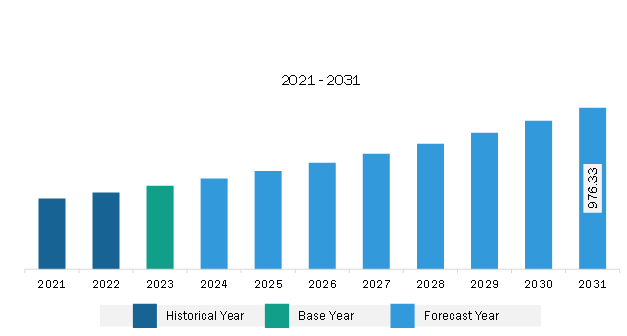

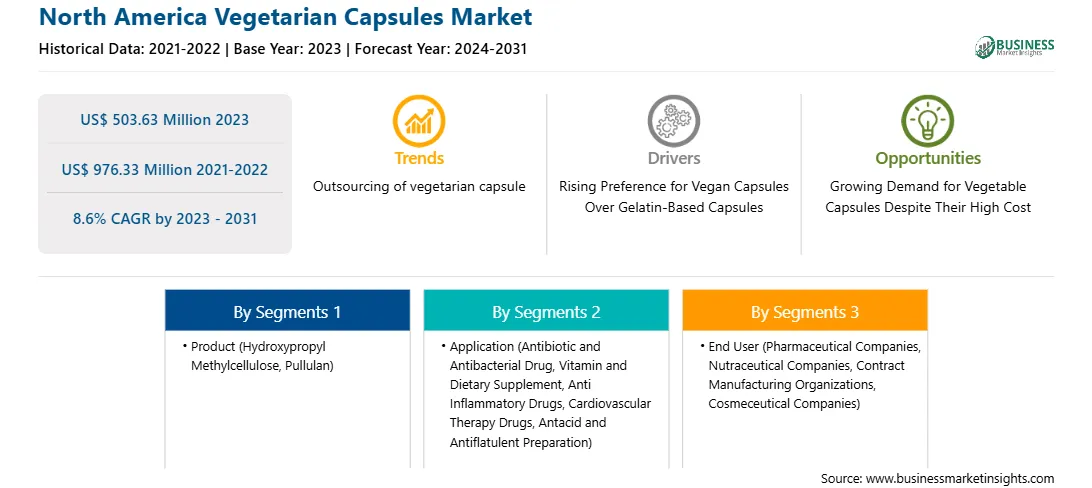

The North America vegetarian capsules market was valued at US$ 503.63 million in 2023 and is expected to reach US$ 976.33 million by 2031; it is estimated to register a CAGR of 8.6% from 2023 to 2031.

The majority of pharmaceutical companies are procuring vegetarian capsules over animal-derived capsules as they have low moisture content and better stability for hygroscopic compounds. For many years, there have been medical, religious, cultural, and ethical concerns about adding animal substances to capsule coatings or formulations in pharmaceutical medicines. Also, some consumers expressed concerns over the use of animal-derived pharmaceutical medicines due to the associated healthcare risks. In July 2023, the Center for Disease Control and Prevention (CDC) published a report for Alpha-gal syndrome (AGS) patients to limit the consumption of animal-derived medicines and supplements, as 75% of these medications contain animal-sourced ingredients. Also, AGS patients revealed serious allergic reactions after consuming medications or supplements that include mammalian-derived ingredients. Such instances have raised interest among the manufacturers to produce animal-free medications and supplements.

Factors | Gelatin Capsules | Vegetarian Capsules |

Source | Bovine, Skin, Cow, and Pigs | Plants |

Target Audience | Vegan and Nonvegetarian Population | Vegan or Vegetarian Population |

Allergy | Allergy Due to Cow and Pig-Based Ingredient | No Allergies |

Cross Linking Ingredients | Cross Linking with Other Drug-Drug Derivatives | No Cross Linking |

External Ingredients | Preservatives | No Preservatives |

Currently, the high volume of pharmaceutical capsules available in the market are composed of gelatin. However, the crosslinking of gelatin with drug incompatibilities and strict regulations on the use of animal-derived gelatin have encouraged pharmaceutical manufacturers to replace gelatin components with vegetable-based ingredients. Pharmaceutical manufacturers identified that Hydroxypropyl Methylcellulose (HPMC)-derived vegetarian capsules are a good alternative to gelatin due to its vegetable derived source. Vegicaps soft capsules are the best example of animal-free capsules. The shell is composed of seaweed extract and gluten-free starch containing no modified sugars and artificial colors. Advantages of Vegicaps soft capsules are that they are free from animal derivatives, easy to swallow, soft, natural, and healthier products. In the case of gelatin-based capsules, the shell may get soft and become sticky upon spraying aqueous enteric polymer dispersions or may become brittle due to water evaporation during drying, ultimately losing mechanical stability. However, in HPMC-derived vegetarian capsules, it is less sensitive to aqueous coating, and the capsule shell is hard that avoids leakage of the ingredients.

Therefore, rising preference toward vegetarian medicines proves advantageous for the manufacturers to accelerate the production of vegetarian capsules, which drives the North America vegetarian capsules market growth.

According to data published in the American Osteopathic Association (AOA) report in 2024, in the US more than 4 in 5 American adults (86%) consume vitamins or dietary supplements. The report reveals that American adults consume vitamins or nutraceuticals due to personal needs or recommendations by physicians, friends, or family members. Also, with the rising prevalence of vitamin deficiency, the consumption of nutraceutical supplements such as capsules is high among the US population. The 2023 CRN Consumer Survey on Dietary Supplements shows that almost 74% of adults in the US consume dietary supplements, among which 55% are regular consumers. Some US population is shifting toward vegan diet. Health-conscious vegan consumers look for the “Vegan Trademark” while purchasing nutraceuticals and other dietary supplement products.

In the US, the nutraceutical industry provides innovative vegan products to meet rising consumer demand and diverse consumer intake shift toward animal-free dietary supplements. In April 2023, IFF announced the launch of "VERDIGEL SC". The introduction of "VERDIGEL SC" enables manufacturers of vegan soft gels to offer carrageenan-free products that are in high demand in several markets. Softgels are gaining high popularity in the nutritional and supplement sectors, and this new product developed by the IFF offers manufacturers a suitable option to switch to plant-based, carrageenan-free alternatives without disrupting existing production processes and compromising performance and quality.

Strategic insights for the North America Vegetarian Capsules provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 503.63 Million |

| Market Size by 2031 | US$ 976.33 Million |

| Global CAGR (2023 - 2031) | 8.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Vegetarian Capsules refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America vegetarian capsules market is categorized into product, application, functionality, end user, and country.

Based on product, the North America vegetarian capsules market is segmented hydroxypropyl methylcellulose (HPMC), pullulan, and others. The hydroxypropyl methylcellulose (HPMC) segment held the largest market share in 2023.

In terms of application, the North America vegetarian capsules market is categorized into antibiotic and antibacterial drug, vitamin and dietary supplement, anti-inflammatory drugs, cardiovascular therapy drugs, antacid and antiflatulent preparation, and others. The antibiotic and antibacterial drug segment held the largest market share in 2023.

By functionality, the North America vegetarian capsules market is segmented into immediate release capsules, sustained release capsules, and delayed release capsules. The immediate release capsules segment held the larger market share in 2023.

By end user, the North America vegetarian capsules market is segmented into pharmaceutical companies, nutraceutical companies, contract manufacturing organizations (CMOS), and cosmeceutical companies. The pharmaceutical companies segment held the largest market share in 2023.

By country, the North America vegetarian capsules market is segmented into the US, Canada, and Mexico. The US dominated the North America vegetarian capsules market share in 2023.

ACG; CapsCanada; Capsugel, Inc (A subsidiary of Lonza Group AG); HealthCaps India; Lefancaps; NATURAL CAPSULES LIMITED; QUALICAPS; Shanxi Guangsheng Medicinal Capsules Co (GS Capsules); Sunil Healthcare Limited; Yasin; and Zhejiang Huili Capsules Co., Ltd. are some of the leading companies operating in the North America vegetarian capsules market.

The North America Vegetarian Capsules Market is valued at US$ 503.63 Million in 2023, it is projected to reach US$ 976.33 Million by 2031.

As per our report North America Vegetarian Capsules Market, the market size is valued at US$ 503.63 Million in 2023, projecting it to reach US$ 976.33 Million by 2031. This translates to a CAGR of approximately 8.6% during the forecast period.

The North America Vegetarian Capsules Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Vegetarian Capsules Market report:

The North America Vegetarian Capsules Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Vegetarian Capsules Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Vegetarian Capsules Market value chain can benefit from the information contained in a comprehensive market report.