The primary purpose of transformer maintenance is to ensure that the internal and external components of transformers are kept in good condition, fit for the purpose, and operating safely. Preventative maintenance of transformers involves routine inspection, adjustment, testing, minor fixes, and special handling instructions. The transformer needs scheduled maintenance for interfacial tension (IFT), flash point, sludge content, acidity, water content, and dielectric strength, along with performance of transformer oil in the transformer. The electrical transformers are an expensive and important part of any machinery. Thus, for optimal performance and increased product life, it is becoming necessary to focus on regular maintenance check-ups. Thus, increased focus on performing regular maintenance activities on transformers is propelling the market growth.

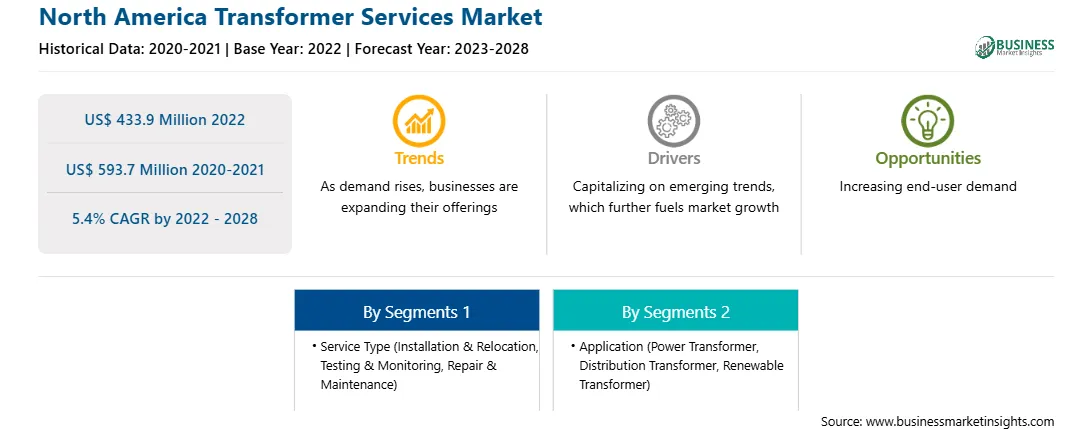

The North America transformer services market size was valued at US$ 433.9 million in 2022 and is projected to reach US$ 593.7 million by 2028; it is expected to grow at a CAGR of 5.4% from 2022 to 2028.

The transformer is costly and essential equipment within an electrical substation. Thus, various preventative maintenance activities must be performed to ensure that the transformer maintains a high level of performance and a long functional life. Other types of maintenance activities such as emergency or breakdown transformer maintenance are conducted in the event of a fault. However, regular maintenance significantly reduces the chances of such emergency maintenance. The increase in need for conducting the transformer services at regular intervals, along with inorganic growth strategies, are the prominent factors attributed to the growth of the market. For instance, in August 2022, RESA Power, LLC, a market leader in power systems electrical testing and transformer services, announced the acquisition of Advanced Electrical Services, Ltd. This initiative bolstered the company’s presence in Canada.

The US is one of the major markets in the North American region as the country is investing in the upgradation and maintenance of its current transformer networks. Factors such as the steady demand for repair and installation of power, distributor, and renewable transformers are projected to provide ongoing growth opportunities during the coming years. The growth of the North America transformer services market is primarily attributed to increasing focus on transformer maintenance and service activities, intense emphasis on routine maintenance and aging of transformers. The demand for power supply is growing at a faster pace, wherein the deployment of transformers is also increasing, which is fueling the market growth for transformer services in North America. As per the data published by the US Energy Information Administration (EIA), the US electricity generation had increased from 4,007 billion kWh in 2020 to 4,115 billion kWh in 2021.

The primary purpose of transformer maintenance is to ensure that the internal and external components of transformers are kept in good condition, fit for the purpose, and operating safely. Preventative maintenance of transformers involves routine inspection, adjustment, testing, minor fixes, and special handling instructions. The transformer needs scheduled maintenance for interfacial tension (IFT), flash point, sludge content, acidity, water content, and dielectric strength, along with performance of transformer oil in the transformer. The electrical transformers are an expensive and important part of any machinery. Thus, for optimal performance and increased product life, it is becoming necessary to focus on regular maintenance check-ups. Different types of maintenance checks need to be conducted on a power transformer, such as transformer maintenance checks on a monthly basis, daily maintenance testing and checking, annual transformer maintenance schedule, and transformer maintenance on a half-yearly basis. Thus, increased focus on performing regular maintenance activities on transformers is propelling the North America transformer services market growth.

The transformer is costly and essential equipment within an electrical substation. Thus, various preventative maintenance activities must be performed to ensure that the transformer maintains a high level of performance and a long functional life. Other types of maintenance activities such as emergency or breakdown transformer maintenance are conducted in the event of a fault. However, regular maintenance significantly reduces the chances of such emergency maintenance. The increase in need for conducting the transformer services at regular intervals, along with inorganic growth strategies, are the prominent factors attributed to the growth of the market. For instance, in August 2022, RESA Power, LLC, a market leader in power systems electrical testing and transformer services, announced the acquisition of Advanced Electrical Services, Ltd. This initiative bolstered the company’s presence in Canada.

Based on service type, the repair and maintenance segment held the largest share of the North America transformer services market, in 2021. The growth of the segment is primarily attributed to the increase in need for maintenance and repair activities in order to make sure its internal and external parts are in good condition and to maintain a record of its condition. Based on application, the power transformers segment held the largest share of the North America transformer services market. The rise in energy demand, increase in renewable power generation, growing initiatives for smart cities & urbanization are the key factors responsible for the demand of power transformer. Thus, such factors are driving the North America transformer services market growth.

A few major primary and secondary sources referred to for preparing this report on the North America transformer services market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the North America Transformer Services market report include GE; Vertiv Group Corp.; Hitachi Energy Ltd.; Stark International Ltd.; RESA Power LLC; Houghton International; Siemens Energy; VCM Solutions; Power Substation Services; Magneto Electric North American Substation Services Ltd. (NASS); SPX Corporation; Transformer Services, Inc.; Kinectrics; Transformer Engineering Service; EMERALD; SDMyers; ELSCO TRANSFORMERS; American Superconductor; Tru-Amp Corporation; Controlled Magnetics, Inc.; CES Transformers; Aevitas Lineman's Testing Laboratories Of Canada Limited; van Kooy Transformer Consulting Services Inc; EthosEnergy; Sunbelt Solomon; Maschinenfabrik Reinhausen GmbH; TCI of NY (G&S Family of Companies); Pace Technologies Inc.; Scherer Electric; Eaton and among others.

Strategic insights for the North America Transformer Services provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 433.9 Million |

| Market Size by 2028 | US$ 593.7 Million |

| Global CAGR (2022 - 2028) | 5.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Service Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Transformer Services refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The List of Companies - North America Transformer Services Market

- GE

- Hitachi Energy Ltd

- Siemens

- Vertiv Group Corp.

- Stark International Inc.

- RESA Power LLC

- Houghton International

- VCM Solutions

- Power Substation Services

- Magneto Electric

The North America Transformer Services Market is valued at US$ 433.9 Million in 2022, it is projected to reach US$ 593.7 Million by 2028.

As per our report North America Transformer Services Market, the market size is valued at US$ 433.9 Million in 2022, projecting it to reach US$ 593.7 Million by 2028. This translates to a CAGR of approximately 5.4% during the forecast period.

The North America Transformer Services Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Transformer Services Market report:

The North America Transformer Services Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Transformer Services Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Transformer Services Market value chain can benefit from the information contained in a comprehensive market report.