The North America Telemedicine market is divided into the US, Canada, and Mexico. North America captured the most significant share in the global market. The growth of the market is driven by factors such as rising adoption of Telemedicine in the US, rising public health awareness, increasing strategic activities by the government, and presence of leading players. In the United States, 76% of hospitals connect with patients using some form of telemedicine. With increasing need for a multidisciplinary approach to care and patient-provider partnerships, telemedicine has helped strengthen connections between patients, health care providers, and other stakeholders. In the face of the COVID-19 pandemic, the relevance of telemedicine has become even more acute. Use of telemedicine has been rapidly promoted, and laws on its coverage are rapidly changing. Though the use of telemedicine in the U.S. has been minimal prior to COVID-19, interest in and implementation of telemedicine has expanded rapidly during the crisis, as policymakers, insurers and health systems have looked for ways to deliver care to patients in their homes to limit transmission of the novel coronavirus. With growing demand for telemedicine, several changes have been made to telehealth policy, coverage and implementation, in order to make telemedicine more widely accessible during this state of emergency. Many states in the US are also mandating fully insured private plans to cover and reimburse for telemedicine services equally. Meanwhile, many commercial insurers have voluntarily addressed telemedicine in their response to COVID-19, focusing on reducing or eliminating cost sharing, broadening coverage of telemedicine and expanding in-network telemedicine providers. Health systems have rapidly adapted to implement new telehealth programs or ramp up existing ones.

The COVID-19 pandemic has resulted in a significant increase in the reliance on telemedicine and telehealth for the provision of health care services. COVID-19 has caused a massive acceleration in the use of telehealth. Consumer adoption has skyrocketed, from 11 percent of US consumers using telehealth in 2019 to 46 percent of consumers now using telehealth to replace canceled healthcare visits. For instance, according to a report published by the US National Library of Medicine, National Institutes of Health in November 2020, "as Coronavirus continues to spread, many hospitals and physician practices have transitioned to telemedicine to conduct nonessential appointments. A study of NYU Langone Health trends (New York, NY, USA) showed a decline of 80% in in-person visits and a 683% increase in telemedicine visits between March 2 and April 14, 2020. As the number of COVID-19–infected patients increase, using computers and tablets for telemedicine can also reduce staff exposure in ambulances and hospitals. It is expected that demand for these services will increase dramatically in the US over the next few months, with shares of one telehealth provider, Teladoc Health Inc., increasing almost 50% since the start of 2020. Hospitals and health systems are already encouraging people with suspected COVID-19 symptoms to use telehealth services to limit people's flow to already crowded emergency rooms and doctor surgeries. Therefore, the growing demand for telemedicine during COVID-19 in North America is likely to boost the growth of the telemedicine market.

Strategic insights for the North America Telemedicine provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

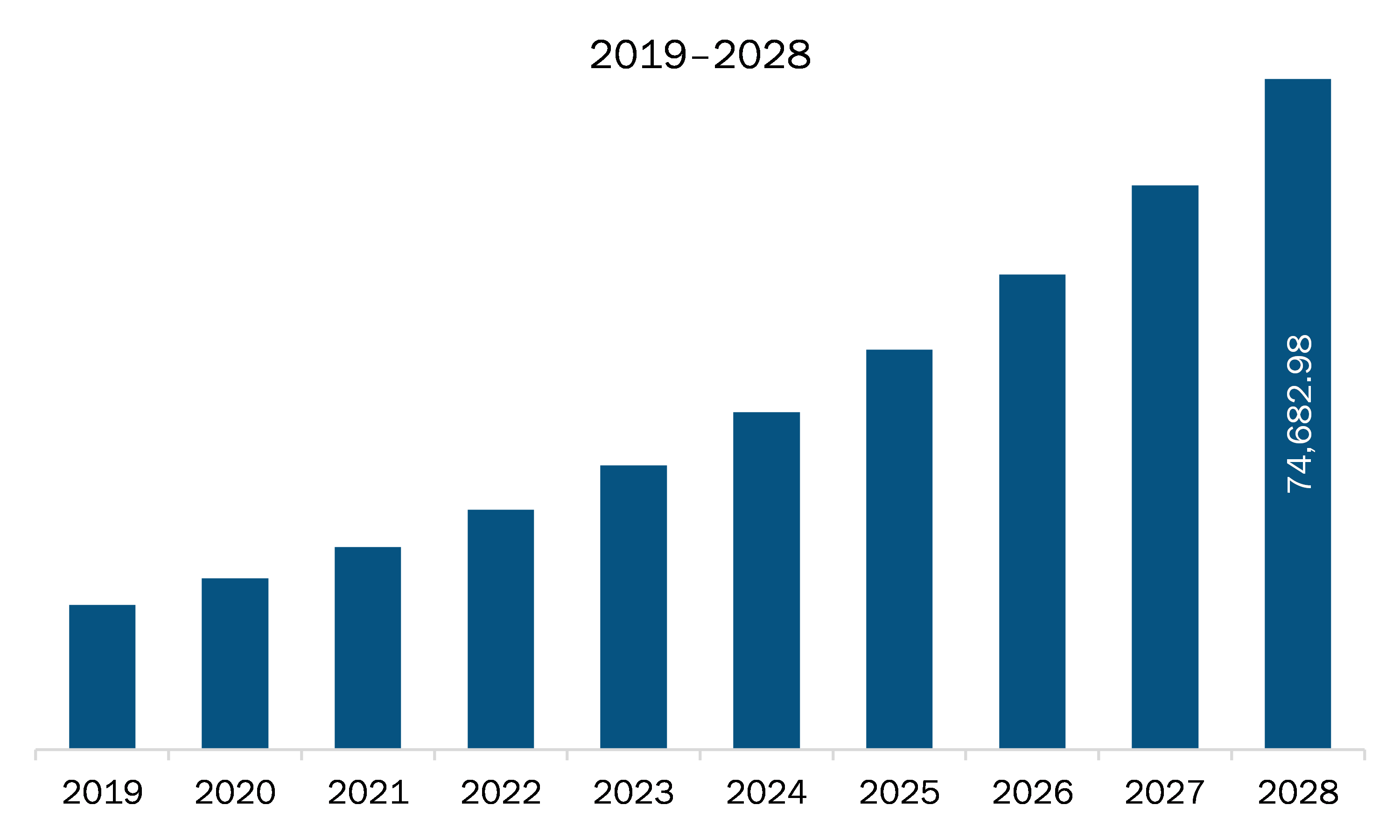

| Market size in 2021 | US$ 22,556.58 Million |

| Market Size by 2028 | US$ 74,682.98 Million |

| Global CAGR (2021 - 2028) | 18.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Telemedicine refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The telemedicine market in North America is expected to grow from US$ 22,556.58 million in 2021 to US$ 74,682.98 million by 2028; it is estimated to grow at a CAGR of 18.7% from 2021 to 2028. Social distancing is one of the major strategies adopted by various countries to contain the spread of COVID-19 infection. Among such circumstances, telemedicine is proving key expertise to get health consultations. Increasing number of people are opting for virtual visits for health check-ups. For instance, in March 2020, Teladoc, one of the leading companies offering virtual care, announced that it received ~15,000 virtual visit requests in a single day. High number of patients requesting virtual visits and increasing influence of self-quarantine and social distancing. Telehealth has emerged as an essential component of healthcare amid the COVID-19 pandemic. According to a research article published in the JCO North America Oncology-An American Society of Clinical Oncology Journal, 2020, physical distancing norms imposed to minimize the spread of the SARS-CoV-2 disease resulted in the adoption of most of the outpatient oncology appointments to telemedicine. Although the telemedicine services were integrated into the healthcare systems of many countries before the onset of the pandemic, the adoption of services increased extensively only during the COVID-19 crisis, which is majorly attributed to the conditions that are non-suitable for in-person visits as well as to limitations and restrictions on travel, which encouraged clinicians to adapt to telemedicine-based consultations. Technologies such as telemedicine, and chatbots and robots are being deployed to help gather information, reassure the population, treat patients, make diagnoses, and schedule patients checking.

North America telemedicine market is segmented into type, product and services, specialty, delivery mode, and country. North America telemedicine market, based on the product and services is segmented into software and hardware, tele-consulting, tele-monitoring, and tele-education/training. In 2020, the software and hardware segment held the largest share of the market. North America telemedicine market, based on the type was segmented into telehospital, and telehome. In 2020, the telehospital segment held the largest share of the market. North America telemedicine market, based on the specialty was segmented into cardiology, gynecology, orthopedics, neurology mental health (psychiatry) and others. In 2020, the others segment held considerable share of the market. North America telemedicine market, based on the delivery mode was segmented into mobile, web, and call centers. In 2020, the mobile segment held the largest share of the market. Based on country, the North America telemedicine market is segmented into US, Canada, and Mexico. US held the largest market share in 2020.

A few major primary and secondary sources referred to for preparing this report on the telemedicine market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Allscripts Healthcare Solutions, Inc.

The North America Telemedicine Market is valued at US$ 22,556.58 Million in 2021, it is projected to reach US$ 74,682.98 Million by 2028.

As per our report North America Telemedicine Market, the market size is valued at US$ 22,556.58 Million in 2021, projecting it to reach US$ 74,682.98 Million by 2028. This translates to a CAGR of approximately 18.7% during the forecast period.

The North America Telemedicine Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Telemedicine Market report:

The North America Telemedicine Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Telemedicine Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Telemedicine Market value chain can benefit from the information contained in a comprehensive market report.