Market Introduction

The North American veterinary vaccines market has been segmented into the US, Canada, and Mexico. The US held the largest share of the North American veterinary vaccines market in 2021. Livestock groups provide consumers with different products and services, including meat, milk, eggs, fiber, and draught power. Viral infection among livestock, compassion animals, and others is a critical aspect of animal health in the country. The viruses infecting the animals spread at a faster rate. Thus, immunizations of the animal from such viruses are of prime importance in animal healthcare in the country. The outbreak of the COVID19 pandemic has triggered the vaccination of the animals for the COVID19. For instance, in March 2021, orangutans and bonobos at the San Diego Zoo have received a coronavirus vaccine. Moreover, the regulatory agencies in the country have very stringent policies on controlling the spread of infection among animals and humans. As part of such policies, the agencies have adopted various strategies. For instance, in June 2021, the US has banned the import of dogs from 113 Countries After Rising In False Rabies Records. In addition, in 2020, the CDC identified more than 450 dogs imported in the US with falsified or fraudulent rabies certificates, which was estimated to be about a 52% increase compared with the previous couple of years. Vaccination of the pet is mandatory as part of the routine healthcare plan for the pet and livestock animals. There has been a considerable rise in awareness about the vaccination among the owners of the animals country, the increasing prevalence of viral infections, and the presence of prominent market players based in the is expected to augment the growth of Veterinary Vaccines market during the forecast years.

In case of COVID-19, North America, especially the US, is highly affected. The incidence of COVID-19 has been registered in the animals. Also, there has been an instance where companion animals are infected through their human counterparts. As per the CDC, animals have been infected with SARS-CoV-2, which has been documented in different locations worldwide. The majority of these animals are infected after coming in contact with COVID-19 infected owners, caretakers, and others in close contact with the animals. The infected animals include companion animals (including pet cats, dogs, ferrets), animals at zoos and sanctuaries (different types of big cats, otters, non-human primates, a binturong, a coatimundi, a fishing cat, and hyenas), and minks on mink farms. As a preventive measure, various organizations vaccinate the animals for COVID-19 infection. For instance, in October 2021, Cincinnati Zoo vaccinated about 80 animals against COVID-19 with two doses of a COVID-19 vaccine designed for veterinary use. The COVID-19 pandemic has considerably impacted animal health in the region. The regional players operating in the veterinary vaccines market are actively involved in the production and product innovations. Moreover, it positively impacts the veterinary vaccine market by offering potential business opportunities to the market players. Regional governments are offering support to enhance the animal health-related businesses in the region.

Market Overview and Dynamics

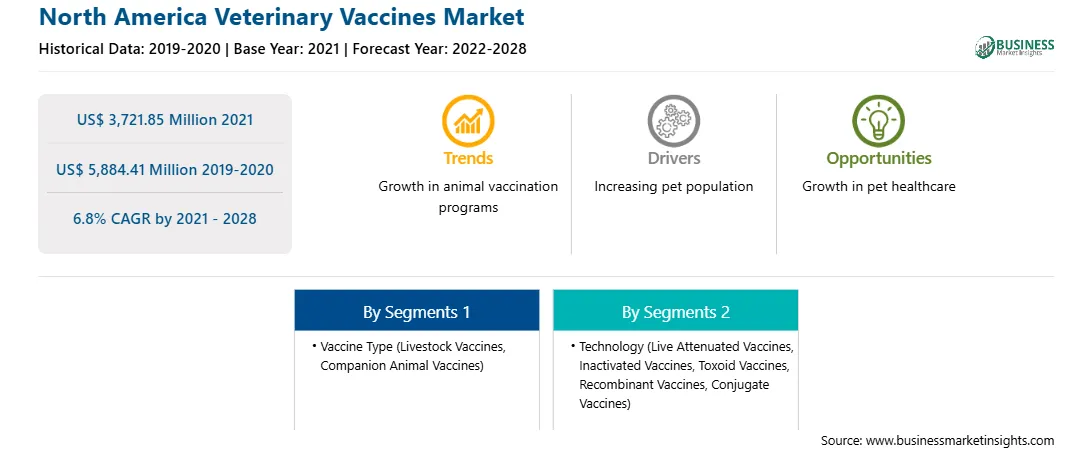

The North America veterinary vaccines market is expected to grow from US$ 3,721.85 million in 2021 to US$ 5,884.41 million by 2028; it is estimated to grow at a CAGR of 6.8% from 2021 to 2028. The veterinary care business is witnessing substantial transformations. Countries across the region have favored sophisticated remedies and supplements that are simple to use and beneficial in healthcare. Countries across the region are projected to be among the biggest contributors to this expansion in veterinary healthcare. The increasing rate of pet ownership, rising disposable income of the population, and growing awareness related to pet health are among the factors that are likely to drive the growth of the market in the future. Further, improvement in animal welfare across the countries and implementation of rules for the manufacturing of animal vaccines and nutritional supplements would propel the growth of the market in emerging countries in the coming years. There has been a movement in the business approach of animal health enterprises that have grown from medicines to preventive to productivity enhancement and now to total healthcare of the animals. This is expected to increase the adoption of veterinary vaccines in the potential market and several countries, which is projected to create lucrative opportunities for North America market growth during the forecast period.

Key Market Segments

In terms of vaccine type, the livestock vaccines segment accounted for the largest share of the North America veterinary vaccines market in 2020. In terms of technology, the live attenuated vaccines segment held a larger market share of the North America veterinary vaccines market in 2020.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the North America veterinary vaccines market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are BIOVAC; Boehringer Ingelheim International GmbH; Ceva; Elanco; HIPRA; Merck & Co., Inc.; NEOGEN Corporation; Virbac; and Zoetis Inc. among others.

Reasons to buy report

North America Veterinary Vaccines Market Segmentation

North America Veterinary Vaccines Market - By Vaccine Type

North America Veterinary Vaccines Market - By

Technology

North America Veterinary Vaccines Market - By Country

North America Veterinary Vaccines Market - Company Profiles

Strategic insights for the North America Veterinary Vaccines provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 3,721.85 Million |

| Market Size by 2028 | US$ 5,884.41 Million |

| Global CAGR (2021 - 2028) | 6.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Vaccine Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Veterinary Vaccines refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America Veterinary Vaccines Market is valued at US$ 3,721.85 Million in 2021, it is projected to reach US$ 5,884.41 Million by 2028.

As per our report North America Veterinary Vaccines Market, the market size is valued at US$ 3,721.85 Million in 2021, projecting it to reach US$ 5,884.41 Million by 2028. This translates to a CAGR of approximately 6.8% during the forecast period.

The North America Veterinary Vaccines Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Veterinary Vaccines Market report:

The North America Veterinary Vaccines Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Veterinary Vaccines Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Veterinary Vaccines Market value chain can benefit from the information contained in a comprehensive market report.