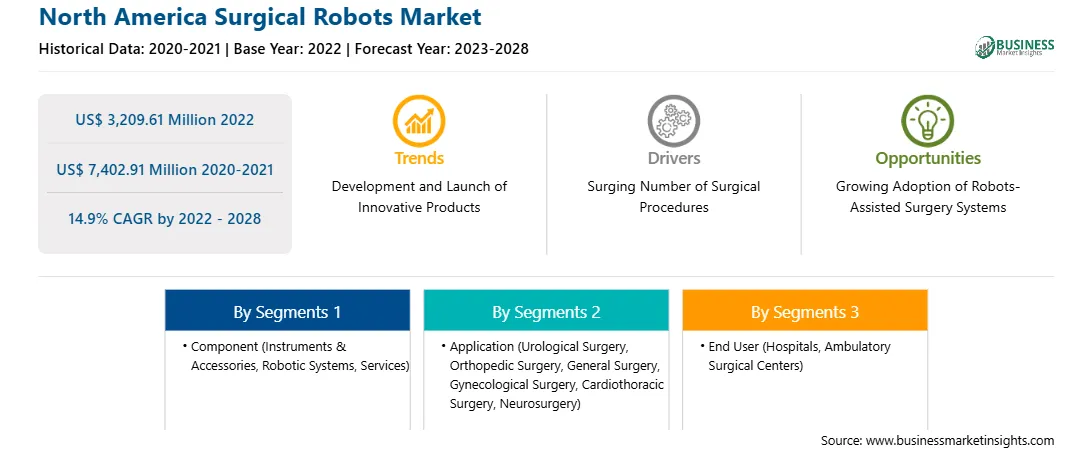

Growing Adoption of Robots-Assisted Surgery Systems to Offer Ample Opportunities for North America Surgical Robots Market during 2022–2028

The increasing incidence of chronic diseases, gynecological diseases, orthopedic diseases, urological diseases, neurological diseases, cardiothoracic diseases, etc. would generate the demand for robots-assisted surgery systems, owing to their several advantages such as the facilitation of precise, tremor-free surgeries and benefits of minimally invasive methods. The adoption of robotic telesurgery is increasing owing to the rising incidence of cholecystectomy, which is creating growth opportunities for the development of surgical Robots such as the Puma 560, a robot that was first used in 1985. It carried out neurosurgical biopsies and the transurethral resection of the prostate. According to the National Air and Space Administration (NASA) Ames Research Center, telesurgery is one of the most intensive research areas. Intuitive Surgical Inc has been developing active medical robots to perform surgeries. The da Vinci surgical system, an advanced master-slave system, has multiple-slave systems with several robotic arms or manipulators controlled remotely by a surgeon from a console. These systems use miniaturized operating arms, unlike the one-centimeter surgical arms of the Puma 560, avoiding the need to retract the sides of the incision. The Endo-Wrist features of the operating arms in da Vinci also provide seven degrees of movement freedom. Further, newer systems use ergonomically superior open consoles rather than the closed ones of the da Vinci system. Laparo-endoscopic single-site surgery (LESS) robots are also being developed by leading market players. The LESS robots insert the camera and multiple instruments through a single incision, preferably the umbilical, without scar.

Additionally, smaller systems such as the SurgiBot-SPIDER (Single-Port Instrument Delivery Extended Research) systems are being developed, which are significantly less expensive and have not yet gained FDA approval. The Minimally Invasive Neurosurgical Intracranial Robot (MINIR) is one of the newer robots used to remove brain tumors, based on a CTSM with SMA actuators. The flex system uses cables with variable tension to modulate the flexibility of the endoscope, allowing many procedures to be carried out while using only a fraction of the space required by the da Vinci system. The above-mentioned factors are creating growth opportunities for the surgical robots market during the forecast period.

Market Overview

North America holds the largest share of the global surgical robot market. The market in the region is growing due to the rising number of surgical procedures associated with colorectal and urological conditions and increasing healthcare expenditure. The surgical robots market in the US is expected to grow during the forecast period owing to a huge demand for technologically advanced products ensuring better healthcare delivery for newborns. The value-based healthcare model has led to the development of well-equipped NICU centers along with an increasing number of approvals for newborn care devices from the FDA.

North America Surgical Robots Market Revenue and Forecast to 2028 (US$ Million)

Strategic insights for the North America Surgical Robots provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Surgical Robots refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.North America Surgical Robots Strategic Insights

North America Surgical Robots Report Scope

Report Attribute

Details

Market size in 2022

US$ 3,209.61 Million

Market Size by 2028

US$ 7,402.91 Million

Global CAGR (2022 - 2028)

14.9%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Component

By Application

By End User

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Surgical Robots Regional Insights

North America Surgical Robots Market Segmentation

The North America surgical robots market is segmented on the basis of component, application, end user, and country. Based on component, the market is segmented into instruments & accessories, robotic systems, and services. The instruments & accessories segment held the largest market share in 2022.

Based on application, the North America surgical robots market is segmented into urological surgery, orthopedic surgery, general surgery, gynecological surgery, cardiothoracic surgery, neurosurgery, and others. The urological surgery segment held the largest market share in 2022. Based on end user, the North America surgical robots market is segmented into hospitals, ambulatory surgical centers, and others. The hospitals segment held the largest market share in 2022. Based on country, the North America surgical robots market is segmented into the US, Canada, and Mexico. The US dominated the market share in 2022. Intuitive Surgical; Smith+Nephew; Johnson & Johnson Services, Inc.; Stryker; Zimmer Biomet; Medtronic; Siemens Healthineers AG; Asensus Surgical, Inc.; and Renishaw plc are among the leading companies operating in the North America surgical robots market.

The North America Surgical Robots Market is valued at US$ 3,209.61 Million in 2022, it is projected to reach US$ 7,402.91 Million by 2028.

As per our report North America Surgical Robots Market, the market size is valued at US$ 3,209.61 Million in 2022, projecting it to reach US$ 7,402.91 Million by 2028. This translates to a CAGR of approximately 14.9% during the forecast period.

The North America Surgical Robots Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Surgical Robots Market report:

The North America Surgical Robots Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Surgical Robots Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Surgical Robots Market value chain can benefit from the information contained in a comprehensive market report.