In the US, tobacco is one of the significant causes of disease, disability, and death. According to the data published by CDC in 2021, an estimated 28.3 million adults smoke cigarettes in the US. Nearly 1,600 people (younger than 18 years) smoke their first cigarette every day in the US, and nearly half a million Americans die prematurely due to secondhand smoke exposure. As per the same source, e-cigarettes are the most frequently used tobacco products among high and middle school students. CDC also states that the US spends more than US$ 225 billion on medical care each year to treat smoking-related diseases in adults.

Nicotine replacement therapy (NRT) has proven to help people seeking to quit smoking. It makes use of nicotine patches that deliver modest nicotine dosages to relieve cravings. Nicotine is progressively absorbed through the skin once nicotine patches are applied. Smokers with a greater dependence level can use the most robust patches, while those with a lower dependence level can use a lesser dosage. The critical advantage of nicotine patches over acute NRT formulations (gum, nasal spray, oral inhaler, and tablet) is the simplicity of compliance, rather than consuming a medicine throughout the day.

Thus, the increasing consumption of tobacco leads to increasing demand for nicotine patches, thereby driving the growth of the transdermal medical patch market.

The North American transdermal medical patch market is segmented into the US, Canada, and Mexico. In 2022, the US held the largest share of the North America transdermal medical patch market. The rising number of patients suffering from chronic conditions and increasing activities in research and development are the key factors propelling the market for transdermal medical patches.

Strategic insights for the North America Transdermal Medical Patch provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

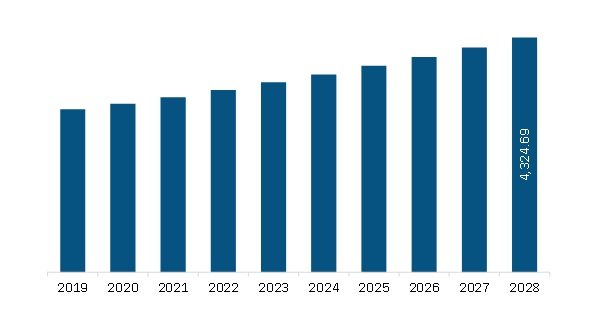

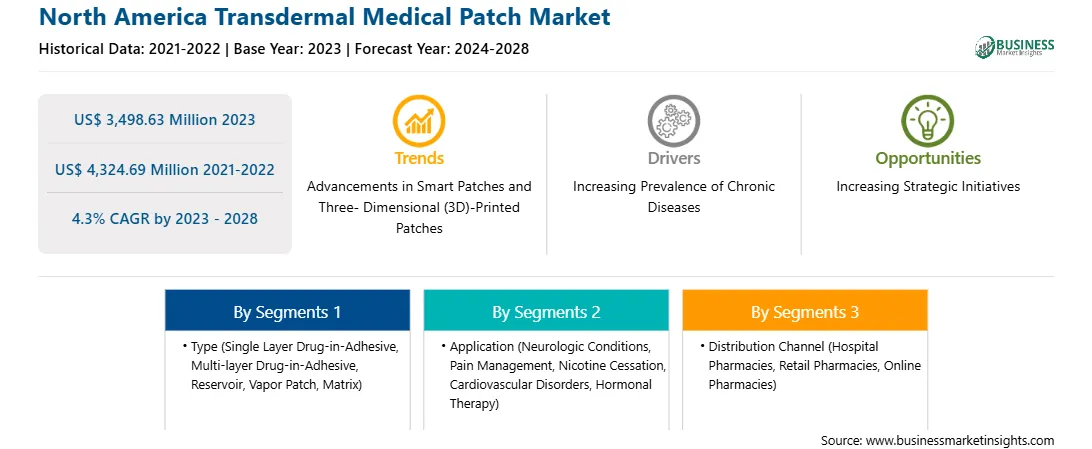

| Market size in 2023 | US$ 3,498.63 Million |

| Market Size by 2028 | US$ 4,324.69 Million |

| Global CAGR (2023 - 2028) | 4.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Transdermal Medical Patch refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America transdermal medical patch market is segmented into type, application, distribution channel, and country.

Based on type, the market is segmented into single-layer drug in-adhesive, multi-layer drug in-adhesive, reservoir, vapor patch, and matrix. The matrix segment registered the largest market share in 2023.

Based on application, the market is segmented into neurologic conditions, pain management, nicotine cessation, cardiovascular disorders, hormonal therapy, and others. The pain management segment held the largest market share in 2023.

Based on distribution channel, the North America transdermal medical patch market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies segment held the largest market share in 2023.

Based on country, the North America transdermal medical patch market is segmented into the US, Canada, and Mexico. The US dominated the market share in 2023.

Boehringer Ingelheim International GmbH, Corium, LLC, Endo International Inc, Hisamitsu Pharmaceutical Co Inc, Johnsons and Johnsons, Medline Industries LP, Novartis AG, Teva Pharmaceutical Industries Ltd., UCB SA, and Viatris Inc are the leading companies operating in the transdermal medical patch market in the region.

The North America Transdermal Medical Patch Market is valued at US$ 3,498.63 Million in 2023, it is projected to reach US$ 4,324.69 Million by 2028.

As per our report North America Transdermal Medical Patch Market, the market size is valued at US$ 3,498.63 Million in 2023, projecting it to reach US$ 4,324.69 Million by 2028. This translates to a CAGR of approximately 4.3% during the forecast period.

The North America Transdermal Medical Patch Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Transdermal Medical Patch Market report:

The North America Transdermal Medical Patch Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Transdermal Medical Patch Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Transdermal Medical Patch Market value chain can benefit from the information contained in a comprehensive market report.