In recent years, competition in the wealth management business in North America has increased with the development of new operating models in businesses and vigorous efforts of new entrants to capture a share of the world's largest market of investable assets. Banks and private firms, on the other hand, are increasingly demanding more from their wealth management advisors, thus creating huge demand for cutting-edge financial solutions that are tailored to their individual needs. Furthermore, gross wealth of North America has risen with time. According to the Capgemini World Wealth report, North America has surpassed Asia Pacific in terms of the rise in number of high-net-worth people and the speed at which their wealth has grown, for the first time since 2015. In 2020, 55% of ~1.2 million newly listed high-net-worth people were North Americans, in contrast to 39% of ~1.6 million newly listed ones in the previous year. The region accounted for 46% of the total increase in wealth within that group in 2020, up from 37% in 2019. Therefore, there would be a surge in demand for wealthtech solutions in North America during the forecast period. Investors from North America continue to have a greater risk tolerance than investors in other parts of the world. In 2019, the US invested over half of its entire wealth in the stock market. The subsequent emergence of new pricing structures and wealth management business models, based on better client–advisor ties and more personalized financial advice, fuel the demand for wealthtech solutions. wealthtech processes were already in action before to the onset of COVID-19, and the pandemic has accelerated them further.

The US is the worst-hit country in North America due to the outbreak of COVID-19, with thousands of infected individuals facing severe health conditions across the country. The increasing number of infected individuals has led the government to impose lockdown across the nation’s borders during Q2 in 2020. A few of the critical issues faced by the North American manufacturers a majority of manufacturing plants are either temporarily shut or are operating with minimum staff and the supply chain of components and parts is disrupted. The outbreak has severely affected the working process of banks and ongoing investments. Thus, the factors mentioned above have had a negative impact on the growth of the wealthtech solution market in the region.

Strategic insights for the North America WealthTech Solution provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

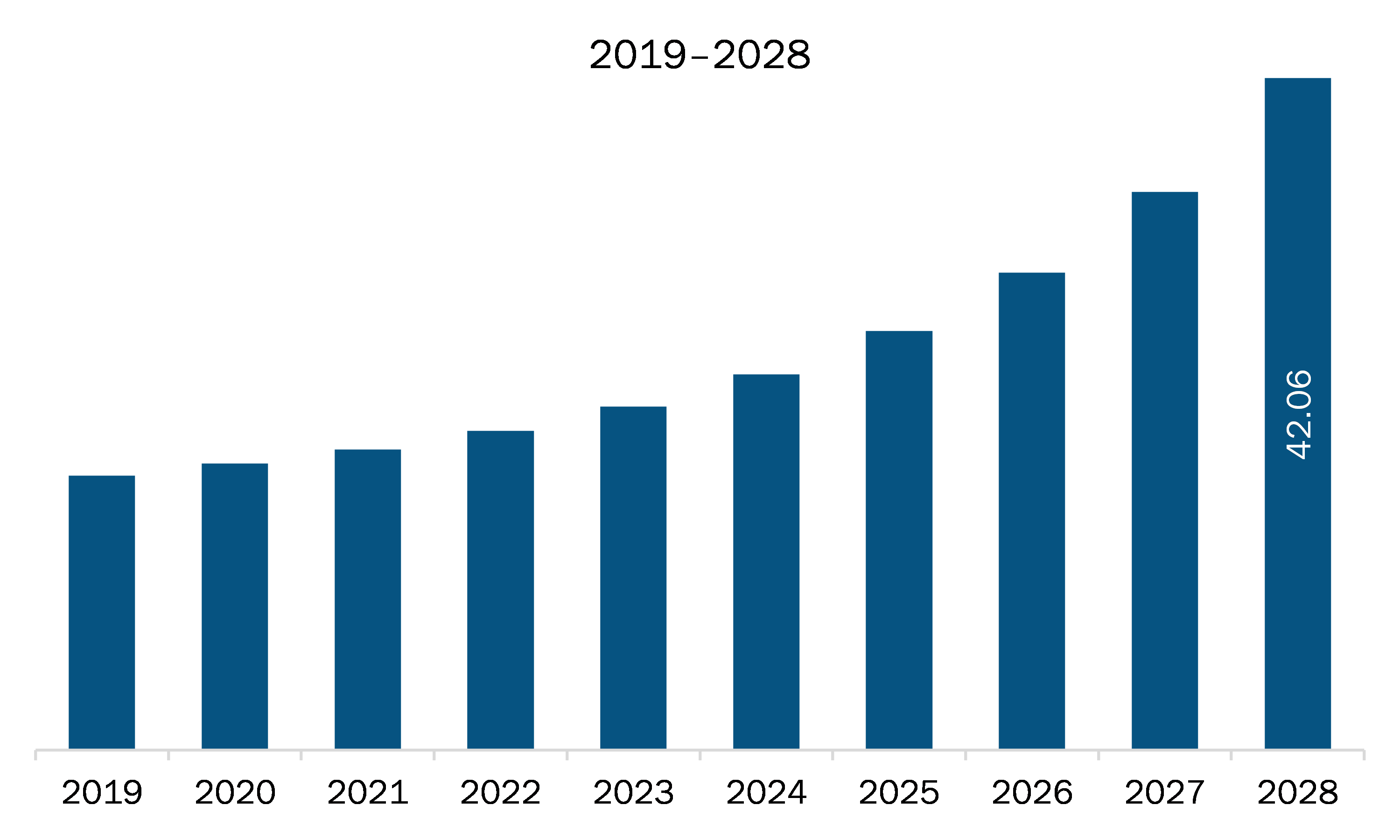

| Market size in 2021 | US$ 18.81 Billion |

| Market Size by 2028 | US$ 42.06 Billion |

| Global CAGR (2021 - 2028) | 12.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America WealthTech Solution refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The wealthtech solution market in North America is expected to grow from US$ 18.81 billion in 2021 to US$ 42.06 billion by 2028; it is estimated to grow at a CAGR of 12.2% from 2021 to 2028. With the digital transformation, the use of the cloud-based platform as these platforms deployed with simplicity in less time and at low deployment costs. Further, developed countries have matured internet infrastructure, while it is flourishing in several developing countries, which is a major factor contributing to the enhanced access of cloud-based platforms to end users. Financial analytics helps banking sectors to provide enhanced customer experience and risk management assistance. Cloud is emerging as a better alternative for banking and other financial service providers to store data and applications, and access advanced software applications through the internet. It helps synchronize enterprise operations and break down operational and data silos. Moreover, cloud-based financial analytics helps build resilient operations, drive business innovation, enhance IT security, and scale computing costs as needed. Therefore, the growing need of cloud-based financial analytics in the banking sector and other financial firms is bolstering the demand for wealthtech solutions.

North America wealthtech solution market is segmented into component, end user, organization size, deployment mode, and country. Based on component, the wealthtech solution market is bifurcated into solution and services. In 2020, the solution segment led the market, accounting for a larger market share. Based on end user, the wealthtech solution market is segmented into banks, wealth management firms, and others. In 2020, the wealth management firms segment accounted for the largest market share. Based on organization size, the wealthtech solution market is bifurcated into large enterprises and small and medium-sized enterprises. In 2020, the large enterprises segment accounted for a larger market share. By deployment mode, the wealthtech solution market is bifurcated into cloud-based and on-premises. In 2020, the cloud-based segment accounted for a larger market share.

A few major primary and secondary sources referred to for preparing this report on the wealthtech solution market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are 3rd-eyes analytics AG; BlackRock, Inc.; FinMason, Inc.; InvestCloud, Inc.; InvestSuite; Synechron; Wealthfront Inc.; and WealthTechs Inc.

The North America WealthTech Solution Market is valued at US$ 18.81 Billion in 2021, it is projected to reach US$ 42.06 Billion by 2028.

As per our report North America WealthTech Solution Market, the market size is valued at US$ 18.81 Billion in 2021, projecting it to reach US$ 42.06 Billion by 2028. This translates to a CAGR of approximately 12.2% during the forecast period.

The North America WealthTech Solution Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America WealthTech Solution Market report:

The North America WealthTech Solution Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America WealthTech Solution Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America WealthTech Solution Market value chain can benefit from the information contained in a comprehensive market report.