The North America ultra-low alpha metals market is a highly fragmented market with the presence of considerable regional and local players providing numerous solutions for companies investing in the market arena. Alpha emission of the material involves decaying of one atom into another, along with the reduction in mass number by four times and atomic number by two. The rate of alpha emission helps to determine the grade of the metal to be used in different applications such as in the production of printed circuit boards (PCBs), circuit boards, semiconductor packaging, and plating. Apart from their use in the semiconductor and electronics industry, these metals are extensively used across medical and defense sectors. The ultra-low alpha metals are significantly used in the development of military equipment and medical devices attributable to their characteristics such as wetting behavior, mechanical properties, and soldering properties. These metals help minimize device malfunctions arising due to the occurrence of soft errors. This makes them suitable to be used in advanced clinical devices and military hardware and equipment. The expanding demand for clinical gadgets is expected to provide impetus to market growth. Moreover, the demand for ultra-low alpha metals is rising in 3D printing, consumer electronics, wearable devices, telecommunication, and aerospace equipment, which is expected to augment the growth of the ultra-low alpha metals market. Further, rapid industrialization and an increase in investment in advanced materials are expected to stimulate market growth. The implementation of the government regulations on use of the unsafe substances is boosting the market growth.

In North America, the US reported a huge number of COVID-19 cases, which led to the discontinuation of several business operations, including ultra-low alpha metals manufacturing activities. The disruption in the supply chain with volatility in raw material pricing and sourcing in the initial weeks of lockdown has impacted the industrial products and processes. However, as the economies are planning to revive their operations, the demand for ultra-low alpha metals is expected to rise in North America. However, the focus on just-in-time production is another concerning factor hindering market growth. The increasing demand for advanced industrial materials backed by the growth of end-use industries such as electronics, aerospace & defense, automotive, medical, and telecommunication is expected to contribute to the market's growth. Further, significant investments by prominent manufacturers in advancing ultra-low alpha lead-free alloys are expected to drive the ultra-low alpha metals market.

Strategic insights for the North America Ultra-Low Alpha Metals provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

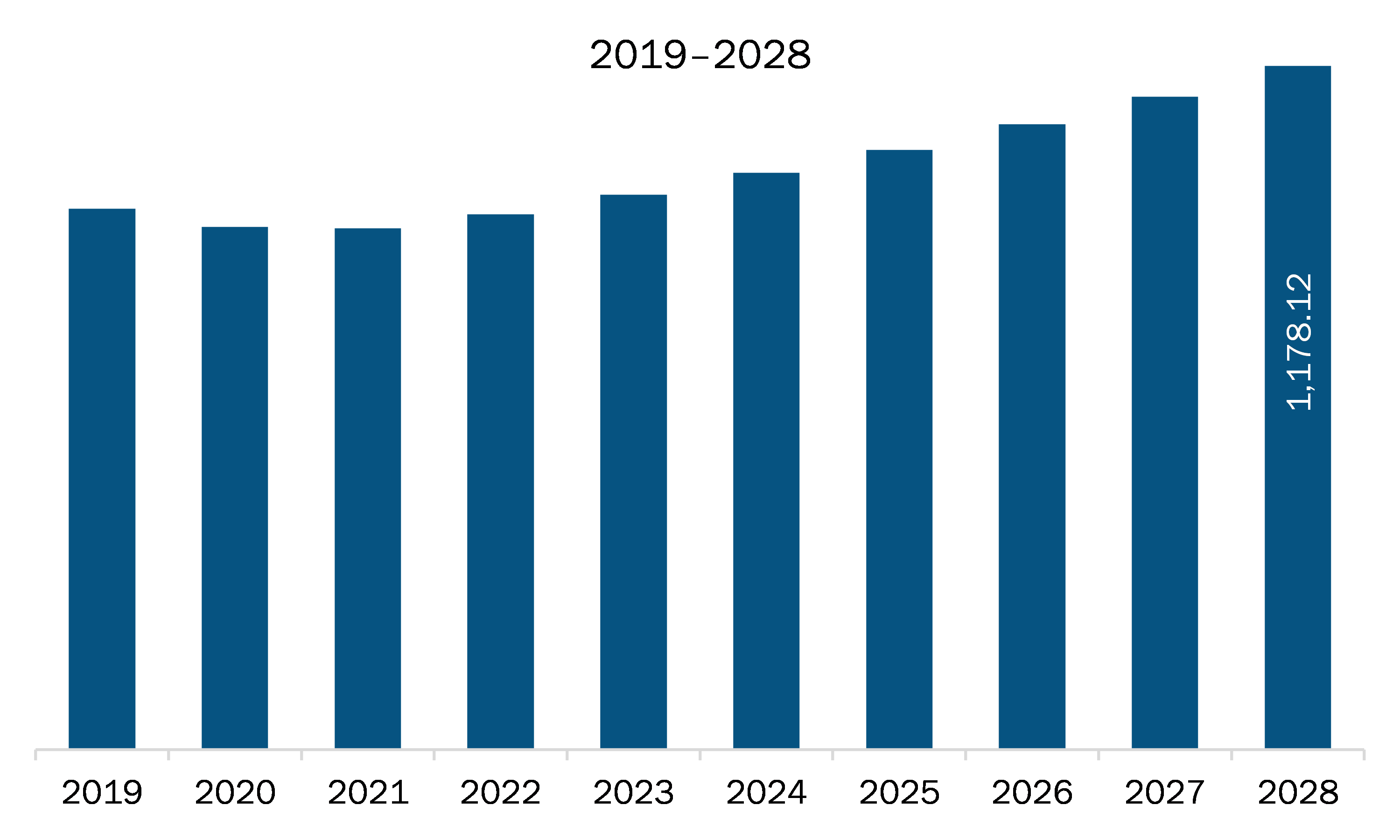

| Market size in 2021 | US$ 734.77 Million |

| Market Size by 2028 | US$ 1,178.12 Million |

| Global CAGR (2021 - 2028) | 7.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Ultra-Low Alpha Metals refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The ultra-low alpha metals market in North America is expected to grow from US$ 734.77 million in 2021 to US$ 1,178.12 million by 2028; it is estimated to grow at a CAGR of 7.0% from 2021 to 2028. The increase in the development of the medical industry in North America is one of the reasons driving the ultra-low alpha metals market in the region. Advances in medical technology and the increase in population have fueled the demand for ultra-low alpha metals in the medical industry. The automotive industry's tremendous growth in North America further contributes to the development of the ultra-low alpha metals market in the region. The US has one of the largest automotive marketplaces. Mexico is the largest passenger vehicle manufacturer, and the automotive industry in the country is growing. The key players operating in the North American ultra-low alpha metals market include MITSUBISHI MATERIALS Corporation, Pure Technologies, Honeywell International Inc., and MacDermid Alpha Electronics Solutions. These players focus on research and development activities to offer innovative products to the industries, thereby driving the ultra-low alpha metals market in North America.

Based on type, the ULA lea-free alloys and others segment accounted for the largest share of the North America ultra-low alpha metals market in 2020. Based on application, the electronics segment accounted for the largest share of the North America ultra-low alpha metals market in 2020.

A few major primary and secondary sources referred to for preparing this report on the North America ultra-low alpha metals market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report include Mitsubishi Materials Corporation; Teck Resources Limited; Pure Technologies; Honeywell International Inc. and MacDermid Alpha Electronics Solutions.

The North America Ultra-Low Alpha Metals Market is valued at US$ 734.77 Million in 2021, it is projected to reach US$ 1,178.12 Million by 2028.

As per our report North America Ultra-Low Alpha Metals Market, the market size is valued at US$ 734.77 Million in 2021, projecting it to reach US$ 1,178.12 Million by 2028. This translates to a CAGR of approximately 7.0% during the forecast period.

The North America Ultra-Low Alpha Metals Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Ultra-Low Alpha Metals Market report:

The North America Ultra-Low Alpha Metals Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Ultra-Low Alpha Metals Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Ultra-Low Alpha Metals Market value chain can benefit from the information contained in a comprehensive market report.