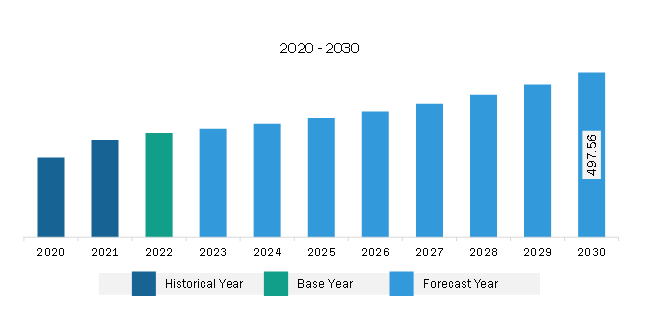

The North America third party logistics market was valued at US$ 315.07 billion in 2022 and is expected to reach US$ 497.56 billion by 2030; it is estimated to register a CAGR of 5.9% from 2022 to 2030.

Third-party logistics enterprises specialize in logistics, and their expertise in this field is always better than that of the core corporations. They can also meet technical needs. Furthermore, third-party logistics providers can aid in cutting inventory expenses and can strategize to lower a company's overall shipping and delivery costs. Many core companies may lack the time and competence to keep logistic services and systems up to date. During periods of rapid commercial expansion, the organization frequently faces difficulties in meeting product delivery deadlines.

Additionally, hiring third-party firms is more cost-effective than investing in one's logistic operations. According to a study conducted by NTT Data in 2022, over 65% of the total study respondents who use third-party logistics services admit that using third-party logistics has decreased logistic expenditures. Reduced logistic expenditure directly affected the overall profit of the shipping companies positively.

Besides, consumer preferences for delivery services have changed drastically in recent years. Consumers are opting for faster delivery and are willing to pay additional costs for the same. According to Omnitracs’ 2021 consumer behavior survey, 65% of buyers in the US are willing to spend more money to receive faster, more reliable delivery. As a result, the demand for reliable logistics services has increased exponentially.

Choosing a third-party logistics firm enables the company to devote its time and resources to areas of core competency and actual business. According to the survey conducted by Coyote Logistics, 56% of the total respondents opted for third-party logistics only to improve their business operation efficiency. Thus, the advantages above are anticipated to drive the market for third-party logistics.

North America is one of the notable regions in the global logistics industry. One of the significant factors for the market growth is the presence of global retail and e-commerce leaders, such as Walmart and Amazon. Exponential growth and initiatives like one-day delivery by Amazon have notably affected the North American 3PL industry. Another factor for the industry's growth is increased export activities to developing economies such as Indonesia, Thailand, and India. In 2021, US exports to Indonesia experienced a 28.2% increase, to reach US$ 9.5 billion, a US$ 2.1 billion increase in terms of value. Moreover, the US has secured the second position in exporting agricultural goods to Indonesia, with ~13% of the market share. Additionally, in 2022, US goods exports to India were $ 47.2 billion, up 17.9%, amounting to $7.2 billion from 2021 and 113% hike from 2012. Further, government initiatives, infrastructure development, and key player initiatives are some of the factors that support market growth. For instance, the US, Canada, and Mexico are collaborating on five different initiatives to improve the region's supply chain. These initiatives are mainly focusing on strengthening semiconductor supply chain and coordinating crisis management. In addition, XPO Logistics, one of the key providers, expanded its facility in two different states.

Strategic insights for the North America Third Party Logistics provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Third Party Logistics refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Third Party Logistics Strategic Insights

North America Third Party Logistics Report Scope

Report Attribute

Details

Market size in 2022

US$ 315.07 Billion

Market Size by 2030

US$ 497.56 Billion

Global CAGR (2022 - 2030)

5.9%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Mode of Transports

By Services

By End user

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Third Party Logistics Regional Insights

The North America third party logistics market is categorized into mode of transports, services, end user, and country.

Based on mode of transports, the North America third party logistics market is segmented into roadways, railways, waterways, and airways. The roadways segment held the largest market share in 2022.

In terms of services, the North America third party logistics market is segmented into international transportation, warehousing, domestic transportation, inventory management, and others. The others segment held the largest market share in 2022.

Based on end user, the North America third party logistics market is segmented into automotive, healthcare, retail, consumer goods, and others. The others segment held the largest market share in 2022.

By country, the North America third party logistics market is segmented into the US, Canada, and Mexico. The US dominated the North America third party logistics market share in 2022.

C H Robinson Worldwide Inc, DB Schenker, DSV AS, GEODIS SA, Kuehne + Nagel International AG, Nippon Express Co Ltd, Sinotrans Ltd, United Parcel Service Inc, and XPO Inc are among the leading companies operating in the North America third party logistics market.

The North America Third Party Logistics Market is valued at US$ 315.07 Billion in 2022, it is projected to reach US$ 497.56 Billion by 2030.

As per our report North America Third Party Logistics Market, the market size is valued at US$ 315.07 Billion in 2022, projecting it to reach US$ 497.56 Billion by 2030. This translates to a CAGR of approximately 5.9% during the forecast period.

The North America Third Party Logistics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Third Party Logistics Market report:

The North America Third Party Logistics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Third Party Logistics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Third Party Logistics Market value chain can benefit from the information contained in a comprehensive market report.