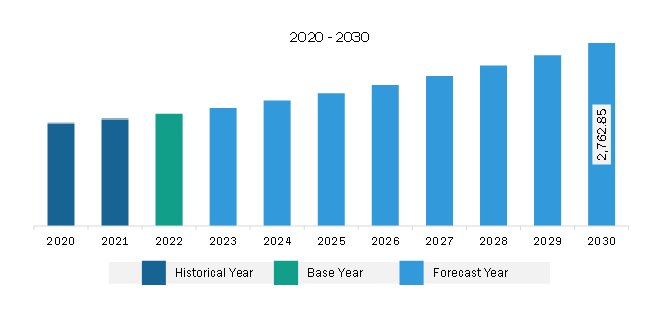

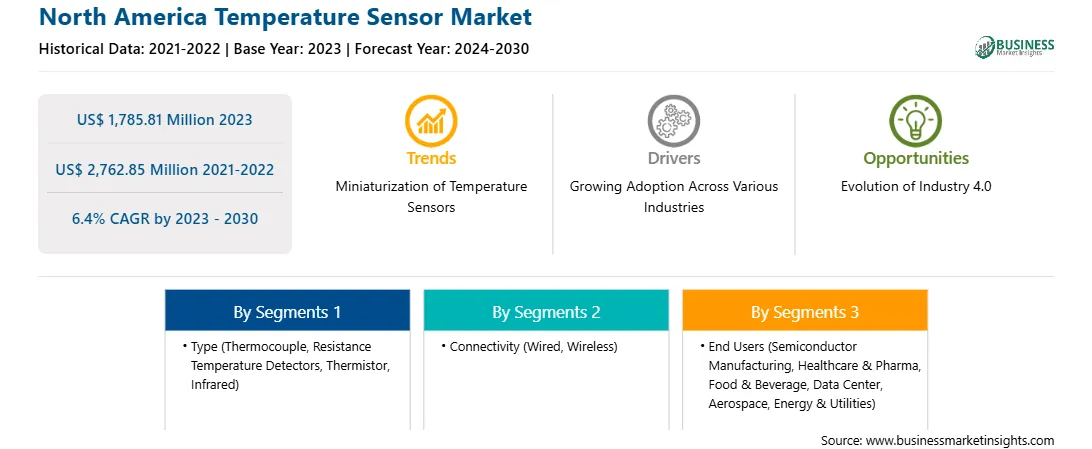

The North America temperature sensor market was valued at US$ 1,785.81 million in 2023 and is expected to reach US$ 2,762.85 million by 2030; it is estimated to register a CAGR of 6.4% from 2023 to 2030.

Miniaturized devices play a crucial role in monitoring and controlling temperature in a wide range of applications such as medical, wearables, diagnostics, and automotive. Advancements in microelectromechanical systems (MEMS) and nanotechnology have enabled the development of smaller and more precise temperature sensors. These technologies allow seamless integration of temperature-sensing capabilities into smaller devices without hampering accuracy and reliability. Furthermore, market players are highly adopting advanced technologies and entering partnerships to meet industry-specific requirements. For instance, in May 2022, Heraeus Holding collaborated with accensors GmbH to jointly develop solutions that support the miniaturization trend. The companies are planning to integrate miniaturized temperature sensors into film sensors to increase measurement accuracy. Moreover, the emergence of numerous other industries, including agriculture and environment monitoring, has surged the demand for miniaturized temperature sensors for monitoring soil conditions and climate change indicators. Thus, the rising demand for miniaturized temperature sensors is projected to drive the market soon.

The data center industry in North America has witnessed continued demand and growth in recent years. This growth in the data center industry in North America was majorly attributed to the substantial rise in demand from cloud providers. In the US, Texas, North California, and certain areas of San Antonio registered relatively higher cloud activity. However, the overall absorption and demand for data centers in the US and other prominent countries is growing. Various companies are launching new data centers in the region. For instance, in April 2023, Equinix announced plans to construct a new data center in Montreal, Canada. Also, in November 2023, Vertiv introduced Vertiv SmartMod Max CW, a prefabricated modular data center designed to address the growing demand for rapid deployment of computing. Temperature sensors continuously monitor the ambient temperature in different areas of the data center. Thus, with the increasing data centers, the demand for temperature sensors is also growing in the region.

The automotive industry in the region is growing significantly, boosting the demand for temperature sensors. The governments in the region are increasing their investments to boost their automotive manufacturing industry. In January 2021, the US President announced the plan to strengthen the US manufacturing sector under the "Made in America" initiative, which focused on making the manufacturing sector technologically advanced and automated. He announced an investment of US$ 300 billion for the R&D and inclusion of advanced technologies to boost the country's production output, focusing on electric vehicle production. To meet the growing demand for temperature sensors in electric vehicles, various companies are launching new temperature sensors for the automotive industry in the region. For instance, in October 2023, in an ongoing effort to expand its product offering for the North American automotive aftermarket, AISIN introduced its OES Engine Coolant Temperature Sensors. The new products were unveiled at the 2023 AAPEX Show in Las Vegas. Thus, the temperature sensor market is growing significantly in North America.

Strategic insights for the North America Temperature Sensor provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Temperature Sensor refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Temperature Sensor Strategic Insights

North America Temperature Sensor Report Scope

Report Attribute

Details

Market size in 2023

US$ 1,785.81 Million

Market Size by 2030

US$ 2,762.85 Million

Global CAGR (2023 - 2030)

6.4%

Historical Data

2021-2022

Forecast period

2024-2030

Segments Covered

By Type

By Connectivity

By End Users

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Temperature Sensor Regional Insights

The North America temperature sensor market is categorized into type, connectivity, end user, and country.

Based on type, the North America temperature sensor market is segmented into thermocouple, resistance temperature detectors (RTD), thermistor, infrared, and others. The thermocouple segment held the largest share of North America temperature sensor market share in 2023.

In terms of connectivity, the North America temperature sensor market is bifurcated into wired and wireless. The wired segment held a larger share of North America temperature sensor market in 2023.

By end users, the North America temperature sensor market is segmented into semiconductor manufacturing, healthcare & pharma, food and beverage, data center, aerospace, energy & utilities, and others. The semiconductor manufacturing segment held the largest share of North America temperature sensor market in 2023.

By country, the North America temperature sensor market is segmented into the US, Canada, and Mexico. The US dominated the North America temperature sensor market share in 2023.

Texas Instruments Inc.; Siemens Ltd.; TE Connectivity Ltd.; Amphenol LTW Ltd.; Analog Devices Inc.; Emerson Electric Co.; Microchip Technology Inc.; Panasonic Corporation; Honeywell International, Inc.; and NXP Semiconductors N.V are some of the leading companies operating in the North America temperature sensor market.

The North America Temperature Sensor Market is valued at US$ 1,785.81 Million in 2023, it is projected to reach US$ 2,762.85 Million by 2030.

As per our report North America Temperature Sensor Market, the market size is valued at US$ 1,785.81 Million in 2023, projecting it to reach US$ 2,762.85 Million by 2030. This translates to a CAGR of approximately 6.4% during the forecast period.

The North America Temperature Sensor Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Temperature Sensor Market report:

The North America Temperature Sensor Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Temperature Sensor Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Temperature Sensor Market value chain can benefit from the information contained in a comprehensive market report.