North America Treasury and Risk Management Market

No. of Pages: 153 | Report Code: BMIRE00025577 | Category: Technology, Media and Telecommunications

No. of Pages: 153 | Report Code: BMIRE00025577 | Category: Technology, Media and Telecommunications

Organizations use financial analytics tools to gain insights into a few present and future trends to improve their business performance. Financial analytics services offer financial data quality analysis, data layout, client analytics, predictive analytics, principal component analysis, and financial data collection. These analytics require detailed financial and other relevant data to identify patterns; based on these predictions, enterprises make predictions regarding their customers' purchases and their employees' tenure. Thus, financial analytics services help organizations improve profitability, cash flow, and business value. They can use the insights gained through these analytics to improve their revenues and business processes. For instance, Accenture PLC provides the newest data and analytics solutions for financial service providers and assists them in deploying the same. The services for these firms include cost analytics and enterprise performance analytics. With a prime focus on income statements, balance sheets, and cash flow statements, financial analysis is used to evaluate economic trends, set financial policies, formulate long-term business plans, and pinpoint investment projects or companies. Financial service providers such as investment banks generate and store more data than other businesses, as finance is a transaction-heavy industry. The banks use data to estimate risks to improve the overall profitability in the coming years. Thus, with multiple benefits in banks and investment firms, the demand for financial analytics services is increasing significantly, thus boosting the treasury and risk management market growth. The treasury functions are clear beneficiaries of financial analytics, which provides better insights into customers, competitors, profitability, and processes. Financial analytics can also strengthen the chief financial officer's (CFO) ability to drive strategic decision-making and investment planning. Thus, creating an analytics-driven organization has also become the top driver of collaboration between the CFO and chief information officer (CIO). Thus, the demand for financial analytics services is growing significantly, driving the treasury and risk management market.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the North America treasury and risk management market. The North America treasury and risk management market is expected to grow at a good CAGR during the forecast period.

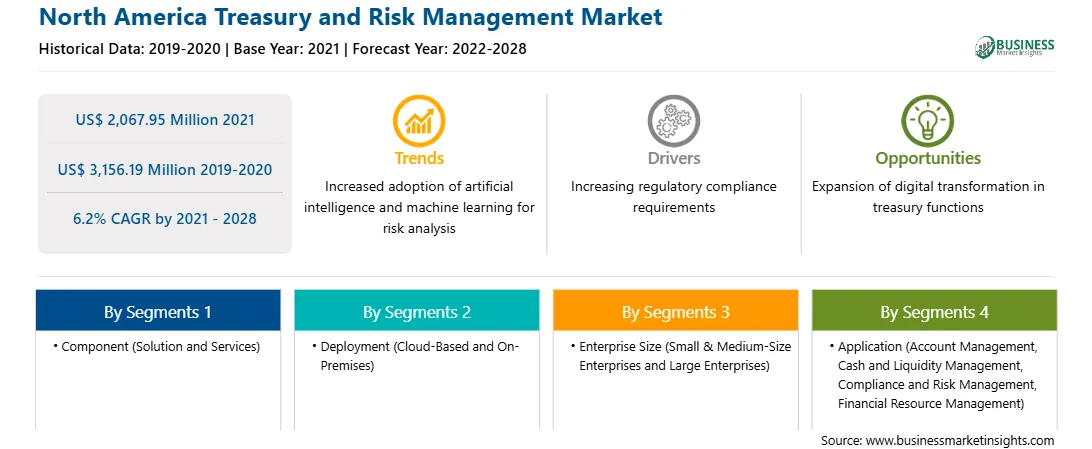

North America Treasury and Risk Management Market Segmentation

The North America treasury and risk management market is segmented based on component, deployment, enterprise size, application, end user, and country. Based on component, the market is bifurcated into solution and services. The solution segment dominated the market in 2020, and the same segment is expected to grow faster during the forecast period. In terms of deployment, the market is bifurcated into cloud-based and on-premises. The cloud-based segment dominated the market in 2020, and the same segment is expected to grow faster during the forecast period. Based on enterprise size, the market is bifurcated into small & medium-size enterprises and large enterprises. The large enterprises segment dominated the market in 2020, and the small & medium-size enterprises segment is expected to grow faster during the forecast period. In terms of application, the market is segmented into account management, cash and liquidity management, compliance and risk management, and financial resource management. The cash and liquidity management segment dominated the market in 2020, and the same segment is expected to be the fastest-growing segment during the forecast period. Based on end user, the market is segmented into BFSI, IT and telecom, retail and e-commerce, healthcare, manufacturing and automotive, and others. The BFSI segment dominated the market in 2020, and the healthcare segment is expected to be the fastest growing during the forecast period. Based on country, the North America treasury and risk management market has been segmented into the US, Canada, and Mexico.

Broadridge Financial Solutions, Inc.; Calypso Technology, Inc (Adenza); FIS; Fiserv, Inc.; Kyriba Corp; Mors Software; Oracle Corporation; Pricewaterhousecoopers International Limited (PWC); SAP SE; and Wolters Kluwer are among the leading companies in the North America treasury and risk management market.

Strategic insights for the North America Treasury and Risk Management provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 2,067.95 Million |

| Market Size by 2028 | US$ 3,156.19 Million |

| Global CAGR (2021 - 2028) | 6.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Treasury and Risk Management refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America Treasury and Risk Management Market is valued at US$ 2,067.95 Million in 2021, it is projected to reach US$ 3,156.19 Million by 2028.

As per our report North America Treasury and Risk Management Market, the market size is valued at US$ 2,067.95 Million in 2021, projecting it to reach US$ 3,156.19 Million by 2028. This translates to a CAGR of approximately 6.2% during the forecast period.

The North America Treasury and Risk Management Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Treasury and Risk Management Market report:

The North America Treasury and Risk Management Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Treasury and Risk Management Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Treasury and Risk Management Market value chain can benefit from the information contained in a comprehensive market report.