturers webbing material. Other than this, as per an article published by Industrial Fabrics Association International, Paiho North America is involved in offering special spun polyester material for webbing, which can be used in diverse application bases such as apparel, shoes and sporting goods, and industrial or medical applications. The rapid pace of technological developments and supporting government regulations have transformed North America into the most promising market for the aviation, automotive, medical, marine, and other sectors. The shifting lifestyle of consumers promote the demand for several industrial and consumer products, which accelerates the growth of several industrial bases. The growth of these industries is directly impacting the demand for webbing.

Based on material, the man-made segment accounted for the largest share of the North America webbing market in 2020. Based on product, the flat webbing segment accounted for the largest share of the North America webbing market in 2020. Based on product, the automotive segment accounted for the largest share of the North America webbing market in 2020.

A few major primary and secondary sources referred to for preparing this report on the North America webbing market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report include American Cord & Webbing Co. Inc.; Bally Ribbon Mills; Belt-Tech; E. Oppermann GmbH; Murdock Webbing Company, Inc.; Narrowtex Australia; National Webbing Products Co.; Ohio Plastics Belting Co.; Ribbon Webbing Corp and Tennessee Webbing Products.

The North America Webbing Market is valued at US$ 230.17 Million in 2021, it is projected to reach US$ 327.92 Million by 2028.

As per our report North America Webbing Market, the market size is valued at US$ 230.17 Million in 2021, projecting it to reach US$ 327.92 Million by 2028. This translates to a CAGR of approximately 5.2% during the forecast period.

The North America Webbing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Webbing Market report:

The North America Webbing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Webbing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Webbing Market value chain can benefit from the information contained in a comprehensive market report.