North America Trade Surveillance Systems Market

No. of Pages: 120 | Report Code: TIPRE00024732 | Category: Technology, Media and Telecommunications

No. of Pages: 120 | Report Code: TIPRE00024732 | Category: Technology, Media and Telecommunications

The US, Canada, and Mexico are the key contributors to the trade surveillance systems market in North America. North America is one of the frontrunners in terms of developing and accepting new and advanced technologies across all markets, such as the financial market. The significant adoption of technologies in the last five years has fueled the demand for trade surveillance systems in the region. Owing to the rise in trading activities across North American countries, such as the US, special governing bodies were formed to monitor the activities across the security market. A few legal acts that govern the market in the US are Securities Act of 1933, Securities Exchange Act of 1934, and Investment Company Act of 1940. The Securities Exchange Act gives the U.S. Securities and Exchange Commission (SEC) considerable regulatory jurisdiction over the securities business. The act gives the government body an authority to register, regulate, and supervise brokerage firms, transfer agents, clearing agencies, and securities self-regulatory organizations (SROs) across the country. The New York Stock Exchange, the NASDAQ Stock Market, and the Chicago Board of Options are a few examples of securities exchanges. SROs consist of the Financial Industry Regulatory Authority (FINRA). The Act also recognizes and forbids specific types of market behavior, as well as gives the Commission disciplinary authority over regulated firms and their associates. The rising complexities in the security trading is creating the need for trade surveillance, which is driving the growth of the trade surveillance systems market across the region.

It is becoming apparent with the COVID-19 pandemic spreading across the United States have impacted all industries severely. Thus, any impact on industries directly affects the region's economic development. The unprecedented rise in number of COVID-19 cases across the US and the subsequent lockdown to combat the spread of the virus across the country in the first two quarters of 2020 have led to numerous businesses to come on a standby situation. Technological investments in 2020 experienced a dip owing to the above-mentioned reasons. The sudden lockdown imposed across the region have also severely impacted the stock market leading to high price volatility across the United States. This rise in price volatility across the stock market has also reduced the trading activities by individuals and enterprise traders, thereby negatively impacting the trade surveillance market. However, the normalization of economy from the third quarter of 2020, also led to normalization in trading activities across the region. This is resulted in investment in cloud-based trade surveillance solutions to enable remote surveillance of trading activities. Thus, the outbreak of the pandemic is expected to have moderate impact on the trade surveillance market of the region over the years.

Strategic insights for the North America Trade Surveillance Systems provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 416.73 Million |

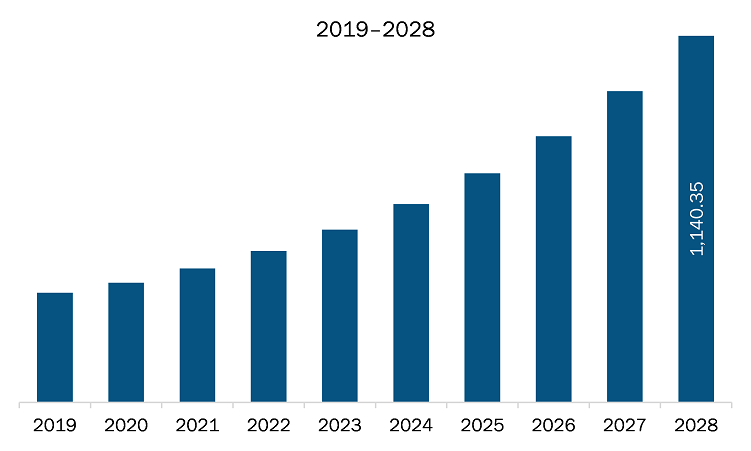

| Market Size by 2028 | US$ 1,140.35 Million |

| Global CAGR (2021 - 2028) | 15.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Trade Surveillance Systems refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The trade surveillance systems market in North America is expected to grow from US$ 416.73 million in 2021 to US$ 1,140.35 million by 2028; it is estimated to grow at a CAGR of 15.5% from 2021 to 2028. With the adoption of security trading across both developed and developing countries the rate of illegal activities inside the market is also increasing. Real-time monitoring and response to malicious activities can prevent huge losses of companies and the market. Trade surveillance is a perfect illustration of how regulatory requirements have grown and diversified, with enterprises having to monitor and report market abuse across more markets and jurisdictions than ever before, and at faster rates. To provide efficient surveillance services at low cost, trade surveillance market players are integrating technologies, such as artificial intelligence and machine learning, in the systems. For instance, company named Sybenetix, employs artificial intelligence and machine learning to support its trade monitoring and performance evaluation services. The company is credited with pioneering the development of behavioral analytics in the financial sector, merging data analytics with behavior profile algorithms to identify behaviors that may violate market abuse regulations for both buy- and sell-side firms. Similar technologies are used to monitor decision-making behavior to improve trade performance, particularly in investment management. Similarly, Alithya, an AI enables trade surveillance system changes the way compliance team operates in a security market. Thus, the implementation of technologies such as artificial intelligence and machine learning is expected to create lucrative opportunities for trade surveillance market players during the forecast period.

In terms of component, the solution segment accounted for the largest share of the North America trade surveillance systems market in 2020. Further, in term of solution, the risk and compliance segment held a larger market share of the trade surveillance systems market in 2020. Similarly, in terms of services, the professional services segment held a larger market share of the trade surveillance systems market in 2020. In terms of deployment, the on premise segment held a larger market share of the trade surveillance systems market in 2020. In terms of organization size, large enterprises segment held a larger market share of the trade surveillance systems market in 2020

A few major primary and secondary sources referred to for preparing this report on the trade surveillance systems market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are ACA Group; B-Next; OneMarketData LLC; SIA S.P.A.; CRISIL Limited; FIS Global; Nasdaq Inc; and Software AG among others.

The North America Trade Surveillance Systems Market is valued at US$ 416.73 Million in 2021, it is projected to reach US$ 1,140.35 Million by 2028.

As per our report North America Trade Surveillance Systems Market, the market size is valued at US$ 416.73 Million in 2021, projecting it to reach US$ 1,140.35 Million by 2028. This translates to a CAGR of approximately 15.5% during the forecast period.

The North America Trade Surveillance Systems Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Trade Surveillance Systems Market report:

The North America Trade Surveillance Systems Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Trade Surveillance Systems Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Trade Surveillance Systems Market value chain can benefit from the information contained in a comprehensive market report.