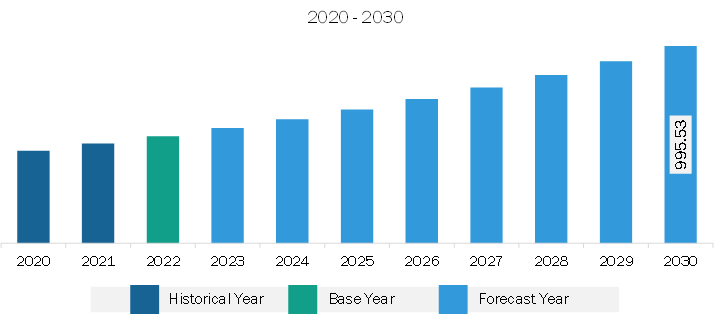

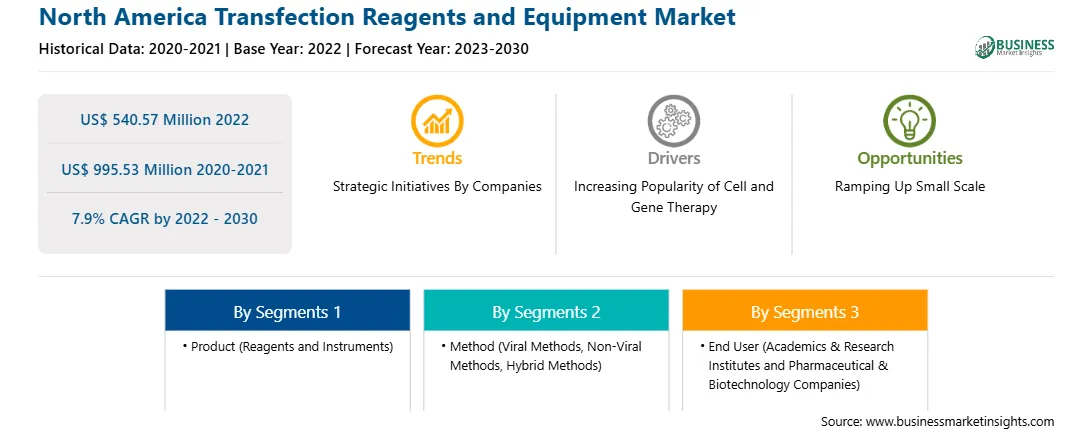

The North America transfection reagents and equipment market was valued at US$ 540.57 million in 2022 and is expected to reach US$ 995.53 million by 2030; it is estimated to register at a CAGR of 7.9% from 2022 to 2030.

Strategic Initiatives by Companies Fuel North America Transfection Reagents and Equipment Market

Companies operating in the North America transfection reagents and equipment market focus on strategic developments such as collaborations, expansions, agreements, partnerships, and new product launches, which help them improve their sales, expand their geographic scope, and enhance their capacities to cater to a larger than existing customer base. These developments also contribute to the introduction of new trends to the market to a certain extent. A few of the noteworthy developments in the North America transfection reagents and equipment market are mentioned below.

Thus, the introduction of products such as transfection reagents and systems; the development of innovative products targeting various health issues to create new or improved products; and the initiation of new businesses to remain competitive in the market, all, through collaborations and partnerships can help speed up the development of new platforms for transfection reagents and equipment.

North America Transfection Reagents and Equipment Market Overview

Cell and gene therapies (CGTs) are prescribed to treat patients suffering from serious and rare diseases with unaddressed therapeutic needs. Manufacturing CGTs is a highly complex process, with the insufficiency of infrastructure and expertise being a major limiting factor. Logistics-related challenges associated with intermediates and the final product also limit the CGT manufacturing capacity of companies. The CGT manufacturing process involves the extraction of autologous cells through "apheresis," dispatching them to specialized laboratories and sending them back to clinics for administration into patients, all of which must be performed with strict quality control. The US Food and Drug Administration (FDA) has approved only 7 CGT drugs so far, and the pipeline of new products has reached ~1,200 experimental therapies. Half of these are in Phase 2 clinical trials. With these prospects, annual sales of cell therapies and gene therapies are estimated to grow by 15% and ~30%, respectively, as stated in the Chemical & Engineering News Report 2023.

Many manufacturers approach contract development manufacturing organizations (CDMOs) such as Labcorp, Lonza, and Catalent to overcome the barriers associated with the production and commercialization of their CGT products. Lonza has invested ~US$ 9.2 million to strengthen its cell and gene therapy manufacturing capabilities. Such initiatives by CDMOs are contributing to the growth of the transfection reagents and equipment market in the US.

Furthermore, in February 2022, François-Philippe Champagne, the minister of Innovation, Science and Industry, announced the funding of US$ 45 million to the Government of Canada through the Canada Foundation for Innovation (CFI) to ensure that research teams have appropriate labs and infrastructure, and access to technology departments for carrying about world-class research. The Canadian Institutes of Health Research (CIHR) announced a partnership with the Quebec Consortium for Drug Discovery (CQDM) for a new collaborative funding program on personalized medicine to accelerate drug discovery and drug development.

North America Transfection Reagents and Equipment Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the North America Transfection Reagents and Equipment provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Transfection Reagents and Equipment refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Transfection Reagents and Equipment Strategic Insights

North America Transfection Reagents and Equipment Report Scope

Report Attribute

Details

Market size in 2022

US$ 540.57 Million

Market Size by 2030

US$ 995.53 Million

Global CAGR (2022 - 2030)

7.9%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Product

By Method

By End User

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Transfection Reagents and Equipment Regional Insights

North America Transfection Reagents and Equipment Market Segmentation

The North America transfection reagents and equipment market is segmented based on product, method, application, end user, and country.

Based on product, the North America transfection reagents and equipment market is bifurcated into reagents and instruments. The reagents segment held a larger share in 2022.

In terms of method, the North America transfection reagents and equipment market is segmented into viral methods, non-viral methods, and hybrid methods. The non-viral methods segment held the largest share in 2022. The viral segment is sub categorized into retrovirus, adenovirus, adeno associated virus, and herpes virus. The non-viral segment is bifurcated into physical/mechanical method and chemical method. Further, the physical/mechanical method segment is sub categorized into electroporation, microinjection, biolistic method, laser method, magnetofection, and sonoporation. Also, the chemical method segment is sub categorized into liposomal based/high lipid and non-liposomal/high lipid based.

By application, the North America transfection reagents and equipment market is segmented into biomedical research, protein production, and therapeutic delivery. The biomedical research segment held the largest share in 2022.

Based on end user, the North America transfection reagents and equipment market is bifurcated into academics & research institutes and pharmaceutical & biotechnology companies. The academics & research institutes segment held a larger share in 2022.

Based on country, the North America transfection reagents and equipment market is categorized into the US, Canada, and Mexico. The US dominated the North America transfection reagents and equipment market in 2022.

Thermo Fisher Scientific Inc, Promega Corp, F. Hoffmann-La Roche Ltd, Bio-Rad Laboratories Inc, Mirus Bio LLC, QIAGEN NV, Merck KGaA, Lonza Group AG, MaxCyte Inc, and Polyplus-Transfection SA are some of the leading companies operating in the North America transfection reagents and equipment market.

1. Thermo Fisher Scientific Inc

2. Promega Corp

3. F. Hoffmann-La Roche Ltd

4. Bio-Rad Laboratories Inc

5. Mirus Bio LLC

6. QIAGEN NV

7. Merck KGaA

8. Lonza Group AG

9. MaxCyte Inc

10. Polyplus-Transfection SA

The North America Transfection Reagents and Equipment Market is valued at US$ 540.57 Million in 2022, it is projected to reach US$ 995.53 Million by 2030.

As per our report North America Transfection Reagents and Equipment Market, the market size is valued at US$ 540.57 Million in 2022, projecting it to reach US$ 995.53 Million by 2030. This translates to a CAGR of approximately 7.9% during the forecast period.

The North America Transfection Reagents and Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Transfection Reagents and Equipment Market report:

The North America Transfection Reagents and Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Transfection Reagents and Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Transfection Reagents and Equipment Market value chain can benefit from the information contained in a comprehensive market report.