Targeted treatment, faster and more efficient recovery, and reduced side effects are among the advantages of cell therapy. Globally, cell therapies are widely adopted owing to the availability FDA approved products. Following is the list of T-cell therapy products approved by FDA in recent years:

• For instance, in June 2022, Bristol Myers Squibb received FDA approval for Breyanzi (lisocabtagene maraleucel), a CD19-directed chimeric antigen receptor (CAR) T-cell therapy, for the treatment of adult patients with large B-cell lymphoma (LBCL).

• In February 2022, the US Food and Drug Administration (FDA) approved Yescarta (axicabtagene ciloleucel) CAR T-cell therapy for adult patients with large B-cell lymphoma that is refractory to first line chemoimmunotherapy or that relapses within 12 months of first line chemoimmunotherapy. Yescarta is the first CAR T-cell therapy to receive a National Comprehensive Cancer Network (NCCN) Category 1 recommendation.

• In February 2022, the FDA approved ciltacabtagene autoleucel (brand name CARVYKTI) for treating adult patients with relapsed or refractory multiple myeloma after four or more prior lines of therapy, including a proteasome inhibitor, an immunomodulatory agent, and an anti-CD38 monoclonal antibody.

• In January 2022, the FDA approved Kimmtrak (tebentafusp-tebn) for treating unresectable or metastatic uveal melanoma patients who are HLA-A*02:01 positive.

• In March 2021, Abecma (idecabtagene vicleucel) was approved by the FDA for treating relapsed or refractory multiple myeloma. The treatment is a B-cell maturation antigen (BCMA)-directed genetically modified autologous T-cell immunotherapy indicated for treating adult patients with refractory multiple myeloma.

Therefore, the increasing number of approvals for T-cell therapies is fueling the North America T cell therapy market growth.

The T-cell therapy market in North America is segmented into the US, Canada, and Mexico. In 2022, the US held the largest market share in this region and is expected to continue its dominance during the forecast period due to the increasing burden of chronic disorders such as cancer and autoimmune disorders, growth in research and development activities, and strong and established market players. Also, with an increase in clinical studies in CAR T-cell therapies, the market in North America is expected to grow during the forecast period. According to CDC, 1,603,844 new cancer cases were reported and 602,347 people died in the US in 2020. An estimated 184,720 people in the US will be diagnosed with leukemia, lymphoma, or myeloma in 2023.

Tisagenlecleucel (KymriahTM, Novartis, Morris Plains, NJ, US) and axicabtagene ciloleucel (YescartaTM, Gilead Sciences Canada, El Segundo, CA, US) were the first two CAR T-cells commercially available and approved in Canada by Health Canada in 2018 and 2019, respectively. Both are second-generation anti-CD19 CAR T-cells, approved for adult patients with r/r DLBCL, primary mediastinal B-cell lymphoma, and transformed follicular lymphoma. Moreover, Canadian-Led Immunotherapies in Cancer-01 (CLIC-01) is the first to introduce CAR T-cell therapy in Canada. It uses a different kind of cell manufacturing that unveils less expensive and more equitable treatment. The Queen Elizabeth II Health Sciences Centre in Halifax became the first facility in Atlantic Canada to offer CAR T-cell therapy locally as of March 2022. Prior to this, Nova Scotia patients who were recommended for this highly personalized cancer medicine had to travel outside the country to receive the treatment. The program was made possible with a government investment of US$ 6.7 million annually. Thus, the rising cancer cases and initiative by the government fuel the T-cell therapy market in North America.

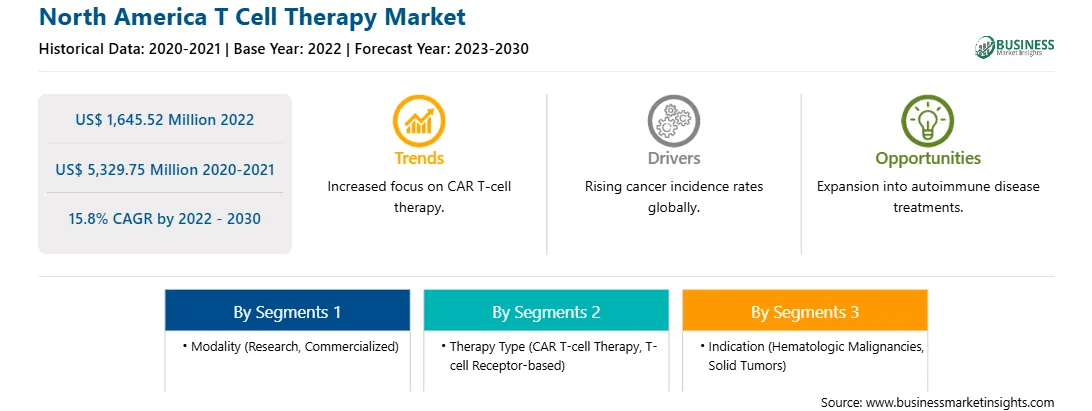

The North America T cell therapy market is segmented into modality, therapy type, indication, and country.

Based on modality, the North America T cell therapy market is bifurcated into research and commercialized. The commercialized segment held a larger market share in 2022.

Based on therapy type, the North America T cell therapy market is divided into CAR T-cell therapy and T-cell Receptor (TCR)-based. The CAR T-cell therapy segment held a larger market share in 2022.

Based on indication, the North America T cell therapy market is bifurcated into hematologic malignancies and solid tumors. The hematologic malignancies segment held the largest market share in 2022.

Based on country, the North America T cell therapy market is segmented into the US, Canada, and Mexico. The US dominated the North America T cell therapy market share in 2022.

Bluebird Bio Inc, Bristol-Myers Squibb Co, Cartesian Therapeutics Inc, Gilead Sciences Inc, Innovent Biologics Inc, Janssen Global Services LLC, and Novartis AG are some of the leading companies operating in the North America T cell therapy market.

Strategic insights for the North America T Cell Therapy provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,645.52 Million |

| Market Size by 2030 | US$ 5,329.75 Million |

| Global CAGR (2022 - 2030) | 15.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Modality

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America T Cell Therapy refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

1. Bluebird Bio Inc

2. Bristol-Myers Squibb Co

3. Cartesian Therapeutics Inc

4. Gilead Sciences Inc

5. Innovent Biologics Inc

6. Janssen Global Services LLC

7. Novartis AG

The North America T Cell Therapy Market is valued at US$ 1,645.52 Million in 2022, it is projected to reach US$ 5,329.75 Million by 2030.

As per our report North America T Cell Therapy Market, the market size is valued at US$ 1,645.52 Million in 2022, projecting it to reach US$ 5,329.75 Million by 2030. This translates to a CAGR of approximately 15.8% during the forecast period.

The North America T Cell Therapy Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America T Cell Therapy Market report:

The North America T Cell Therapy Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America T Cell Therapy Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America T Cell Therapy Market value chain can benefit from the information contained in a comprehensive market report.