North America Unified Threat Management Market

No. of Pages: 94 | Report Code: BMIRE00030277 | Category: Technology, Media and Telecommunications

No. of Pages: 94 | Report Code: BMIRE00030277 | Category: Technology, Media and Telecommunications

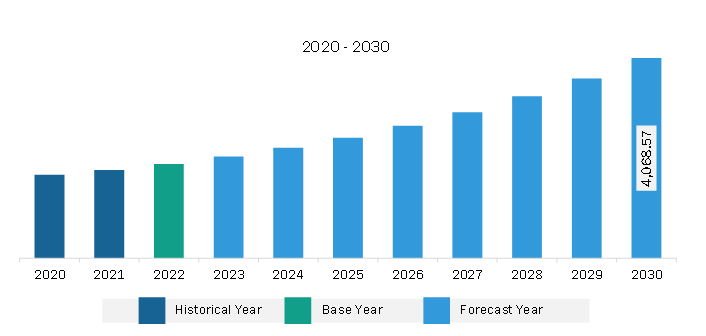

The North America unified threat management market was valued at US$ 1,915.59 million in 2022 and is expected to reach US$ 4,068.57 million by 2030; it is estimated to register at a CAGR of 9.9% from 2022 to 2030.

Integration of Artificial Intelligence and Machine Learning Fuels North America Unified Threat Management Market

The emergence of artificial intelligence (AI) technology has changed the way businesses used to work. The benefits of AI technology have encouraged various businesses to invest in it as they want quick solutions that can save time and avoid threats. AI and machine learning (ML) are great solutions to enable automated security tasks and responses. A unified threat management solution integrated with AI technology automates the tasks to speed up the time to handle sensitive threats.

Several companies are burdened with security data generated from multiple apps. If such data is left unfiltered, it makes it difficult to isolate the real threats. In such a scenario, a unified threat management software integrated with artificial intelligence filters out this data automatically, exposing the real threats in a real-time environment.

Unified threat management providers are leveraging artificial intelligence and machine learning to offer intelligent and predictive threat management capabilities and real-time threat monitoring capabilities. For instance, WiJungle, a cybersecurity startup, offers a unified security solution aided by artificial intelligence for offices, remote workforce, and the cloud. Unified threat management integrated with technologies such as AI and ML provides several benefits, such as automated threat response, behavioral analysis, scalability, resource optimization, cost reduction, user-centric security, and real-time analysis.

Thus, AI and ML is the future of the technology and is expected to become a game changer across various industries. Increasing adoption and developments in AI and ML will improve the cybersecurity scenario across organizations and become key to threat management solutions in the future.

North America Unified Threat Management Market Overview

The North America unified threat management software market is segmented into the US, Canada, and Mexico. The substantial majority of Americans experienced major cyberattacks in 2022 on the nation's public infrastructure or financial and banking systems. Because of this, the US government is taking some initiatives to handle cyberattacks on public infrastructure or government agencies. Also, the increasing number of Distributed Denial-of-Service (DDoS) attacks in North America is one of the factors for the growth of the unified threat management market. In August 2023, Zayo Group Holdings, Inc.-a leading global communications infrastructure provider-announced its annual Distributed Denial of Service (DDoS) Insights Report, analyzing DDoS attack activity and impact across industries in the first half of 2023. The report analyzed more than 70,000 threat detections and mitigation experiences by Zayo Group Holdings, Inc.'s customers across 14 industries in America and Western Europe between January 1 and June 30, 2023. Various sectors, including IT & telecommunication, education, retail, media, healthcare, and government, were hit by DDoS attacks. Telecommunications companies were a prime target for attackers due to the critical role telecom providers play in providing communication and Internet services. The industry saw the most frequent attacks, accounting for roughly half of the total attack volume, with more than 37,000 attacks in the first half of 2023. Hence, the increase in DDoS attacks in North America is boosting the adoption of unified threat management solutions.

North America Unified Threat Management Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the North America Unified Threat Management provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,915.59 Million |

| Market Size by 2030 | US$ 4,068.57 Million |

| Global CAGR (2022 - 2030) | 9.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Unified Threat Management refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

1. Fortinet Inc

2. Sophos Ltd.

3. Cisco Systems Inc

4. Juniper Networks Inc

5. Huawei Technologies Co Ltd

6. Barracuda Networks, Inc.

7. WatchGuard Technologies Inc

8. SonicWall Inc

9. Check Point Software Technologies Ltd

The North America Unified Threat Management Market is valued at US$ 1,915.59 Million in 2022, it is projected to reach US$ 4,068.57 Million by 2030.

As per our report North America Unified Threat Management Market, the market size is valued at US$ 1,915.59 Million in 2022, projecting it to reach US$ 4,068.57 Million by 2030. This translates to a CAGR of approximately 9.9% during the forecast period.

The North America Unified Threat Management Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Unified Threat Management Market report:

The North America Unified Threat Management Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Unified Threat Management Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Unified Threat Management Market value chain can benefit from the information contained in a comprehensive market report.