North America Veterinary Rapid Test Market

No. of Pages: 121 | Report Code: TIPRE00025744 | Category: Life Sciences

No. of Pages: 121 | Report Code: TIPRE00025744 | Category: Life Sciences

The North America veterinary rapid test market is analyzed on the basis of three major countries: the US, Canada, and Mexico. The US holds the largest size of the market owing to factors such as owing to a wide range of effective measures adopted by government animal welfare organizations along with technological advancements, rising incidence of zoonotic diseases, and an increasing number of pet owners. The growth of the market in the country is attributable to growing adoption of dogs, increasing prevalence of diseases, and the growing pet health expenditure. The increase in the number of pet owners and rising concern to maintain the health of pets is prime factor for the market growth. For instance, as per Animal Health Institute (AHI), more than 67% of American households own pets, totaling nearly 400 million pets, including dogs, cats, horses, birds, fish, horses, and more. In addition, as per the American Pet Products Association, Inc., Americans spent over US$ 103.6 billion on their pets in 2020. Also, increasing prevalence of Zoonotic diseases is driving the demand for rapid tests. As per the CDC, each year, enteric diseases linked to animals or their environments are estimated to cause 450,000 illnesses, 5,000 hospitalizations, and 76 deaths in the US. These illnesses are attributed to contact with an animal’s feces or bodily fluids. Because of the close connection between people and animals it is important to screen these diseases on time. Rising incidence of zoonotic diseases is the major factor driving the growth of the North America veterinary rapid test market.

The outbreak of COVID-19 has impacted all the industries including veterinary sector. There was an increase in pet adoption reported due to social isolation. For instance, shelters, nonprofit rescues, private breeders all reported high consumer demand during COVID 19 in the US. Most of the consumers in the market grappled with the onset of the pandemic. The retail e-commerce platforms witnessed high growth due to several restrictions on the brick-and-mortar stores and the disruption of the overall supply channel. Sales have spiked for pet care products at home, driven by the closure of veterinary clinics. Also, the pet population has increased in the region because of lockdown and people wanting a companion. Home isolation have driven the short-term pet fostering programs that may translate into long-term pet population growth in the future. Despite some disruptions caused by COVID-19 containment measures, the long-term growth potential of the sector remains intact. Also, the COVID-19 pandemic has highlighted the adaptability and response by veterinary diagnosticians to an emerging infectious disease and their role in maintaining animal health and protecting human public health. In addition, the market players have witnessed rise in sales. For instance, IDEXX’s companion animal group (CAG) diagnostics revenue increased by 23% in Q3 2020 as compared to last year. The recent surge in ownership, driven by an increase in adoption and fostering by people confined to their homes, offers lucrative opportunities for the growth of the market.

Strategic insights for the North America Veterinary Rapid Test provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 258.39 Million |

| Market Size by 2028 | US$ 461.52 Million |

| Global CAGR (2021 - 2028) | 8.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Veterinary Rapid Test refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

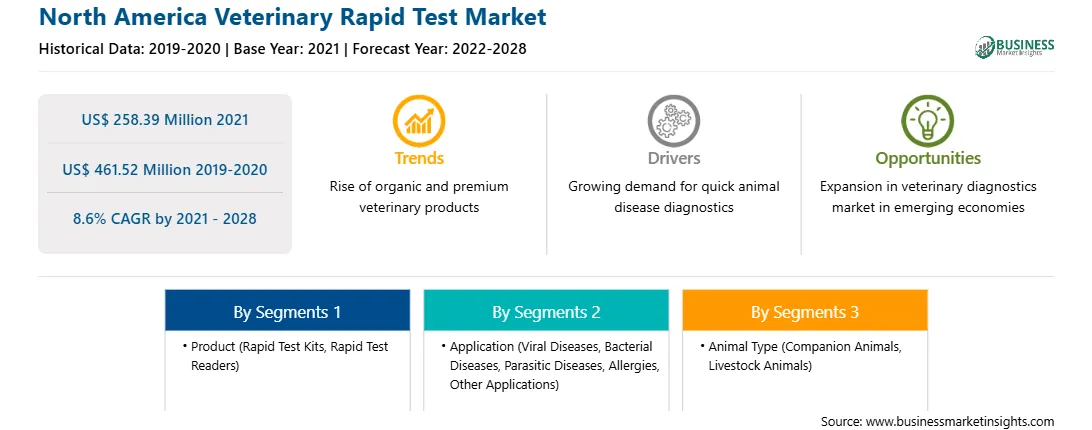

The veterinary rapid test market in North America is expected to grow from US$ 258.39 million in 2021 to US$ 461.52 million by 2028; it is estimated to grow at a CAGR of 8.6% from 2021 to 2028. The increasing demand for rapid tests and portable instruments, and the use of advanced technologies such as machine learning is offering potential growth opportunities for the veterinary rapid test market. There has been a paradigm shift in veterinary medicine. Artificial intelligence can be used in collecting data to manage a wide range of chronic diseases is offering an opportunity to leverage these platforms for veterinary healthcare. In the last few years, the industry has witnessed a few product launches associated with artificial intelligence. Many market players have ventured into this field to offer innovative and effective offerings. For instance, IDEXX Laboratories has deployed in-house urinalysis machine SediVue Dx that operates machine learning. In January 2019, the company updated its SediVue Dx with its Neural Network 4.0 software, expanding its diagnostic capabilities. This software update utilizes 175 million veterinary patient-generated images from ~2.5 million patient urine samples. Apart from this, the company also offers VetConnect PLUS that is a cloud-based technology helps veterinarians in accessing patients’ data from company’s diagnostic modalities. Moreover, increasing deaths of pets due to chronic diseases is also further offering opportunities for the integration of advanced technologies to enhance diagnostic capabilities. For instance, chronic kidney disease (CKD) is the most frequent cause of deaths in cats; in line with this, many players have come up with advanced solutions to enhance disease diagnosis. All the aforementioned factors will offer several opportunities for the growth of veterinary rapid test market during the forecast period.

The North America veterinary rapid test market is segmented on the bases of product, application, animal type, and country. Based on product, the market is segmented into rapid test kits and rapid test readers. The rapid test kits segment dominated the market in 2020 and is expected to be the fastest growing during the forecast period. On the basis of application, the veterinary rapid market is segmented into viral diseases, bacterial diseases, parasitic diseases, allergies, and other applications. The viral diseases segment dominated the market in 2020 and is expected to be the fastest growing during the forecast period. On the basis of animal type, the veterinary rapid test market is segmented into livestock animals and companion animals. The livestock animals segment dominated the market in 2020 and companion animals segment is expected to be the fastest growing during the forecast period. The livestock animals segment is further bifurcated into cattle, poultry, swine, and others. Similarly, the companion segment is segmented into dogs, cats, horses, and others.

A few major primary and secondary sources referred to for preparing this report on the veterinary rapid test market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are HESKA CORPORATION; IDEXX LABORATORIES, INC.; Virbac; Woodley Equipment Company Ltd; and Zoetis Inc. are among others.

The North America Veterinary Rapid Test Market is valued at US$ 258.39 Million in 2021, it is projected to reach US$ 461.52 Million by 2028.

As per our report North America Veterinary Rapid Test Market, the market size is valued at US$ 258.39 Million in 2021, projecting it to reach US$ 461.52 Million by 2028. This translates to a CAGR of approximately 8.6% during the forecast period.

The North America Veterinary Rapid Test Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Veterinary Rapid Test Market report:

The North America Veterinary Rapid Test Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Veterinary Rapid Test Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Veterinary Rapid Test Market value chain can benefit from the information contained in a comprehensive market report.