The North America virology market is analyzed based on three major countries: the US, Canada, and Mexico. The US holds the largest size of the virology market owing to factors such as the increasing burden of COVID19, increasing product launches are among the factors leading the market. In North America, the US is the largest market for virology solutions. The growth of the US market is primarily driven by increasing research and development activities and rising demand for advanced diagnostic solutions to treat chronic conditions and viral diseases. In addition, increasing demand for viral antigens due to the growing adoption of advances viral testing is also anticipated to drive the market during the forecast period. Due to the increasing demand, major players in the market are focusing on expanding their viral antigens manufacturing capacity. The pharmaceutical and biotechnology companies in the country are actively operating to develop effective vaccines for COVID19. Various players have received EUA for respective vaccines. The data is being studied continuously on a larger scale, and the drug manufacturers are consistently developing antiviral drugs for COVID19. However, despite the commercialization and widespread access to vaccines, the primary focus is still to perform maximum testing for COVID19 to control the infection rate. For instance, in May 2020, the US FDA approved emergency use authorization for a COVID19 antigen test from Quidel Corporation for the Sofia 2 SARS Antigen FIA. Thus, similar approvals by the regulatory agencies are expected to support the growth of the virology market. Rise in prevalence of viral infectious diseases is the major factor driving the growth of the North America virology market.

North America has experienced a rising number of cases of COVID-19 since its outbreak. The cases are also increasing in countries such as Mexico and Canada in the region. As COVID19 is a novel virus and had no established treatment methods, no vaccines, drugs specific to the virus were not available. Thus, it was a potential opportunity for product innovation and development to the market players operating in the virology-related business. The governments have extensively invested in and promoted vaccine development and prioritized the easy and quick approval process. Regional and international players launch various virus products such as rapid test kits, vaccines, and others. And the large-scale production of these products and rising demand are expected to have a favorable impact on the virology-related market in the region. However, the end-users' panic buying and stocking of the products are expected to cause a loss in terms of product expiry. Thus, such factors are expected to have a negative impact on the related market in the region.

Strategic insights for the North America Virology provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

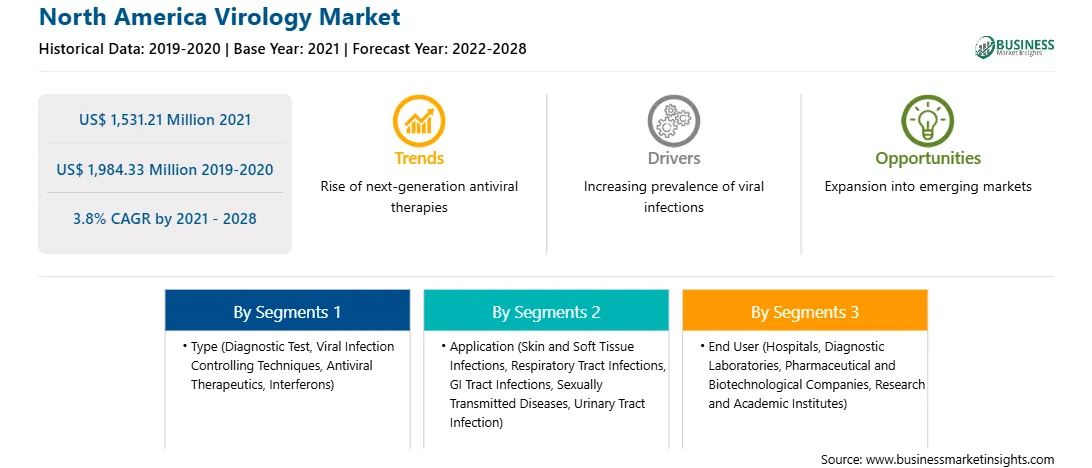

| Market size in 2021 | US$ 1,531.21 Million |

| Market Size by 2028 | US$ 1,984.33 Million |

| Global CAGR (2021 - 2028) | 3.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Virology refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The virology market in North America is expected to grow from US$ 1,531.21 million in 2021 to US$ 1,984.33 million by 2028; it is estimated to grow at a CAGR of 3.8% from 2021 to 2028. Countries such as Mexico are attractive outsourcing locations for the pharmaceutical and biopharmaceutical industries across the region. Low manufacturing and operating costs and recent growth in the pharmaceutical industry in Mexico are key factors driving the growth of the virology-related markets in this country. Moreover, the growing domestic market and its pipelines are opening new access for the manufacturing of generic drugs in the region. In addition, several contract-based organizations are expanding their manufacturing capacities in North American nations to meet the rising demand for products, such as vaccines. Thus, the emerging markets are likely to create lucrative opportunities for the growth of the virology market in the coming years across the North America region.

The North America virology market is segmented on the bases of type, application, end user, and country. Based on type, the market is segmented into diagnostic test, viral infection controlling techniques, antiviral therapeutics, and interferons. The antiviral therapeutics segment dominated the market in 2020 and viral infection controlling techniques segment is expected to be the fastest growing during the forecast period. The diagnostic test segment is further categorized into DNA virus testing, RNA virus testing, others. Similarly, the viral infection controlling techniques is bifurcated into active prophylaxis, and passive prophylaxis. Likewise, the antiviral therapeutics segment is categorized into virucidal agents, antiviral agents, immunomodulators, and interferons. On the basis of application, the virology market is segmented into skin and soft tissue infections, respiratory tract infections, GI tract infections, sexually transmitted diseases, urinary tract infections, and others. The respiratory tract infections segment dominated the market in 2020, and is expected to be the fastest growing during the forecast period. On the basis of end user, the virology market is segmented into hospitals, diagnostic laboratories, pharmaceutical and biotechnological companies, and research and academic institutes. The hospitals segment dominated the market in 2020, and diagnostic laboratories segment is expected to be the fastest growing during the forecast period.

A few major primary and secondary sources referred to for preparing this report on the virology market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Abbott; AbbVie Inc.; F. Hoffmann-La Roche Ltd.; Gilead Sciences, Inc.; GlaxoSmithKline Plc; Illumina, Inc.; Johnson and Johnson Services, Inc.; QIAGEN; Siemens AG; and Thermo Fisher Scientific Inc. are among others.

The North America Virology Market is valued at US$ 1,531.21 Million in 2021, it is projected to reach US$ 1,984.33 Million by 2028.

As per our report North America Virology Market, the market size is valued at US$ 1,531.21 Million in 2021, projecting it to reach US$ 1,984.33 Million by 2028. This translates to a CAGR of approximately 3.8% during the forecast period.

The North America Virology Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Virology Market report:

The North America Virology Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Virology Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Virology Market value chain can benefit from the information contained in a comprehensive market report.