A mouthguard is an essential piece of sporting equipment that helps reduce the severity and frequency of injuries such as alveolar process fractures, including radicular and coronal fractures, and corpus fractures of the mandible, condyle, and gonial angles. Thermoplastic sports mouth protectors are becoming increasingly popular among athletes participating in both contact and non-contact sports. These protectors are used to protect athletes from injury in contact sports such as MMA, boxing, basketball, football, hockey, and baseball.

Strategic insights for the North America Sports Mouthguard provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 858.58 Million |

| Market Size by 2028 | US$ 1,786.20 Million |

| Global CAGR (2021 - 2028) | 11.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Sports Mouthguard refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

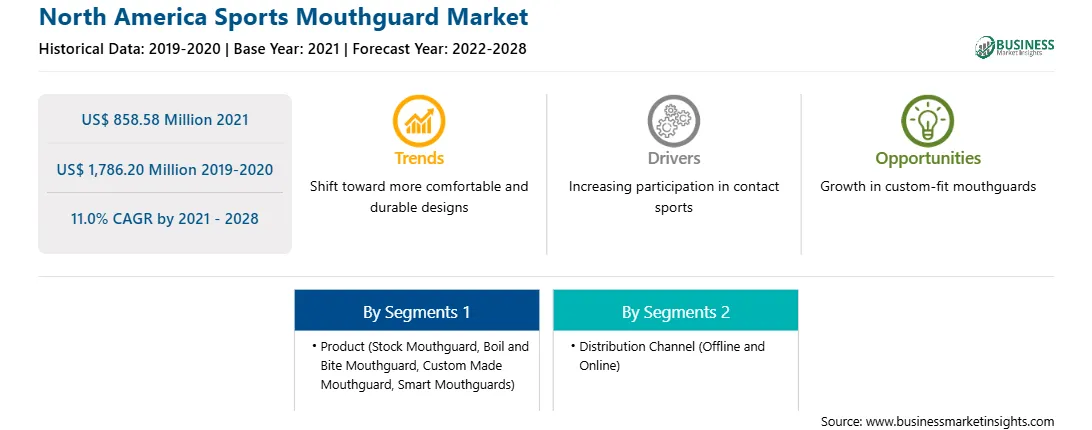

The North America sports mouthguard market is expected to reach US$ 1,786.20 million by 2028 from US$ 858.58 million in 2021; it is estimated to grow at a CAGR of 11.0% from 2021 to 2028. The major factors driving the growth of market are the rising number of sports-related oral injuries and their high treatment expenses, and introduction of technologically advanced mouthguards. However, the lack of consumer awareness regarding the importance of sports mouthguards hampers the market growth.

According to the American Dental Assistants' Association, ~15 million Americans suffer from a sports-related dental injury every year. According to Procter & Gamble, more than 5 million teeth are avulsed every year, many of them during athletic activities, costing ~US$ 500 million annually for tooth replacement procedures. Similarly, according to a study published in the Journal of the American Dental Association (JADA), sports-related dental injuries account for 13–39% of all dental injuries, with 2–18% of maxillofacial injuries. Oral injuries can cause severe pain, emotional and psychological effects, and financial burdens. According to a study published in the Dentistry Journal, the average cost of treatment of dental and maxillofacial injuries in contact sports was more than double than all other body injuries. A comprehensive treatment may be required if the dental trauma extends to the supporting periodontal apparatus. A sports mouthguard helps prevent oral injuries. Therefore, the increasing frequency of dental injuries during sports fuels the growth of the sports mouthguard market. The innovations in mouthguards are not limited to their fit. Technological advancements have also increased the durability of mouthguards since a denser material confers a better damage resistance, without adding any thickness to them. A self-fit mouthguard is another example of technological developments in them. OPRO Self-Fit mouthguards, for instance, have innovative fins that are anatomically oriented for the greatest fit and retention. Data from ~1 million OPRO Custom-Fit dental impressions was used to determine the placement and depth of the fins. Mouthguards with shock absorbers have been introduced for the impact made on mouth, jaw, or head area during sport activities. For instance, an NXTRND mouthguard acts as a shock absorber by dispersing impact forces and increasing spacing between the upper and lower teeth. Hence, the abovementioned technological advancements in mouthguards bolster the growth of the sports mouthguard market.

North America is a critical market for the growth of various sport-related offerings owing to the presence of developed countries such as the US and Canada in the region. As per the recent WHO statistics, the US is the world’s worst-affected country by the COVID-19 outbreak with highest number of confirmed cases and deaths. The pandemic has hindered the economies of the entire region due to a decline in overall activities of various businesses and growth of industries. The global crisis also led to the cancellation and postponement of various big sports events, which is hampering the revenues of key sports mouthguard market players operating in North America. The US has suspended the seasons of several major sports leagues in 2020. Further, social distancing mandates are further aggravating the adversities in the US sports industry. The slowdown in North American sports industry is also resulting in financial challenges for teams, clubs, leagues, and sports organizers present in the region. Hence, the ongoing COVID-19 crisis is expected to restrain the sports mouthguard market growth in North America for the next few quarters.

The North America sports mouthguard market, by product, is segmented into stock mouthguard, boil and bite mouthguard, custom made mouthguard, and smart mouthguards. The boil and bite mouthguard segment is expected to hold the largest share of the market in 2021; however, the custom-made mouthguard segment is anticipated to register the highest CAGR in the market during the forecast period.

The North America sports mouthguard market, based on distribution channel, is segmented into online and offline. The offline segment is likely to hold a larger share of the market in 2021; however, the online segment is expected to register the fastest CAGR in the market during 2021–2028.

A few of the primary and secondary sources associated with this report on the North America sports mouthguard market are the Journal of the American Dental Association (JADA), American Academy of Pediatric Dentistry (AAPD), and Canadian Dental Association.

The North America Sports Mouthguard Market is valued at US$ 858.58 Million in 2021, it is projected to reach US$ 1,786.20 Million by 2028.

As per our report North America Sports Mouthguard Market, the market size is valued at US$ 858.58 Million in 2021, projecting it to reach US$ 1,786.20 Million by 2028. This translates to a CAGR of approximately 11.0% during the forecast period.

The North America Sports Mouthguard Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Sports Mouthguard Market report:

The North America Sports Mouthguard Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Sports Mouthguard Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Sports Mouthguard Market value chain can benefit from the information contained in a comprehensive market report.