A significant rise in the number of surgical procedures performed at hospitals has compelled medical device manufacturers to develop and launch new products and obtain regulatory approvals for them. Major companies in the surgical stapling devices market allocate significant resources to research and development activities to come up with new offerings. For instance, In October 2022, Teleflex Incorporated completed the acquisition of Standard Bariatrics, Inc., which has commercialized an innovative powered stapling technology for bariatric surgery. Teleflex acquired Standard Bariatrics for US$ 170 million at closing, with additional consideration of up to US$ 130 million that is payable upon achieving certain commercial milestones. Similarly, in June 2022, Ethicon, a part of Johnson & Johnson MedTech, launched ECHELON 3000 Stapler in the US. It is a digitally enabled device that provides surgeons with simple, one-handed powered articulation to help address the unique needs of their patients. Designed with a 39% greater jaw aperture and a 27% larger articulation span, ECHELON 3000 gives surgeons better access and control over each transection, even in tight spaces and on challenging tissue. Combined with software that provides real-time haptic and audible device feedback, these features enable surgeons to make critical adjustments during procedures. An increase in the number of developments and launches of such innovative products, along with business acquisitions and collaborations, boosts the growth of the North America surgical stapling devices market.

The North America surgical stapling devices market is segmented into the US, Canada, and Mexico. The US is expected to be the largest contributor to the market in this region. The market growth in North America is ascribed to the growing geriatric population, favorable healthcare reforms, and surgical procedures performed in large numbers every year. According to the Journal of Thoracic Disease, ~530,000 general thoracic surgeries are performed yearly in the US by ~4,000 cardiothoracic surgeons. According to the American Joint Replacement Registry (AJRR), it is estimated that ~3.48 million people would require knee replacement by 2030. The estimates are calculated by considering the baby boomers reaching old age in the US. Total joint replacement (TJR) is one of the most performed elective surgeries in the US. According to a new study presented at the 2018 Annual Meeting of the American Academy of Orthopedic Surgeons (AAOS), the number of primary total hip replacement (THR) procedures is projected to grow by 171% by 2030, while the primary total knee replacement (TKR) procedures would increase by ~189%, reaching the count of 635,000 and 1.28 million procedures, respectively. A surge in demand for advanced surgical methods and tools such as biocompatible staples with better leakage protection in different types of surgeries favors the growth of the surgical stapling devices market in the US.

Strategic insights for the North America Surgical Stapling Devices provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Surgical Stapling Devices refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.North America Surgical Stapling Devices Strategic Insights

North America Surgical Stapling Devices Report Scope

Report Attribute

Details

Market size in 2022

US$ 1,962.94 Million

Market Size by 2028

US$ 3,208.08 Million

Global CAGR (2022 - 2028)

8.5%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Product

By Type

By Application

By End User

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Surgical Stapling Devices Regional Insights

North America Surgical Stapling Devices Market Segmentation

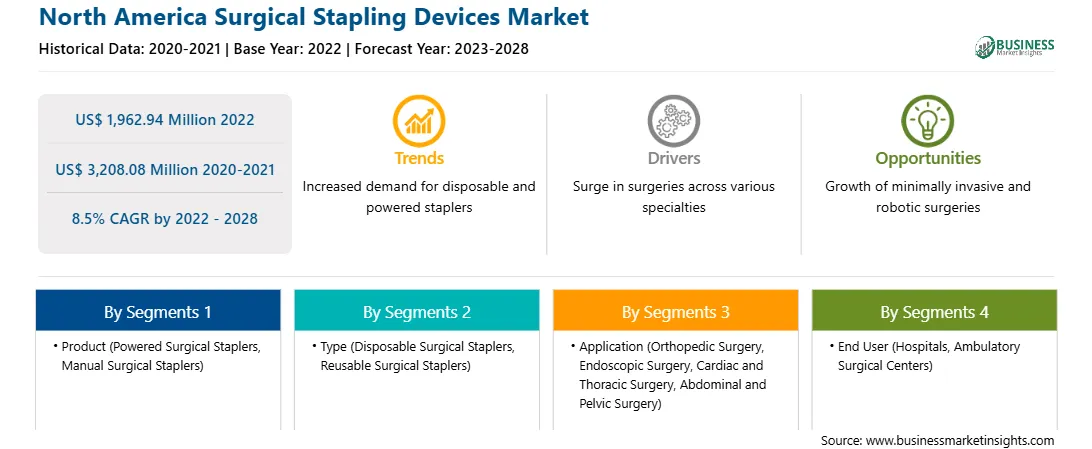

The North America surgical stapling devices market is segmented on the basis of product, type, application, end user, and country. Based on product, the market is segmented into powered surgical staplers and manual surgical staplers. The powered surgical staplers segment held a larger market share in 2022.

Based on type, the North America surgical stapling devices market is segmented into disposable surgical staplers and reusable surgical staplers. The disposable surgical staple segment accounted for a larger market share in 2022.

Based on application, the North America surgical stapling devices market is segmented into orthopedic surgery, endoscopic surgery, cardiac and thoracic surgery, abdominal and pelvic surgery, and others. The orthopedic surgery segment registered the largest market share in 2022.

Based on end user, the North America surgical stapling devices market is segmented into hospitals and ambulatory surgical centers. The hospitals segment accounted for a larger market share in 2022.

Based on country, the North America surgical stapling devices market is segmented into the US, Canada, and Mexico. The US dominated the market in this region in 2022.

3M Co, B. Braun SE, Conmed Corp, Ethicon USA LLC, Intutive Surgical Inc, and Medtronic Plc are the leading companies operating in the North America surgical stapling devices market.

1. 3M Co

2. B. Braun SE

3. Conmed Corp

4. Ethicon USA LLC

5. Intutive Surgical Inc

6. Medtronic Plc

The North America Surgical Stapling Devices Market is valued at US$ 1,962.94 Million in 2022, it is projected to reach US$ 3,208.08 Million by 2028.

As per our report North America Surgical Stapling Devices Market, the market size is valued at US$ 1,962.94 Million in 2022, projecting it to reach US$ 3,208.08 Million by 2028. This translates to a CAGR of approximately 8.5% during the forecast period.

The North America Surgical Stapling Devices Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Surgical Stapling Devices Market report:

The North America Surgical Stapling Devices Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Surgical Stapling Devices Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Surgical Stapling Devices Market value chain can benefit from the information contained in a comprehensive market report.