North America Tea Extracts Market

No. of Pages: 148 | Report Code: BMIRE00031070 | Category: Consumer Goods

No. of Pages: 148 | Report Code: BMIRE00031070 | Category: Consumer Goods

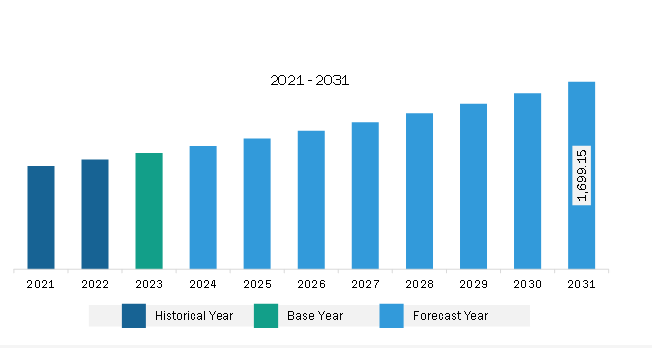

The North America tea extracts market was valued at US$ 1,055.04 million in 2023 and is expected to reach US$ 1,699.15 million by 2031; it is estimated to register a CAGR of 6.1% from 2023 to 2031.

Consumers are becoming aware of the adverse effects of consuming food and beverages with synthetic ingredients. Due to growing concerns about ingredient safety and potential health consequences, natural food additives are being increasingly used in various types of food and beverages. Several health organizations and food safety associations prohibit the use of various artificial flavorings in food and beverages. For instance, the US Food and Drug Administration (FDA) banned seven artificial flavors that have been associated with cancer on October 5, 2018. The FDA had advised using naturally extracted additives available in different flavors as they are a safer option. The FDA prohibited eight artificial flavorings that were included in ice cream, baked goods, confectionery, and beverages. These ingredients used as flavorings have been known to cause cancer in humans.

Consumers increasingly prefer food and beverages that are free of synthetic flavors, colors, and other food additives. Herbal and naturally made products are becoming increasingly popular, owing to their perceived health benefits. Products that are free of artificial ingredients are included in the diets of many consumers, and they are willing to pay high prices for these ingredients. Further, consumers are focusing on holistic and conscious consumption of food and prefer products with ethically sourced ingredients. Tea extracts are widely used as antimicrobials, antioxidant agents, and shelf-life-extending agents in food and beverages to prevent major digestive and chronic diseases. Similarly, green tea extract, with its rich antioxidant content, is particularly favored in yogurt and drinkable dairy products, where it enhances the health profile by adding polyphenols known for their potential benefits in boosting metabolism and supporting overall wellness. Owing to increased applications in the food and beverages industry, manufacturers are significantly launching tea extracts. For instance, in November 2022, Layn Natural Ingredients, a manufacturer of botanical extract ingredients, added an instant tea extract powder line to its portfolio of tea extracts. This extract is suitable for instant tea and ready-to-drink products. Thus, the rising demand for natural ingredients in food and beverages drives the tea extracts market.

Tea extracts derived from various types of tea, such as green, black, and oolong, are valued for their rich antioxidant and bioactive compound content. The increasing consumer interest in health and wellness trends drives the US tea extracts market. The growing demand is driven by the rising popularity of natural, clean-label ingredients across food and beverages, dietary supplements, and cosmetics industries. The key manufacturers in the market are innovating and introducing products with natural ingredients to cater to the diverse demands of consumers. For instance, in May 2024, Pretty Tea Inc launched Pretty Tasty Collagen Tea—a line of functional beverages containing black tea extract, collagen peptide, juice concentrates, and stevia for joint, skin, and hair health—with flavors such as peach and raspberry. Also, in November 2023, Gen Z Skin Care Brand introduced its first eye cream, containing vitamin C, resveratrol, turmeric, and green tea extract.

Strategic insights for the North America Tea Extracts provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Tea Extracts refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Tea Extracts Strategic Insights

North America Tea Extracts Report Scope

Report Attribute

Details

Market size in 2023

US$ 1,055.04 Million

Market Size by 2031

US$ 1,699.15 Million

Global CAGR (2023 - 2031)

6.1%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Type

By Category

By Form

By Application

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Tea Extracts Regional Insights

The North America tea extracts market is categorized into type, form, application, and country.

Based on type, the North America tea extracts market is segmented into green tea, black tea, oolong tea, and others. The green tea segment held the largest market share in 2023.

In terms of form, the North America tea extracts market is bifurcated into powder and liquid. The powder segment held a larger market share in 2023.

By application, the North America tea extracts market is segmented into food and beverages, bakery and confectionery, dairy and frozen dessert, beverages, other food and beverages, dietary supplements, personal care and cosmetics, and others. The food and beverages segment held the largest market share in 2023.

By category, the North America tea extracts market is bifurcated into conventional and organic. The conventional segment held a larger market share in 2023.

By country, the North America tea extracts market is segmented into the US, Canada, and Mexico. The US dominated the North America tea extracts market share in 2023.

Finlays, Botanic Healthcare Group, Martin Bauer GmbH & Co KG, Firmenich International SA, Givaudan SA, International Flavors & Fragrances Inc, Kerry Group Plc, Archer Daniels Midland Company, Sensient Technologies Corp, Kemin Industries Inc, Medikonda Nutrients, Virginia Dare Extract Co Inc, Lipoid-Kosmetik, Florida Food Products, and Dohler GmbH are among the leading companies operating in the North America tea extracts market.

The North America Tea Extracts Market is valued at US$ 1,055.04 Million in 2023, it is projected to reach US$ 1,699.15 Million by 2031.

As per our report North America Tea Extracts Market, the market size is valued at US$ 1,055.04 Million in 2023, projecting it to reach US$ 1,699.15 Million by 2031. This translates to a CAGR of approximately 6.1% during the forecast period.

The North America Tea Extracts Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Tea Extracts Market report:

The North America Tea Extracts Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Tea Extracts Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Tea Extracts Market value chain can benefit from the information contained in a comprehensive market report.