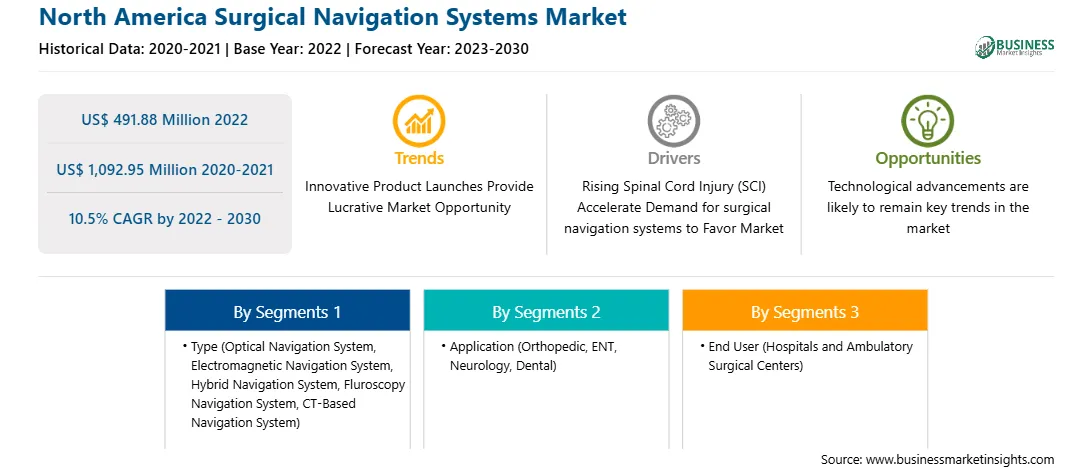

The North America surgical navigation systems market was valued at US$ 491.88 million in 2022 and is expected to reach US$ 1,092.95 million by 2030; it is estimated to grow at a CAGR of 10.5% from 2022 to 2030.

According to the National Safety Council 2023 report, musculoskeletal disorders (MSDs) are pervasive, affecting nearly one-quarter of the global population, causing tendonitis, carpal tunnel syndrome, ruptured or herniated discs, and sprains. Moreover, the Global Burden of Disease (GBD) report revealed that nearly 1.71 billion people lived with musculoskeletal conditions involving low back pain, neck pain, fractures, osteoarthritis, amputations, and rheumatoid arthritis (RA) in 2019. The rising prevalence of musculoskeletal conditions varies by age and diagnosis, affecting people of all ages worldwide. Therefore, there is a high demand for surgical navigation systems intended for orthopedic surgery. These systems are among the most powerful and enabling tools for surgeons. Surgical navigation systems analyze pre- and post-operative data in multiple versions using augmented reality (AR) to improve clinical outcomes of orthopedic surgeries. For example, visualization systems allow surgeons to take suitable positions during surgeries without excessive exposure to X-ray radiation. For instance, in March 2023, Stryker launched the "Ortho Q Guidance System" that enables advanced surgical planning and guidance intended for hip and knee procedures for the benefit of surgeons. Ortho Q was explicitly designed for orthopedic customers to enhance orthopedic surgeons' capability for proper precision while performing surgeries. The product includes features such as Implant Agnostic Software, Triathlon Implant Dedicated Software, and Small Footprint.

Further, the WHO report in 2023 states that at least 1 in 3 people of all ages will suffer from neurological disorders once in their lifetime, making it the highest among all noncommunicable diseases. Navigation systems for neurological procedures assist in a range of procedures, from intracranial tumor resections to frameless biopsies and from pedicle screw placement to spinal stabilization. For example, in skull openings (small craniotomies), neuronavigation systems display anatomical structures and track the virtual axis of surgical instruments.

Medtronic provides innovative surgical navigation systems and related products for neurosurgery, spinal surgery, and cranial surgery. Its StealthStation S8 Surgical Navigation System comprises an intuitive interface that aids advanced visualization to navigate neurosurgery procedures. The system provides optical and electromagnetic (EM) tracking capabilities with the help of external devices such as microscopes and ultrasound, thus acting as a powerful tool for neurosurgical procedures. Therefore, the need for effective surgical treatments for orthopedic and neurosurgery with the rising cases of musculoskeletal and neurological disorders, coupled with innovative product launches by top companies, propels the adoption of surgical navigation systems globally.

The North America surgical navigation systems market has been segmented into the US, Canada, and Mexico. The market growth in this region is attributed to the rising surgeries, acting as a standalone factor positively influencing the growth of the market. Additionally, technological advancements in surgical monitoring devices further enhances the overall market growth during the forecast period.

North America held the largest market share for surgical navigation systems market in 2022. The rising cases of musculoskeletal and neurological disorders and integration of advanced type with surgical navigation systems are among the prominent factors propelling the market growth are the key factors driving the growth of surgical navigation systems in North America region. Market players are launching new products to the market. For instance, in July 2023, Stryker, announced launching of "Ortho Q Guidance System" that enables advanced surgical planning and guidance for hip and knee procedures, easily controlled by the surgeon from the sterile field. The system combines new optical tracking options through a designed, state-of-art camera with sophisticated algorithms of the newly launched Ortho Guidance software that delivers surgical planning and guidance capabilities.

Strategic insights for the North America Surgical Navigation Systems provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 491.88 Million |

| Market Size by 2030 | US$ 1,092.95 Million |

| Global CAGR (2022 - 2030) | 10.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Surgical Navigation Systems refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America Surgical Navigation Systems Market is segmented based on type, application, end user, and country.

Based on type, the North America surgical navigation systems market is segmented into optical navigation system, electromagnetic navigation system, hybrid navigation system, fluoroscopy navigation system, CT-based navigation system, and other navigation system. The electromagnetic navigation system segment held the largest North America surgical navigation systems market share in 2022.

In terms of application, the North America surgical navigation systems market is categorized into orthopedic, ENT, neurology, dental, and others. The orthopedic segment held the largest North America surgical navigation systems market share in 2022.

By end user, the North America surgical navigation systems market is bifurcated into hospitals and ASCs. The hospitals segment held a larger North America surgical navigation systems market share in 2022.

Based on country, the North America surgical navigation systems market is segmented into the US, Canada, and Mexico. The US dominated the North America surgical navigation systems market in 2022.

B Braun SE, Corin Group, DePuy Synthes Inc, GE HealthCare Technologies Inc, Medtronic Plc, Siemens Healthineers AG, Stryker Corp, and Zimmer Biomet Holdings Inc are some of the leading companies operating in the North America surgical navigation systems market.

1. B Braun SE

2. Corin Group

3. DePuy Synthes Inc

4. GE HealthCare Technologies Inc

5. Medtronic Plc

6. Siemens Healthineers AG

7. Stryker Corp

8. Zimmer Biomet Holdings Inc

The North America Surgical Navigation Systems Market is valued at US$ 491.88 Million in 2022, it is projected to reach US$ 1,092.95 Million by 2030.

As per our report North America Surgical Navigation Systems Market, the market size is valued at US$ 491.88 Million in 2022, projecting it to reach US$ 1,092.95 Million by 2030. This translates to a CAGR of approximately 10.5% during the forecast period.

The North America Surgical Navigation Systems Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Surgical Navigation Systems Market report:

The North America Surgical Navigation Systems Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Surgical Navigation Systems Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Surgical Navigation Systems Market value chain can benefit from the information contained in a comprehensive market report.