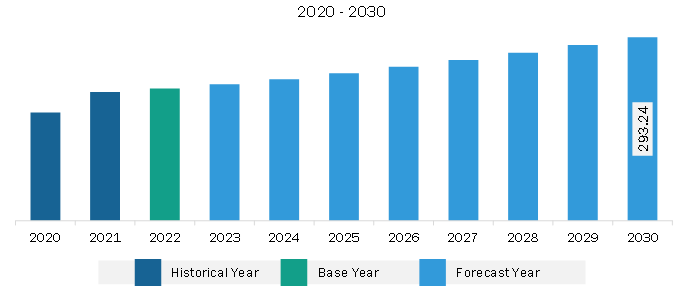

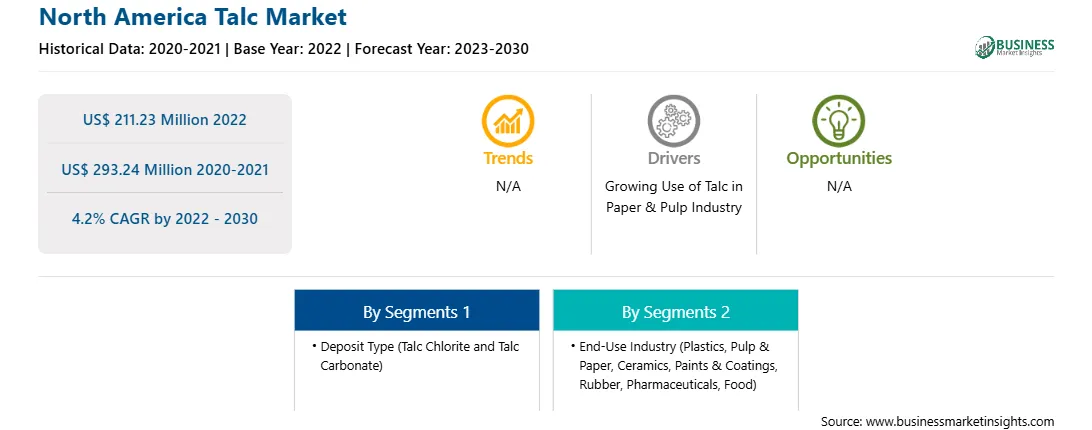

The North America talc market is expected to grow from US$ 211.23 million in 2022 to US$ 293.24 million by 2030. It is estimated to grow at a CAGR of 4.2% from 2022 to 2030.

As per data by the Organisation Internationale des Constructeurs d'Automobiles (OICA), the global car and vehicle production reached over 85 million in 2022, indicating a 6% increase from the previous year. Countries in North America recorded production of over 13.4 million commercial and passenger vehicles in 2021, which increased by 10% rate and registered production of around 14.7 million in 2022. Numerous companies operating in the automotive market are investing heavily in automobile manufacturing to increase production and sales. Further, in January 2021, the US President announced the plan to strengthen the US manufacturing sector under the “Made in America” initiative, which focused on making the manufacturing sector technologically advanced and automated. He announced an investment of US$ 300 billion for the R&D and inclusion of advanced technologies to boost the country's production output, focusing on electric vehicle production. In September 2022, the President announced the plan to achieve a target of electric vehicles accounting for a 50% share of the total vehicles sold by 2030. To meet the target, companies such as Honda, Toyota, General Motors, Ford Motor Company, and Panasonic announced investments in manufacturing in North Carolina, Missouri, Michigan, Kansas, Ohio, and elsewhere. Growing initiatives by the government and rising investments in the manufacturing of electric vehicles are generating the demand for automotive seats and fueling the automotive seat market in North America. Plastics have improved the performance, structure, and safety of automobiles. Plastic use helps reduce the weight of vehicle parts, which increases fuel efficiency and lowers greenhouse gas emissions. Spurred by rigorous regulations, especially regarding fuel efficiency, plastics are key material in manufacturing and designing automotive vehicles. Materials such as polypropylene (PP) and other engineering thermoplastics are extensively used for automotive interiors, exteriors, and under-the-hood applications and replacing the usage of metal parts. Talc is added to polypropylene to enhance its performance and durability. Vehicle’s interior parts such as instrument panels, door panels, pillar covers, seat backs, consoles, and headliners are commonly made of talc-filled polypropylene. Thus, the increasing investments by major automobile manufacturers and surging production of automotive vehicles would propel the demand for automotive plastics, which is expected to boost the talc market growth during the forecast period.

The US, Canada, and Mexico are the key economies in North America. Plastics, paints & coatings, ceramics, pharmaceuticals, rubber, food, and packaging are the major end use industries driving the talc market in North America. According to the Government of Canada, North America produces goods and services valued at more than US$ 23 trillion every year. Furthermore, the construction sector in North America is rapidly developing due to a robust economy and increased federal and state financing for public works and institutional structures. Rapid development and urbanization are also driving the demand for ceramics and paints and coatings in North America. North America's construction industry is a major contributor to the region's economy. According to the Associated General Contractors of America (AGC), the US construction industry annually creates US$ 1.4 trillion worth of structures. The rise in construction activities owing to the increasing population and rapidly growing commercial sector across the region is driving the construction sector in North America. These factors are propelling the growth of the talc market in North America. The US, Canada, and Mexico are the key economies in North America. Many domestic and international corporations, such as Imerys SA and IMI FABI, have a substantial presence in North America. Manufacturers in the area are investing heavily in talc research and development, mining, milling technologies, and product development, fuelling the market growth.

Strategic insights for the North America Talc provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Talc refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Talc Strategic Insights

North America Talc Report Scope

Report Attribute

Details

Market size in 2022

US$ 211.23 Million

Market Size by 2030

US$ 293.24 Million

Global CAGR (2022 - 2030)

4.2%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Deposit Type

By End-Use Industry

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Talc Regional Insights

The North America talc market is segmented into type, application, and country.

Based on type, the North America talc market is bifurcated into talc chlorite and talc carbonate. The talc carbonate segment held a larger share of the North America talc market in 2022.

In terms of application, the North America talc market is segmented into plastics, pulp and paper, ceramics, paints and coatings, rubber, pharmaceuticals, food, and others. The ceramics segment held the largest share of the North America talc market in 2022.

Based on country, the North America talc market is segmented into the US, Canada, and Mexico. The US dominated the North America talc market in 2022.

Elementis Plc, Golcha Minerals Pvt Ltd, Imerys SA, Liaoning Aihai Talc Co Ltd, Minerals Technologies Inc, and SCR-Sibelco NV are some of the leading companies operating in the North America talc market.

The North America Talc Market is valued at US$ 211.23 Million in 2022, it is projected to reach US$ 293.24 Million by 2030.

As per our report North America Talc Market, the market size is valued at US$ 211.23 Million in 2022, projecting it to reach US$ 293.24 Million by 2030. This translates to a CAGR of approximately 4.2% during the forecast period.

The North America Talc Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Talc Market report:

The North America Talc Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Talc Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Talc Market value chain can benefit from the information contained in a comprehensive market report.