The surety market is traditionally a local business based on know-how of the local market. However, with increasing globalization, large surety market players are setting up operations in developing markets such as Canada and Mexico. One of the major challenge faced by surety companies is to acquire the knowledge on local political and regulatory landscape. Global companies, however, have the capacity to hire professional local underwriters to compete in the market. The adoption of surety market in the North America countries is escalating at a tremendous rate over the years, and the adoption trend is foreseen to continue over the years. The fast developing countries are emphasizing urban development thereby, investing substantial amounts towards construction sector. This is generating significant demand for surety bonds, which is catalyzing the surety market to propel in the countries over the years

Strategic insights for the North America Surety provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 8,573.43 Million |

| Market Size by 2027 | US$ 13,498.40 Million |

| Global CAGR (2019 - 2027) | 6.4% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Bond Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Surety refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

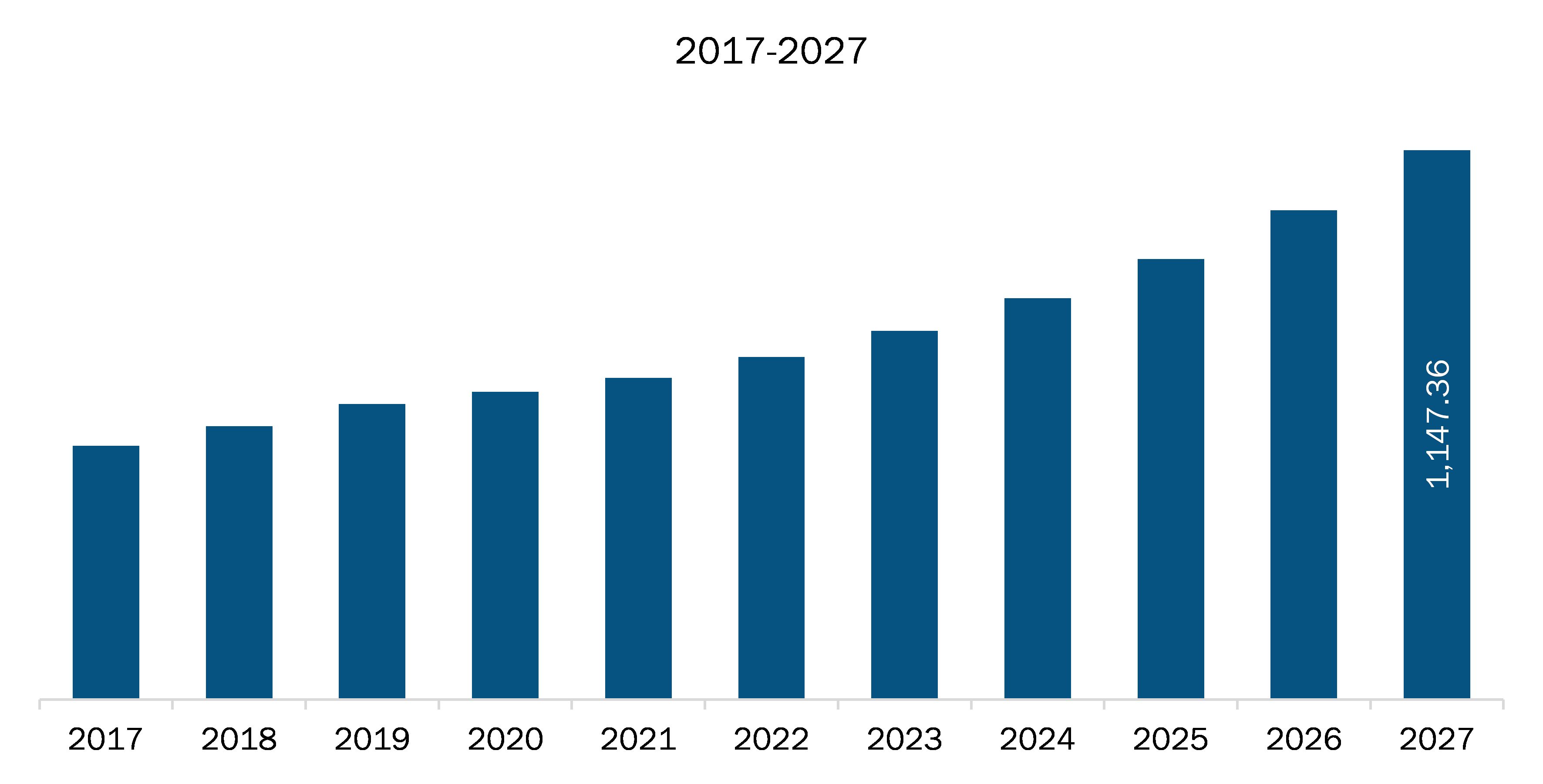

The North America surety market was valued at US$ 8,573.43 million in 2019 and is expected to grow at a CAGR of 6.4% during the forecast period to reach US$ 13,498.40 million by 2027. The North American industrialization have been escalating at a decent rate over the years. The US and Canada experiences continuous rise in number of small businesses year on year. The strong economy and governmental support enables several start-ups to establish their businesses in the countries. Surety bonds facilitates small businesses to acquire contracts by assuring the customer with a guarantee that the defined work will be completed in specified time. Several public and private contracts demand surety bonds, which are provided by surety companies. The constantly increasing number of small businesses in the North American construction industry coupled with the availability of substantial numbers of surety market players in the US and Canada is expected to drive the surety market through 2027.

In terms of bond type, the contract surety bond segment accounted for a largest share of the North America surety market in 2019. Commercial surety bond segment held the second largest share in the market, based on type, in 2019. The court surety bond segment is anticipated to surge at a prime rate during the forecast period from 2020 to 2027.

A few major primary and secondary sources referred to for preparing this report on the surety market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. The major companies listed in the North America surety market report are CNA Financial Corporation, The Travelers Indemnity Company, Liberty Mutual Insurance Company, Chubb, and The Hartford among others.

The North America Surety Market is valued at US$ 8,573.43 Million in 2019, it is projected to reach US$ 13,498.40 Million by 2027.

As per our report North America Surety Market, the market size is valued at US$ 8,573.43 Million in 2019, projecting it to reach US$ 13,498.40 Million by 2027. This translates to a CAGR of approximately 6.4% during the forecast period.

The North America Surety Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Surety Market report:

The North America Surety Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Surety Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Surety Market value chain can benefit from the information contained in a comprehensive market report.