Smart wearable devices, such as smartwatches, fitness trackers, VR headsets, smart wristbands, activity trackers, and sports watches, are integrated with advanced technologies such as artificial intelligence (AI) and the Internet of Things (IoT). Users can access their health-related information on their smartphones, tablets, or computers linked to these devices. With the growing consumer awareness, the adoption of smart wearable devices is on the rise in the healthcare sector. Fit bits, smartwatches, and pulse oximeters are wearable systems incorporated with optical sensors to provide real-time patient health tracking solutions.

The photoplethysmography (PPG) sensors that help monitor heart and respiration rates are highly demanded. For instance, several smartwatches with inbuilt PPG sensors were launched in late 2021 by Moto G, Realme, and Apple. The Realme watches have wide-ranging health functions, comprising blood-oxygen-level and top-level PPG heart rate sensors. In October 2020, Mobvoi launched its new PPG sensor-enabled TicWatch Pro 3 smartwatch in India.

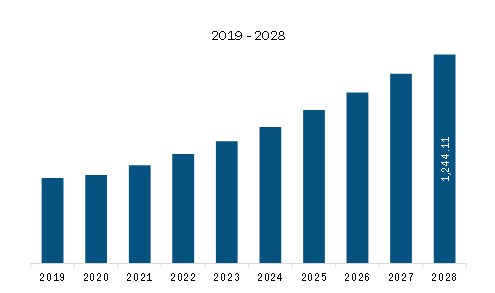

According to the International Data Corporation (IDC) report for 2020, wearable device shipments in North America surged by 28.4% in 2020 compared to the previous year. They further grew by 9.9% till the third quarter of 2021. The North America wearable sensor market is expected to grow at a good CAGR during the forecast period.

Strategic insights for the North America Wearable Sensor provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

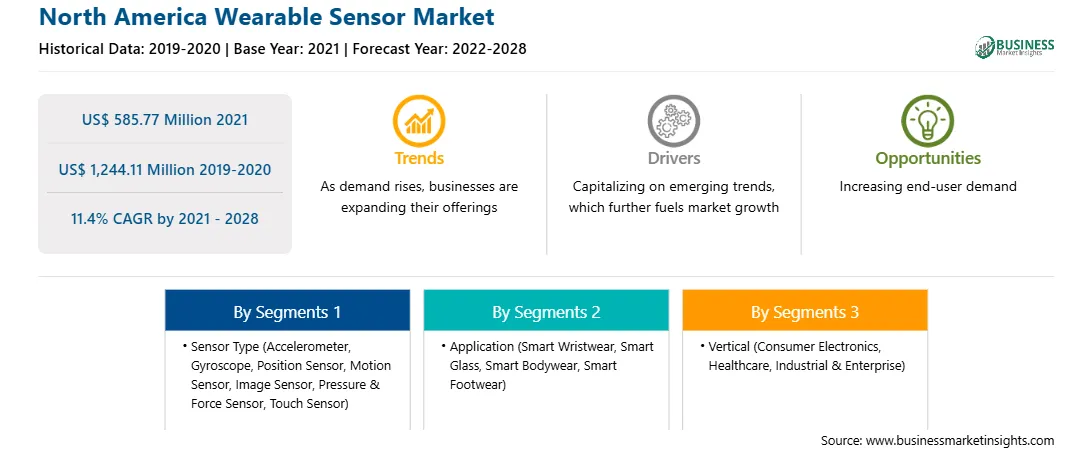

| Market size in 2021 | US$ 585.77 Million |

| Market Size by 2028 | US$ 1,244.11 Million |

| Global CAGR (2021 - 2028) | 11.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Sensor Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Wearable Sensor refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Wearable Sensor Market Segmentation

The North America wearable sensor market is analyzed on the basis of sensor type, application, vertical, and country. Based on sensor type, the market is segmented into accelerometer, gyroscope, position sensor, motion sensor, image sensor, pressure and force sensor, touch sensor, and others. The accelerometer segment dominated the market in 2020.

Based on application, the market is segmented into smart wristwear, smart glass, smart bodywear, and smart footwear. The smart wristwear segment led the market in 2020.

Based on vertical, the market is segmented into consumer electronics, healthcare, and industrial and enterprise. The consumer electronics segment dominated the market in 2020.

Based on country, The market is segmented into the US, Mexico, and Canada. In 2020, the US was the leading country market for wearable sensors in the region.

Texas Instruments Incorporated, NXP Semiconductor, Analog Devices Inc, STMicroelectronics, Infineon Technology, Sensirion AG, Robert Bosch GmbH, Panasonic Corporation, TE Connectivity Corporation, and TDK corporation are the leading companies in North America Wearable Sensor market.

The North America Wearable Sensor Market is valued at US$ 585.77 Million in 2021, it is projected to reach US$ 1,244.11 Million by 2028.

As per our report North America Wearable Sensor Market, the market size is valued at US$ 585.77 Million in 2021, projecting it to reach US$ 1,244.11 Million by 2028. This translates to a CAGR of approximately 11.4% during the forecast period.

The North America Wearable Sensor Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Wearable Sensor Market report:

The North America Wearable Sensor Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Wearable Sensor Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Wearable Sensor Market value chain can benefit from the information contained in a comprehensive market report.